Takeaways

- Consumers are driving force in responsible investment demand

- There are lots of frameworks available to understand responsible investing

- Managing risk is a big component as well

For advisers, conversations about responsible investing are regularly driven by client demand, as investors are increasingly looking for ways to invest that not only deliver strong returns but align with their values.

There are various reasons why investors are getting involved — one is retirees wanting to leave the world in better shape for their grandchildren, or those fed up with the slow pace at which some governments are transitioning to a low-carbon future. Then, there are those who see strong growth opportunities and want to participate in what is likely to be a significant mega trend over the next decade or more — the decarbonisation of the global economy.

There are plenty of opportunities in areas such as clean and renewable energies, electric vehicles, and battery technology. But some investors simply want to avoid certain activities, such as tobacco or gambling.

But responsible investing is more than an ideology. There is clear historical evidence that shows investing responsibly can not only keep pace with peers but can in fact outperform.

A 2015 meta-study conducted by The Journal of Sustainable Finance and Investment looked at more than 2,000 academic studies undertaken over the last 40 years, examining the relationship between ESG factors and corporate financial performance. More than 90 per cent of those studies found that ESG factors do have a positive or at least a mutual impact on financial returns.

Four things that are changing the world

The case for impact investing can be traced back to four main drivers of structural change.

1) Consumers: This is arguably the most powerful group of all contributing significantly to economic activity and critically, their consumption preferences are changing. This is not just a millennial thing. This affects consumers across all demographics and all age groups, and it affects their buying behaviour. According to our recently released research paper Investing for good, three in five (61%)¹ Australians 18 years or older say “they care deeply about environmental issues”, with more than half (54%)¹ indicating they “care deeply about social issues”, too. Consumers are not just looking at whether things conflict with their values, but whether they are aligned with or positively impact their values. For example, electric vehicles and plant-based burger (now offered by McDonalds) were virtually unheard of 10 years ago — a sign of how much consumers are driving change.

2) Proactive governments: Governments have waking up to the fact that solving United Nations 17 sustainability goals is good for their people and the economy. One example is the US Biden-Harris administration embracing these. Closer to home, state governments have been taking a leadership role — such as NSW putting out a large-scale tender for renewable energy.

3) Institutional investors: They have been the leaders in ESG (environment social and governance) and impact investing for many years. Institutional investors engage with companies and have important conversations at a board and senior executive level that has a meaningful impact in the real world.

4) Regulators: The final factor driving change is the increasing willingness of regulators to put up incentives to drive change.

Netwealth's 2022 Investing for good report

This research report examines investor behaviours and drivers for responsible investing (RI) in Australia and breaks down the Australian population into four RI investor segments. It explores their profiles, attitudes, and drivers to RI, and how to use marketing and brand tactics to appeal to this target market.

How to determine your responsible investment criteria

The demand for responsible investing is clear. The next question becomes how to set your criteria.

It is important to note that sustainable investing can take several forms — such as exclusion-based strategies, which use certain screens to exclude certain companies or industries deemed to be doing harm. Or it could be thematic, for example, climate change. Alternatively, there are impact strategies that are looking to directly solve some of the environmental and social challenges the world is facing.

All of these are valid approaches to sustainable investing, and advisers can incorporate any number of them into client portfolios.

