Netwealth's 2022 Advisable Australian Report

Investing for good

An examination of customer attitudes and behaviours to responsible investing

Australians are recognising the role investing can play in fostering positive change to the world around them. This means that responsible investing is increasingly top of mind as they seek to maximise the impact of their investment.

In our latest report, Investing for good, we examine investor behaviours and drivers for responsible investing in Australia, and the likeliness or unlikeliness for them to invest this way.

In this report, you will learn:

According to the Investing for good report, around 22% of Australians 18+ hold responsible investments in their investment portfolios. This figure is set to increase, with more than one in three investors (34%) expecting to increase their allocation to responsible investing in the next five years.

However, the market does vary and through the research we’ve segmented the Australians 18+ into four groups to create the ‘Advisable Australian responsible investment (RI) segments’:

These are people who believe in socially responsible investing, and support ESG principles and what RI stands for. They want their investments to make a difference. However, just because they believe the most doesn’t automatically mean they invest the most in RI, which could be due to reasons such as not having the capital and being less wealthy due to typically being younger.

This is the group who are most likely already invested in socially responsible assets, but they do it out of pragmatism, as a way to diversify or an opportunity for smart investments that could produce high returns. Their attitudes to the environment or responsible investing are somewhere in the middle, yet they invest. They typically have a high understanding of this type of investing.

These individuals do not typically invest in responsible investments (only 13% do). They are not against it, as such, but they are also not strongly for it. They are in the middle, and usually either doubt or do not have a strong opinion about it either way. This is a group who advisers may need convince to consider responsible investing, as more than a third would definitely consider them (37%) and the remaining two thirds (63%) would possibly consider them.

These are people who do not really understand responsible investing and nor do they wish to. Sceptics would not invest in SRI even if it was financially beneficial and are highly unlikely to be convinced otherwise, no matter the strategy or approach adopted by the adviser. We suggest advisers pay less attention to responsible investing strategies for this group.

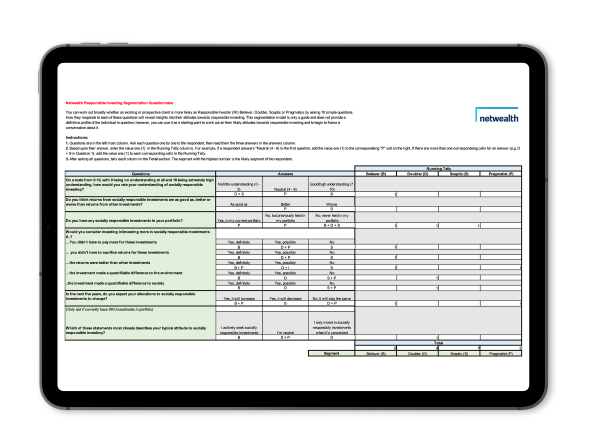

Using this questionnaire, you can segment your clients into the four responsible investor segments, the result is a client segmentation model that will allow you to target your responsible investment advice proposition to those that really care.

Watch Andrew Braun, GM of Marketing unpack our Investing for good report and hear from two advisers and two investment managers with in-depth experience in responsible and ESG investing. Discover ways to tailor your advice practice to clients interested in responsible investing.

More responsible investing related resources from our collection of events, reports, podcasts and masterclass recordings.

Kate Temby, independent director of Netwealth discusses why she is passionate about ESG and impact investing, the various shades of green investing and ‘greeniums’, net zero and transition finance, the availability of ESG data and research.

In this episode, we break down the global trends in ESG with Tim Cook, Head of Client Strategy at Russell Investments, and look at how investors can better define and align their ESG integration and investment process.

John McMurdo, CEO, Australian Ethical discusses what he sees as the next big themes for investing and shares some tips on where advisers can look to self-educate on future trends.

In this session, Ralton, Franklin Templeton and Pendal, explore the companies and sectors, from vegetarian diets to battery storage technology, that are set to benefit from the green wave.

In this panel, industry experts deep dive into the burgeoning field of impact investing and discuss why you don't need to sacrifice returns illustrated through real-life case studies, and explain how impact investing differs from ESG investing.

In this presentation, Pendal, Lonsec and DNR capital discuss what to look for when constructing your sustainable portfolio, including an examination of external benchmarks and how to align your investments with your values and beliefs.

ESG Research

We have ESG research and ratings on managed funds from Morningstar that utilise the “Morningstar Sustainability Rating” and their “Low Carbon Designation” to identify the companies held in a fund that are in general alignment with the transition to a low-carbon economy.

The new ESG ratings available on our Compare Funds & Models page

ESG Funds

Netwealth has a range of the ESG managed funds and managed accounts available giving you and your clients the opportunity to invest responsibly.

Enter your details to get your complimentary copy of the 2022 Investing for good report

By submitting your details, you agree to receive further marketing communications from Netwealth. It is, however, possible to unsubscribe from within each communication received, by clicking the unsubscribe link at the bottom of the email. Alternatively, you can visit the following webpage or contact us on 1800 888 223 and ask to be unsubscribed. Please visit our website www.netwealth.com.au to read our Privacy Policy. By clicking Download, you agree to our Terms & Conditions.