Take outs

- Australians reflect the global trust deficit trend

- Consumers want meaningful engagement through actions rather than rhetoric

- Financial services and planners can act to build trust through 3 key actions

Trust is a commodity that companies covet. Gone are the days of blind confidence and loyalty in a company based solely on brand familiarity or baseless claims of superiority.

As Australians follow the global trust deficit trend, financial services organisations must look to improve confidence and trust through actions not words alone.

The Financial Services Royal Commission has shone a light on the trust chasm between consumers and financial services; a relationship perceived as one based on power rather than affinity, obligation not trust, and necessity rather than want. But it is not just within the financial sector that organisations must work to fundamentally change perceptions. Consumers are looking to brands and services to make a meaningful difference in their lives and society.

Special report: Where culture meets technology

In this report, we explore three cultural mega-trends that are happening right now, and examine how your business can evolve and innovate with these shifts in behaviour.

What is the state of trust and why is it important?

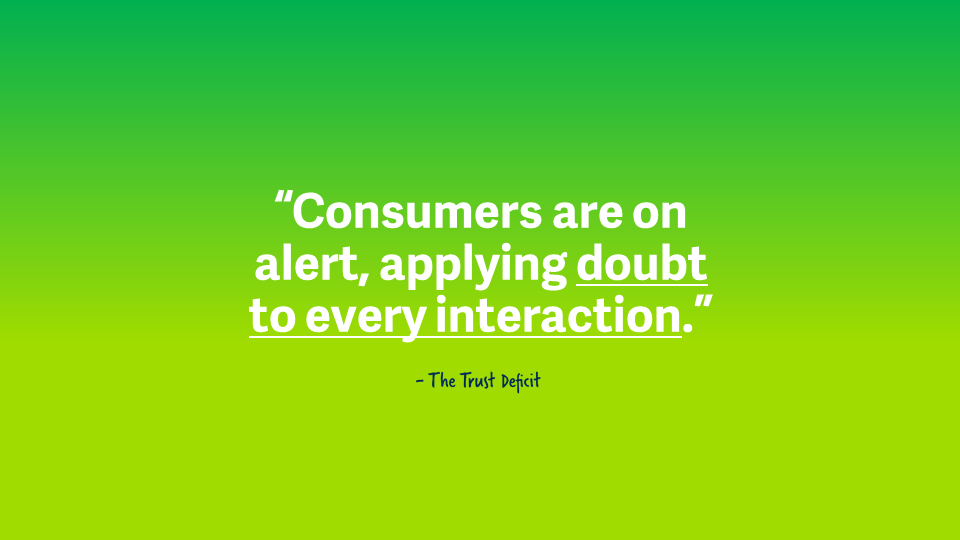

The trust deficit, also known as the trust crisis or the mistrust contagion, has reached epidemic proportions across the globe. This deficit in consumers varies from granular to macro levels. In a Trump-fuelled era, many consumers conclude that they can’t believe what the media and big businesses are feeding them. While at the local level we can’t even trust that the honey we’re buying at the supermarket is genuine.

Sceptical consumers are on alert, applying doubt to every interaction. But Amanda Windus, Strategy Director with brand research and strategy experts The Lab, says this is an opportunity for brands to clarify what’s important to them and their audience. Rather than the age of distrust, it’s the age of action, where the action proves that what you're telling me is real.

“Traditional trust is broken, but it isn't all doom and gloom. Uber, AirBnB and other brands leading the share economy demonstrate our huge capacity for trust, even with complete strangers,” she says.

“We’re simply evolving and finding new ways to build trust and have confidence in our brand and life choices.”

The Royal Commission and trust in financial services

The Financial Services Royal Commission has been a catalyst for change as people demand transparency and justice in all interactions. Similar events are being called for across aged care, energy and the media.

The direct impact on the financial sector is difficult to anticipate given the pre-existing perceptions of banks as a ‘profit at any cost’ culture. In fact, trust surveys regularly rank banks alongside car salesman and advertising executives as most untrusted in consumer minds.

"In some sense, the Commission is simply reinforcing views that financial services is a self-serving system that confuses and confounds rather than genuinely acting in the interests of customers,” says Amanda.

Adding to the complexity of the Commission is a shared awakening by customers that they have a responsibility to engage with their money.

"Customers recognise they need to take back a sense of ownership. This creates an opportunity for advisers to find new footing in their customer relationships through action and leadership.”

Brands acting to build confidence

Banking alternatives to the ‘big 4’, like ING (‘reinventing the way Australians bank by delivering simple; straightforward; and good value products’) and community-owned banks like Bendigo Bank (‘welcome to the better big bank’, and ‘change to a bank you can feel better about’), are in a position to build on brands that have long operated on transparency and built trust through action rather than demanding it. Their building of brands that emphasise their differences from the traditional banks has stood the test of time.

