Product updates

Discover the latest enhancements to the Netwealth platform including new tools, functionality and reporting

We are constantly looking at new way to enhance our platform to include a wider product offering, improved managed account service, better reporting, simplified transactions and more.

Below is a summary of our key product highlights. You can view updates from previous financial years here.

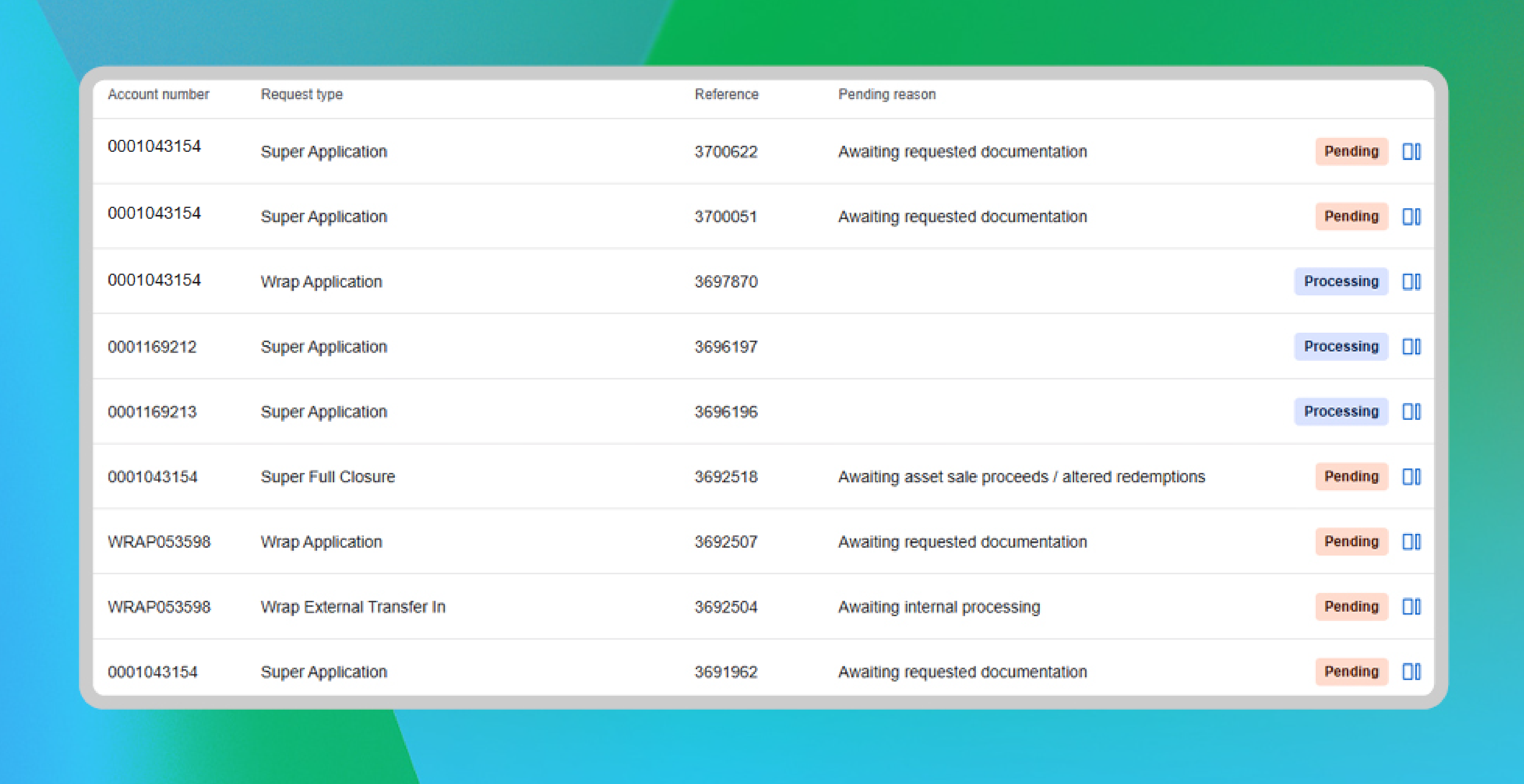

Discover Workflow Tracker designed to help you and your team track outstanding requests with Netwealth, such as applications for new accounts, withdrawals, and benefit payments.

Easily review the status and pending reasons for requests, ensuring you have the information you need, when you need it. Quickly identify requests that require your attention, whether they are awaiting further instructions from you or your clients.