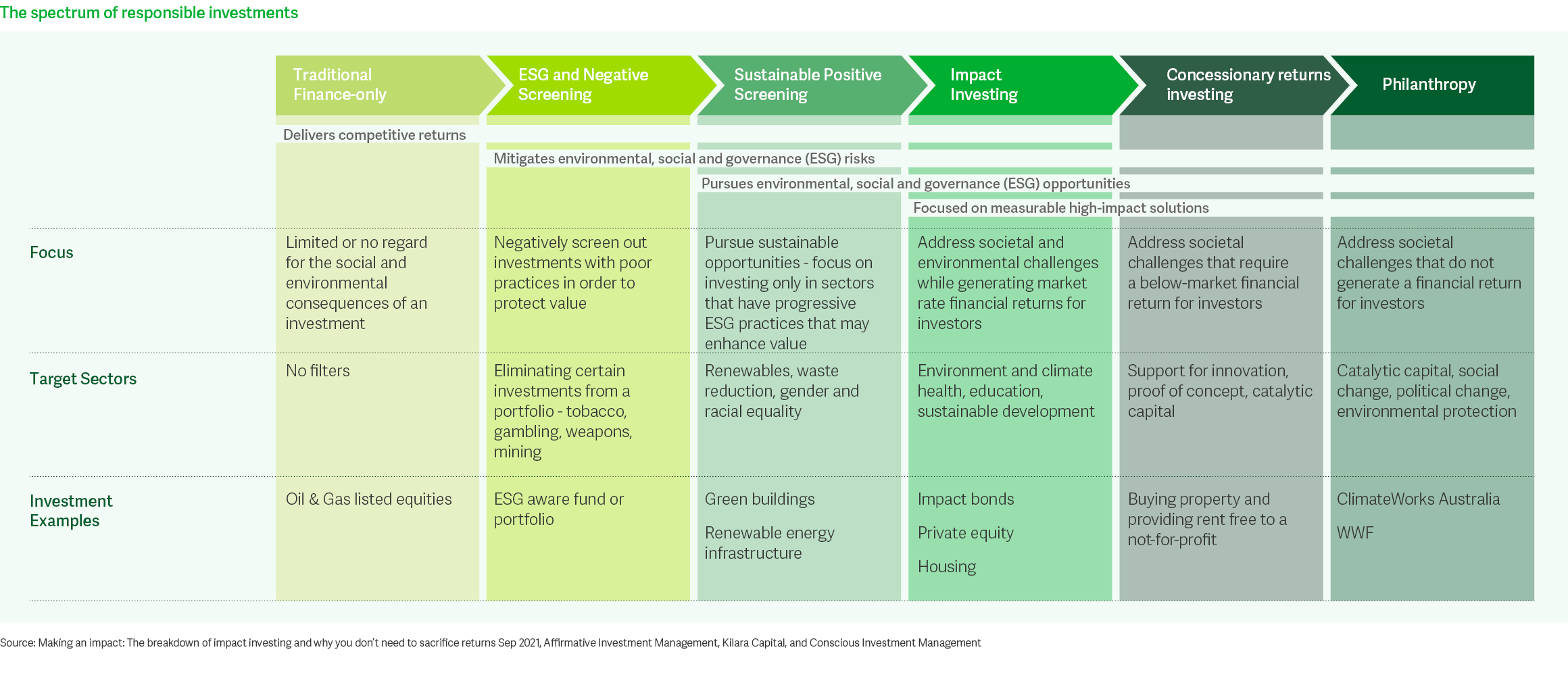

When considering responsible investing, you could look to define the investments universe into a few categories – each of which has a differing impact and also different financial returns.

The spectrum of responsible investments

1/ Negative screening

This involves eliminating specific companies or even entire industries, based on an assessment of the ESG credentials of each company and/or industry. It’s sometimes described as an ‘avoidance’ strategy.

Today, 36% of Australians 18+ who have responsible investments, have done so to stop investing in companies that are involved in controversial activities (e.g. gambling or weapons)¹.

2/ Positive screening

This involves pursuing sustainable opportunities that are focused, that drive capital to sectors and the spaces that the environment and climate desires them to go, and actively selecting companies and investments that meet determined ESG criteria, such as gender or racial equality. It goes beyond just avoiding companies that don’t stack up on ESG metrics.

3/ Impact investing

This involves investing with a very clear and specific environment or social purpose in mind, whilst still earning market rate financial returns. For example, an entity may issue bonds to raise funds for a specific purpose (such as building low-cost housing or investing in renewable energy). An investor can see very clearly, and very directly, what positive impact their investment is having.

4/ Concessionary returns investing

These are investments which have submarket rate, risk adjusted financial returns. An example is buying a property and providing it rent free to a not-for-profit to use as their office or putting solar panels on roofs for a sub-market return.

The United Nationals Sustainable Development as your investment criteria

Some investment managers align their portfolio objectives to the United Nations Sustainable Development Goals (SDGs). The SDGs are a set of 17 broad goals and 169 sub-targets agreed to by all United Nation members around building a more sustainable, equitable and prosperous planet for all. They cover a broad range of sustainability issues from reducing poverty, to accessing quality education, gender equality, climate action, as well as building sustainable cities and communities.

The SDGs are interconnected — reducing poverty, for example, goes hand in hand with reducing hunger. Climate change impacts others like zero hunger due to food insecurity brought about by changing weather patterns like droughts and floods.

Some investment managers look to limit their exposure to controversial industries that are inherently misaligned to the SDGs. Things like coal mining, weapons, adult entertainment, gambling, alcohol, uranium, and tobacco.

Other investment managers employ a third-party data provider to measure the contribution that the underlying holdings in their portfolios are making to the SDGs, as well as to the exposure they will have to those controversial industries.

With respect to climate change, select managers look to align their portfolios with the objectives of the Paris Agreement of limiting global warming to 1.5 to 2 degrees pre-industrial levels, as well as monitor exposure to fossil fuels and the carbon footprint of portfolios.

When selecting underlying investments, they may look to apply filters, such as: whether the fund is rated recommended or highly recommended by external research, and then look at the alignment of its strategy in terms of ESG or responsible investing.

It is important to remember that you can have a company that scores well in terms of ESG, for example with good gender diversity on its board, a great safety record and strong governance structures. But at the end of the day if it's still operating in an industry or have products that are inherently harmful to the environment or the society, such as coal mining or tobacco, it may be deemed not responsible.

Integrating responsible investing into valuation decisions

Another way of determining a responsible investment’s bona fides is to consider the earning potential of a company and long-term revenue outlook to see if there are risks or opportunities around its exposure to climate change.

Alternatively, one might consider how a change in climate regulation could impact the value of a company’s assets or balance sheet strength. Or, whether the company has adequately provisioned for the value of its liabilities — for example, remediation in the case of mining companies.

Investing responsibly is as much about managing risks as taking advantage of growth opportunities. You could own investments that are likely to become stranded, such as coal mines, or physical risks associated with climate change.

For example, you may want to ask yourself: Do you have exposure to buildings or factories that are likely to be subject to flooding due to rise in sea waters? These are the kind of risks that will increasingly need to be managed.

Responsible investing is a conversation no adviser can afford to ignore. While there are plenty of factors driving change and creating growth opportunities, there are also risks to be managed.

¹ The 2022 Netwealth Investing for good report is based on Netwealth’s Advisable Australian research, which surveyed 1,616 Australians 18+. Fieldwork took place from October 28 to November 23, 2021. The report is available at https://www.netwealth.com.au/web/insights/responsible-investing/