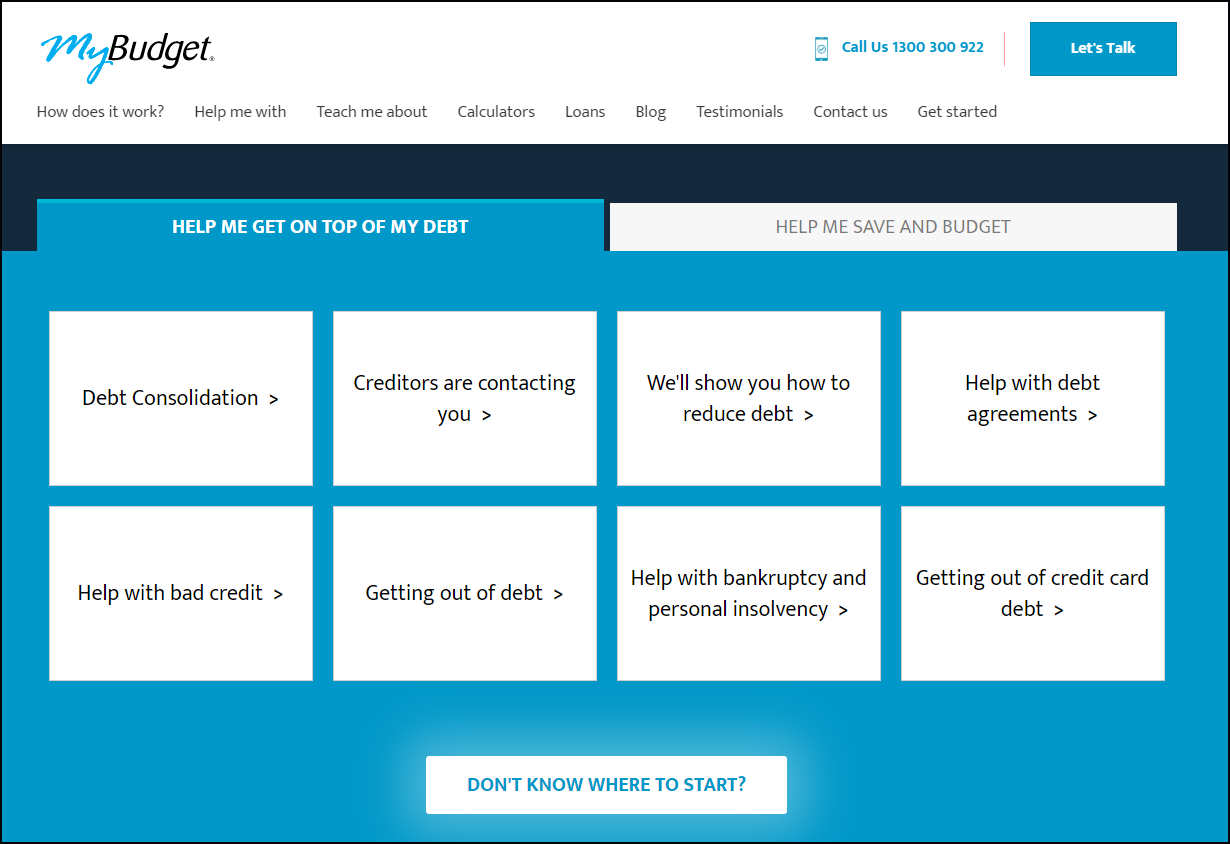

An opportunity also exists for services dealing with consumers’ financial footprints—marrying the everyday with future planning and wealth building. A brand like MyBudget trades on a brand promise of ‘no more money worries’, backed by practical actions of, ‘pay your bills on time and create savings’. By reducing financial complexities into a simple yet complete financial plan of incoming and outgoing monies and how to optimise them, they focus on taking control of your money to get the things you want in life.

Amanda Windus says companies willing to innovate and cultivate customer relationships built on openness, compassion, solidarity and fairness, will come out in front of the trust deficit.

“By its very nature, financial services and planning keeps people at arm’s length. There are limitations around advice models and the level of independence advisers offer,” she says.

“By delivering products and services that reflect a genuine and authentic interest in helping customers with their financial lives and embracing the values emerging in this new era of trust, they will build the credibility and confidence needed to stay in the game.”

MyBudget provides practical support for consumers looking for help with their money

Amanda says companies willing to innovate and cultivate customer relationships built on openness, compassion, solidarity and fairness, will come out in front of the trust deficit.

“By its very nature, financial services and planning keeps people at arm’s length. There are limitations around advice models and the level of independence advisers offer,” she says.

“By delivering products and services that reflect a genuine and authentic interest in helping customers with their financial lives and embracing the values emerging in this new era of trust, they will build the credibility and confidence needed to stay in the game.”

The three keys to building trust through action

Tapping into the trend for trust and confidence to be shown through actions, not rhetoric. Here are three key ways advisers and firms can build trust with consumers.

1. Building financial literacy

Statistics show that people are easily overwhelmed and confused by finances and advice. Acting to develop their expertise through value-adds like educational tools and master-classes can help empower customer decision-making and reflect on the integrity of your brand.

2. Planning for the whole person

Financial advice that takes into account the whole person, their goals, lifestyle and everyday finances, builds solidarity with a customer, not just affinity. The rhetoric of ‘we get you’ can be replaced with a more poignant ‘we know you and we stand with you’.

3. Creating a partnership

In a relationship that has been notoriously one-sided, financial advisers can pioneer a new spirit of working for a mutual advantage. There’s an opportunity for advisers to encourage reconnection with money by recommending clients take control and link their money management to what they want to achieve in life. By focusing on cultivating money management behaviours that banks positively reinforce and reward with genuine discounts or incentives, advisers show they have a vested interest in helping customers make their money work for them.

Building a confident future

Trust isn’t lost to society, but how it is earned has changed.

The trust deficit creates an opportunity for financial planners to focus on maintaining confidence through professional products and delivery. The time is ripe for transformative leadership in the industry that shows vulnerability and dares to stand apart from traditional messaging.

Want to learn more? Download our report on Three mega-trends that matter or contact the Netwealth team.

More cultural mega-trends that matter

Help me feel good

Help consumers feel good with guilt-free goals

Doing good has become part of brand strategy as consumers across the globe look for ways to make an impact with their buying choices.

Gender neutrality

Why the rise of the female matters to your advice business

The rise of the female gives financial advisers an opportunity to take a new approach at empowering female customers and building financial literacy.

Expectation economy

Experience expectation: Why variety is the spice of life

As technology develops and provides access to more options, a movement has emerged where consumers are looking to trial more and commit less.