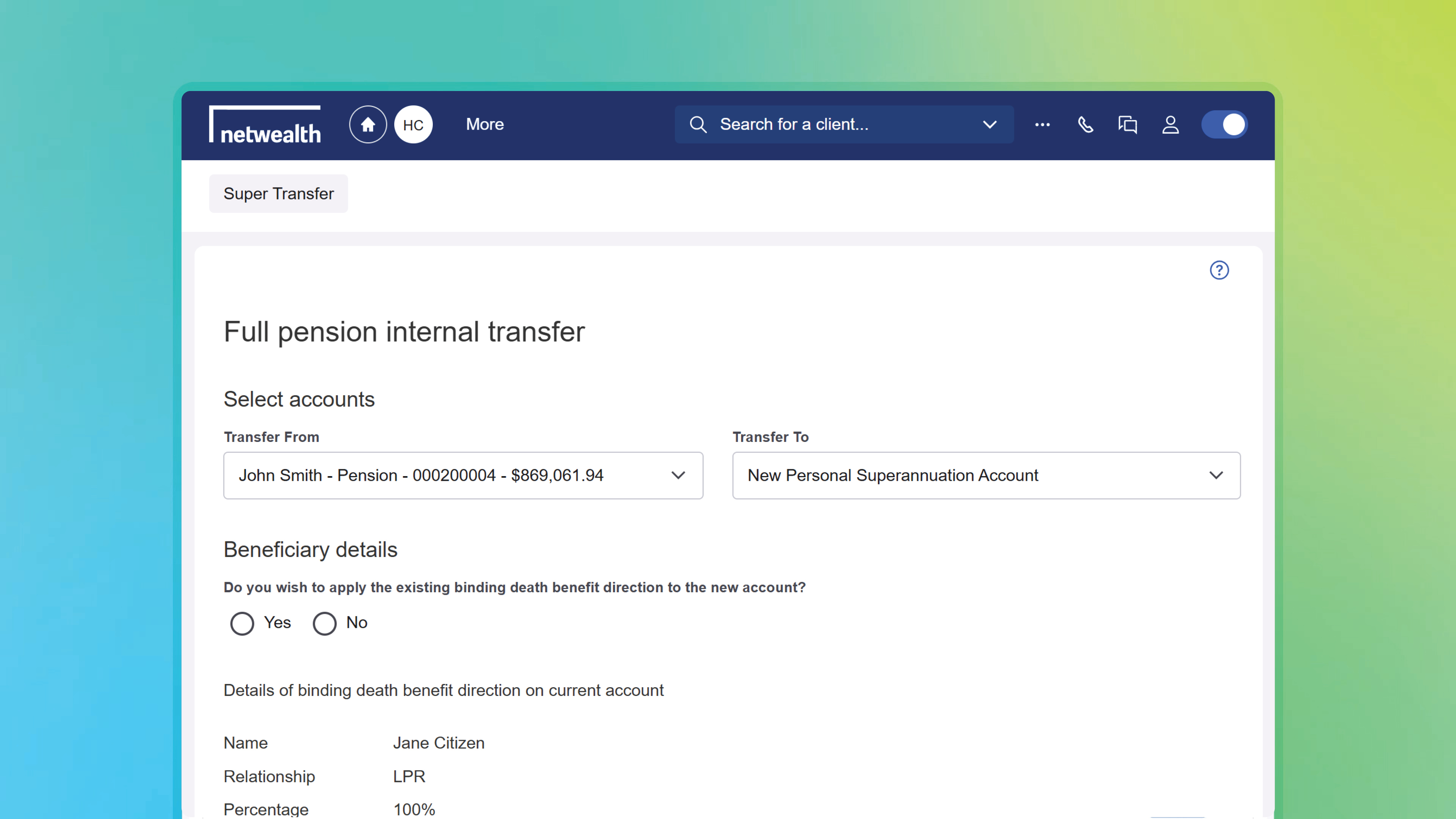

We’re excited to introduce our latest feature that simplifies full transfers from Income Stream accounts to Personal Super accounts. This new tool:

This feature is currently available, select your client’s Standard Income Stream or Transition to Retirement account, and Navigate via the main menu to ‘Activities & Tasks’ > ‘Transfer Between Accounts (new)’. Visit the Knowledge Centre guide for more information and detailed step-by-step guide.

