Results for: Innovation

Adviser Innovation - Using technology to help your advice practice

Technology is already having a profound effect on the way advisers do business, and the rapid rate of innovation means more change is inevitable, writes Netwealth’s Matt Heine.

Is Silicon Valley the key to smashing advice paradigms?

Audere Coaching & Consulting founder Stewart Bell explains how using technology selectively and carefully can deliver huge efficiencies in advice businesses.

Fintech Business- Innovation key to industry longevity

As disruption cements itself as commonplace, financial services - and particularly financial advice - must innovate if it is going to survive, says Netwealth.

Understanding fintech: 6 areas where technology can help your advice practice

The fintech industry as a whole is expected to grow rapidly for a foreseeable future and will profoundly change the client/adviser relationship and the wealth industry as a whole. How will the fintech boom affect your financial ...

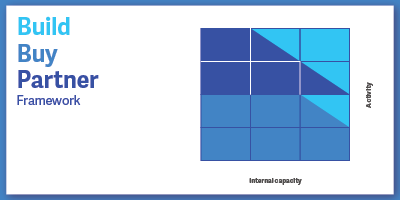

How to decide whether to buy, build or partner

Should you build your own fintech product, buy one off the shelf, or partner with a technology provider to develop a customised solution? This article will help you to make the right decision for your fintech project.

Industry leaders discuss how fintech will impact financial advice

The fintech industry has been quickly increasing in size, and the disruption it is causing has gathered momentum. Watch this short video to hear from industry leaders as they share their thoughts on fintech.

Introducing an objective framework for technology decision making

Buy, build, or partner? Which option is best for your advice business' technology solutions? When making business decisions about fintech solutions (or any other technology products) using a framework can help deliver better outcomes.

Don’t let prejudices get in the way of good decision making

How do your attitudes and experiences affect the ways that you make decisions about technology?

Making your ecosystem your competitive advantage

Learn how to develop an ecosystem innovation strategy leveraging fintech to deliver a better customer experience.

Lessons from Silicon Valley and what it means for Australian advisers

During our December 2016 webinar, Santi Burridge from Implemented Portfolios shared key takeouts from a recent study tour in Silicon Valley and what it means for Australian financial advisers.

Integrate and assimilate are technology must-dos

Cameron Cogle, General Manager of Bridgeport Financial Services explores the challenges many advisers face when adopting new technology, and the importance of company culture in its successful implementation.

An age old theory updated with technology

According to Moneysoft founder Peter Malekas, the most successful advisers make the commitment to technology, taking the time to dismantle their current approach and look at how they can rebuild it with its inclusion.

Technology not the holy grail

Working for tech start up TipRanks, Sean Ickowicz encounters the highs and lows of technology. He delves into the unrealistic expectation that technology can fix all. Advocating it is simply one part of an overall solution.

Innovate and keep doing so

SuiteBox CEO, Ian Dunbar, shares his views on technology and how it provides advisers the tools they need to outsource processes so they have the time to focus purely on the client via advice, coaching and support.

AdviceTech – toys or tools?

Sebastian Mazza, founder of Wealth Depot is passionate about providing innovative wealth management solutions. He believes the relationship between advisers and tech is a predominantly positive one, but is yet ...

Remote but super connected

Shaun Clements founder of North of River Financial, implements cutting edge technology into his processes and practice to keep relevant and accessible to his (predominantly generation X and Y) clients.

Purpose built business with technology

Having recently established his financial planning business, Forwood Planning, John Forwood highlights the importance of technology when optimising business processes within smaller scaled advice practices.

Know it, value it but tread carefully

Kristopher Meuwissen, Financial Adviser at Ability Financial Planning, shares how he leverages technology to both educate and work with advice clients, delivering efficiencies in the business and better client service and outcomes.

Glossary of advice technologies

View a summary of 24 adviser technologies, highlighting key tech providers, along with technology descriptions, features and benefits to advisers. It also covers technology uptake, and anticipated usage in the next 18 months.

Meet the innovators

Hear from three practising advisers as they share their thoughts on what it means to be innovative and initiatives they have implemented in their practice to stay ahead of the curve.

Design thinking - putting ideas into action

Find out about Design Thinking, a technique any organisation can use to test business ideas, prototype new concepts and understand their customers better.

Interview with three advisers on innovation

Innovation means different things to different advisers and each firm is responding in its own way. Hear the innovations some are implementing.

How to turn your business into a hotbed of innovation

To innovate efficiently, it is important to firstly identify which of the four main innovation streams you wish to adopt to drive your wealth management business forward. Learn what these streams are.

What is innovation?

In these videos and article, leading advice practice owners discuss their views on what innovation means and strategies they have used in their business.

Innovation in the UK

This special report identifies key insights and brings you content from some of the worlds most sought after speakers on fintech, innovation, practice management and leadership.

Removing customer friction from the financial advice process

Learn from the world’s customer experience experts about removing friction from your advice practice.

Why the rise of the female matters to your advice business

The rise of the female gives you an opportunity to take a new approach at empowering female customers, and to build financial literacy into service offerings for every audience.

Taking on the trust deficit with actions to build confidence in customers

Trust is a commodity that companies covet. Gone are the days of blind confidence and loyalty based solely on brand familiarity - it's all about doing what you promise.

How spiritual enlightenment can shape your approach to clients

You might notice your social feeds blowing up with yoga, mindfulness and inspirational posts about finding meaning in life. But what’s the connection for financial advisers and your clients?

Help me feel good: Informed customers with guilt-free goals

Doing good has become part of brand strategy as consumers across the globe look for ways to make an impact with their buying choices. Here's how you can provide the same with your offering.

The experimentation experience: Why variety is the spice of life

A movement has emerged as technology develops and provides access to options previously unavailable - a movement where consumers are looking to trial more and commit less.

Building tomorrow's advice firm

Hear from three financial advisers who share how they're future-proofing their business by managing shifts in consumer expectations.

Adopting AI into your practice today

Advanced technology platforms, AI and big data are converging and are ready to transform the advice industry. Understand the different ways advice firms can use AI in their practice today.

Humans, machines and the rise of AI

Machines and humans have worked together for centuries and the new breed of supercomputers and AI are set to supercharge advice firms – staff productivity, business ingenuity, innovation and the client experience.

A short explainer of AI

While it seems to be everywhere, AI has been a long time coming. Learn why Bill Gates thinks that what is happening in AI just in the last 12 months is every bit as important as the PC, the PC with GUI, or the internet.