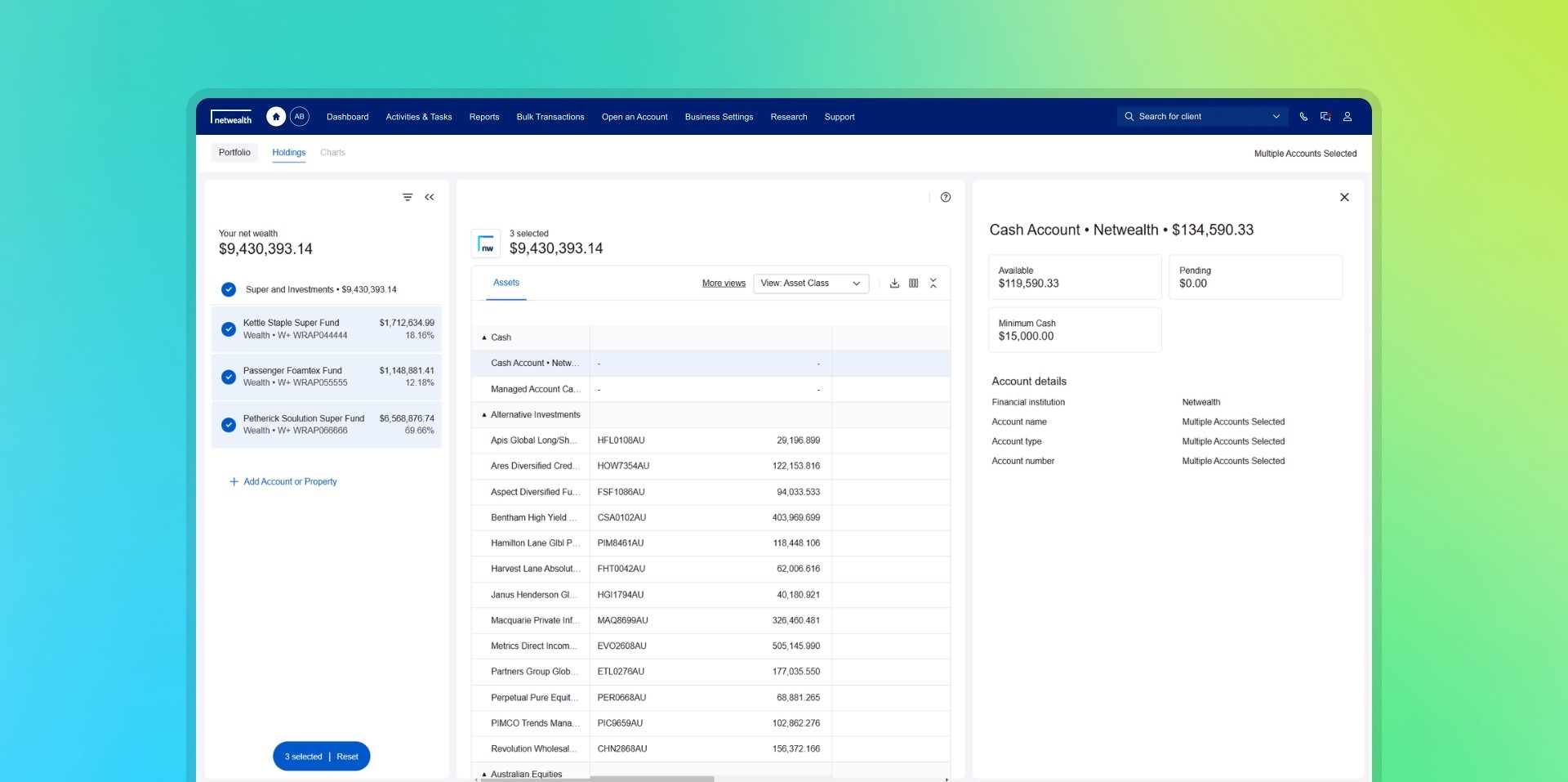

A modern, intuitive design crafted to help you manage your clients’ portfolios more effectively:

We understand how important it is for you to be able to find client information quickly. That's why we've overhauled the client search function to be more intuitive:

More ways to search: Search by account details or adviser, using advanced search functionality.

Streamlined information display: A dedicated side panel provides quick access to select client information.

Faster processing: Spend less time waiting for search results with faster processing times.

*For illustration purposes only

Netwealth is excited to announce the launch of several new features that enhance our client reporting tools. These features have been designed to simplify your reporting processes so you can deliver tailored client reports at scale.

Why you’ll love our client reporting tools:

Our enhanced client reporting is now available. Navigate to Reports > Client Reports to start leveraging these powerful features. For a detailed guide, visit the Knowledge Centre or schedule a demo with a Business Development Manager.

*For illustration purposes only

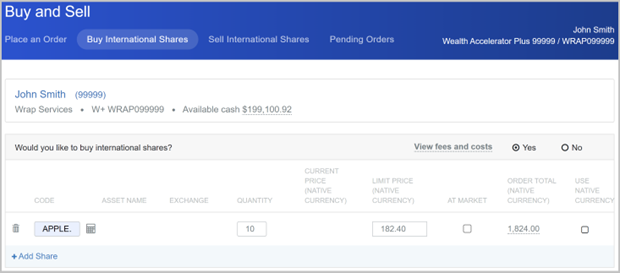

Experience live trading across 16 international exchanges and greater order control with our latest share trading enhancements:

New trading features are available now for trades initiated using ‘Buy & Sell International securities' on an individual account level. Visit the Knowledge Centre guide for more information.

Save time preparing for client reviews with ‘Report Templates’. Select and arrange existing reports to create your own custom report templates which can also be shared across your business.

Here is how it works:

Create your own custom report today, navigate to Reports > Report Templates to get started or for more information visit the Knowledge Centre.

*this video is an illustration

With Wealth Exchange and Data Integrations, you can easily set up and manage third-party data feeds. Subscribe to over 25 data integrations and share Netwealth client data with software providers like Xeppo, BGL, Financial Simplicity, and Xplan.

Our Data Integrations feature gives you complete control over your data in one central location. Cancel subscriptions, edit settings, and manage data feeds on a client level with ease.

To get started, navigate to Business Settings > Wealth Exchange / Data Integrations, and for more information, visit the Knowledge Centre.

*this video is an illustration

Introducing a new GSS 31-Day Notice Fund, further diversifying our cash product investment options. This fund offers a competitive floating yield with interest paid at RBA +25 basis points, plus the flexibility of a 31-day notice period for withdrawals.

Speak with a netwealth Business Development Manager for more information.

We have introduced the ability to tailor your fee arrangements to exclude term deposits, term annuities, and cash account balances. Provide your clients with cost-effective income generating solutions.

Streamline the administration process following your client’s passing with Netwealth’s new online notification system. Upon receiving your online notification, we suspend any adviser fees, cancel any ongoing contributions and reinvestment plans, and initiate the necessary paperwork for death claims. This aids in the smooth closure of accounts and processing of associated insurance claims during these difficult times.

Experience a smarter way to manage external bank accounts with 'Bank Settings'. Easily link bank accounts to simplify the transfer of money into and out of Netwealth accounts. Store multiple standing direct debits for deposits and multiple nominated bank accounts for withdrawals. Securely add nominated and income stream bank accounts using two-factor authentication (2FA), allowing your clients to swiftly and securely approve any changes you make.

Netwealth is excited to partner with iCapital, a fintech platform headquartered in New York, to broaden the scope of investment opportunities for your high-net-worth clients. This collaboration provides wholesale investors with access to private market investment options, such as limited partnerships and non-Australian domiciled funds, all accessible via the Wealth Accelerator non-custodial asset administration.

Netwealth's low cost portfolio solution just got better with a refined administration fee of 0.15%^, more term deposits, a new cash fund, and expanded range of managed models.

With Super and Wealth Accelerator Core, you can build cost effective portfolios with access to over 60 investments, comprising managed funds, models, term deposits, fixed term annuities, and cash.

^The 0.15% administration fee applies to account balances up to $750,000 and is subject to additional fixed and minimum fees. For complete fee details, view the disclosure document for Super Accelerator and Wealth Accelerator.

Your low-cost super and investment solution, Accelerator Core, now offers more options with the addition of BlackRock GSS ESG Screened Models and new offerings from Russell Investments. The BlackRock GSS ESG Screened Models apply passive ESG-screened investment strategies, while the expanded range within the Russell Investment Managed Portfolios now includes a High Growth and Geared 120 Model. These new offerings are also available through Accelerator Plus.

Build a diversified bond portfolio into your income investment strategy with the Netwealth Small Parcel Bond Service, tailored for wholesale clients within our Wealth Accelerator Premium Service.

Netwealth leverages IAM's expertise as an ASX-listed specialist in income investment and provides access to domestic corporate bonds with a minimum investment as low as $50,000, well below the usual $500,000 minimum threshold.

Empower your clients to navigate economic uncertainty with a range of Challenger Fixed Term Annuities. Choose from a range of terms spanning 1 to 5 years, with rates typically higher than those of comparable term deposits. With a seamless application process, you can purchase fixed-term annuities directly via Super Accelerator and Wealth Accelerator, just like you would for other investment options. This eliminates the need for separate Challenger quotes and applications.

Challenger Fixed Term Annuities are available now for purchase through the Netwealth platform with rates updated weekly.

With Netwealth's new Public APIs, it’s now easier for developers to build software solutions for advice firms. An API, or Application Programming Interface, facilitates seamless data sharing and communication between different software applications. Our Public APIs unlock a trove of Netwealth data, enabling you to innovate processes and automate tasks.

Our Public APIs can be useful for AdviceTech software providers, licensees and advice firms wanting to automate their in-house processes, and Managed Account managers looking to automate the review and reallocation of their models. The range of Public API endpoints includes:

For further information, visit our Knowledge Centre guide to get started or contact a Business Development Manager (BDM).

For an in-depth and live look at any of our features, please request for one of our team to contact you.

Streamline your workflow and save valuable time with our redesigned client reporting suite. Access these new client reporting features:

We have integrated Osko payments, enabling near real time deposits from 85 Australian banks, any time of the day, and 365 days of the year. Funds deposited via Osko now appear within a Netwealth account almost instantly so they are immediately available for use.

View the Knowledge Centre guide for reference requirements for superannuation and EFT transfers made using Osko.

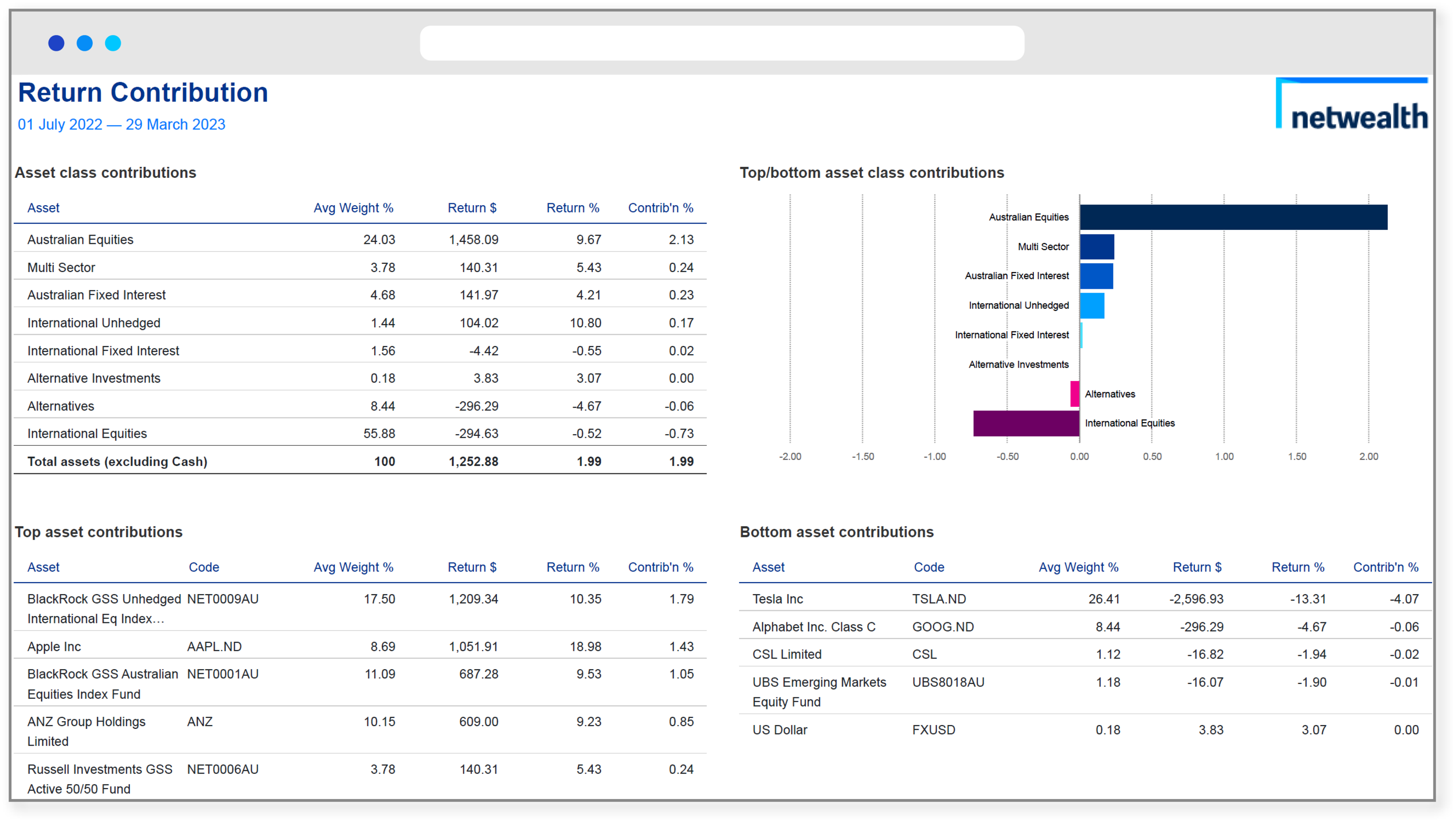

Our latest Return Contribution Report will help you understand the relative contribution each asset and asset class has to your client’s portfolio return and performance over a specified time frame. Quickly pinpoint your client's top-performing investments and those that lag behind.

For each asset or asset class understand:

* The daily returns of each asset are weighted to derive daily contributions, then the daily contributions are added to obtain each asset's contribution for the period.

Welcome to a new look interface to help you better manage your activities, tasks and alerts assigned to you and your team. Easily view, approve, manage, filter and archive activities for you, your team and clients.

Approve and monitor tasks assigned to you or your team: Manage over 20 tasks created by Netwealth for your office and clients, including corporate actions and expiring advice fee renewals.

Smart client alerts and reminders: Take action and avoid manual account checks with over 10 smart client alerts, including alerts for expiring term deposits and maturing annuities, minimum cash balance alerts, pending rollovers and purchases awaiting cash.

Client approvals made simple: Your clients will now use the new Activities area to approve or reject a range of adviser initiated transactions (such as adviser fee requests and change of bank details) when they login to their client portal.

You can now add residential and investment properties to your client portfolios to provide a more accurate picture of their total worth. You and your clients will be able to view this information in the client portal and mobile app, including property photos, estimated property values, along with the comparable median price.

Your clients can now build a complete picture of their financial wealth with Netwealth's client portal. In the one spot, track and monitor external bank, broker, and super accounts from over 200 financial institutions, alongside residential and investment properties:

Improve client engagement, service levels and build trust with Netwealth's client portal and mobile app available on Apple and Android devices.

Netwealth has partnered with Lonsec Investment Solutions to offer investors a suite of diversified managed account models that leverage Lonsec's extensive research capabilities.

The models use a core-satellite investment approach, blending low-cost index funds with actively managed investments, with the intent to help reduce costs, control volatility and generate greater returns.

There are four Lonsec GSS Index Plus models. Each model typically holds around 9-14 investments, and are constructed using a range of growth and defensive assets such as Australian and global equities, property, fixed interest and cash. All models are backed by Lonsec's rigorous governance and review process.

The new Netwealth + Xeppo connector allows you to connect your Netwealth client data with Xeppo's intuitive data warehouse, and also their CRM and rich reporting capabilities.

Xeppo brings together client data from multiple data and system sources, over and above Netwealth, to allow you to consolidate and synchronise client information. Using the Xeppo CRM, you can then view Netwealth account data with other client data in a single interface, plus use other powerful CRM functionality to automate client engagement tasks and view data business and client insights.

Netwealth has also agreed to provide growth funding of up to $2.5 million to accelerate the ongoing development and expansion of the Xeppo data analytics and business management platform which supports the Netwealth “Whole of Wealth” strategy. Under the arrangement, Netwealth, which currently owns 25%, has an option to buy 100% of Xeppo over the next 4 years.

You're in good hands, Netwealth has won the Chant West Advised Product of the Year for the fifth consecutive year. The award recognises funds that score well in Chant West's main criteria and have also invested in dedicated systems to help advisers manage their client base and access their client details.

You can now close your client's Wealth Accelerator online without the need for paper based instructions. The online withdrawal process now allows for a full cash withdrawal with any assets redeemed and the account closed.