Take outs

- Financial advisers are well placed to capitalise on the commercial opportunity to build and deliver a dedicated estate planning service.

- Intestacy is becoming a significant problem, which requires a solution that can potentially be delivered by advisers.

- Advisers need to offer new, human-centric services, such as estate planning, to benefit the 48% of Australian adults with unmet financial advice needs1.

A tremendous opportunity exists for advice firms to establish estate planning as a core service and profit centre in their business.

In the Netwealth webinar, Practical steps to building an estate planning offering, Brandon Thompson, CEO of Yodal, explains why financial advisers are well placed to capitalise on the commercial opportunity of building a dedicated estate planning offering.

According to Brandon, estate planning is much more than just a will.

“Yes, a will is involved,” says Brandon, “but it's also about superannuation, death benefit nominations, testamentary trusts, protecting assets, powers of attorney and powers of guardianship.

“There are quite a few components to an estate plan. It's about peace of mind for clients and their loved ones, regardless of their life stage or change in life circumstances. It's a legacy conversation for every stage in life, not a mortality conversation around end-of-life.”

Advisers are familiar with estate planning as a term, but it’s often peripheral to their core business. They tend to focus on advice and put estate planning to the side, or in the background, perhaps as a ‘value-add’.

Many advisers even refer estate planning out to a third-party law firm, because they believe they need more knowledge than they actually do to provide a comprehensive estate planning service.

Some advisers are also wary of initiating the estate planning conversation with clients.

“It’s a different type of conversation to what you would normally have, from an accounting or an advice perspective,” says Brandon.

Even if an advice firm currently offers estate planning as a service, there may be limited fulfilment capacity, because it is not adequately resourced or embedded into client journey maps. It is often not a dedicated stage that all clients are taken through as a matter of process. And it is generally not measured.

In recent times, however, Brandon has noticed a shift among advisers’ thinking and practices. They are beginning to appreciate the opportunity that estate planning presents, largely due to two key reasons - a lack of a clearly defined estate plan or will among Australians and unmet financial advice need.

The intestacy problem

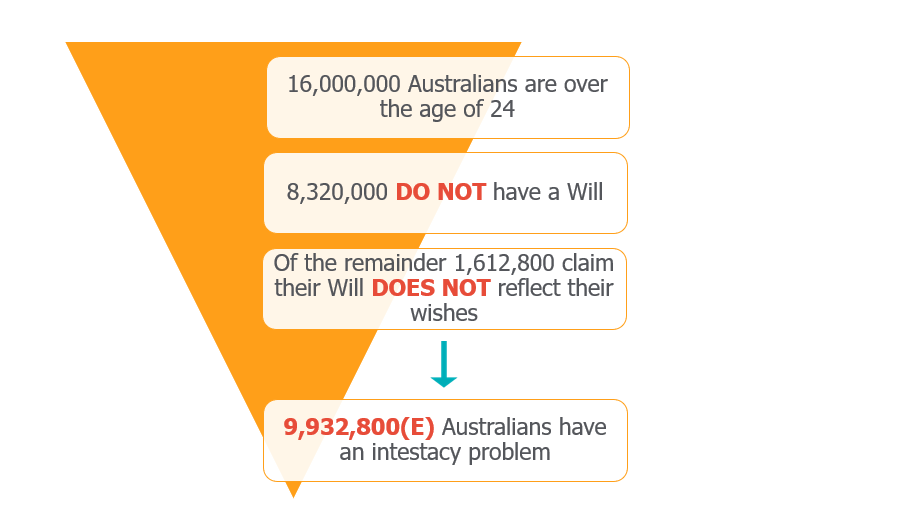

According to the Australian Bureau of Statistics, more than half of Australian adults don’t have a will or an estate plan. Of the people who do, many believe their current estate plan is not aligned with their desired outcomes.

Australians that have a will

| State | Yes | No | Unsure |

| VIC | 41% | 54% | 5% |

| SA | 42% | 54% | 4% |

| NSW | 44% | 52% | 4% |

| WA | 45% | 53% | 2% |

| TAS | 48% | 52% | 0% |

| QLD | 50% | 47% | 3% |

| Avg | 45% | 52% | 3% |

Source: Australian Bureau of Statstics

Source: Australian Bureau of Statstics

“They're big numbers,” says Brandon.

“You're looking at 9.9 million Australians who have an intestacy problem. They do not have an estate plan, or they do not have an estate plan that's a current reflection of their actual wishes.”

On top of this, Australia is on the verge of the largest intergenerational wealth transfer in history. Estimates suggest that Australia will see more than $3 trillion change hands over the next 10 to 20 years2, as the baby boomer generation passes on its wealth. At the same time, it is projected that nearly half of all Australians will die intestate (without a will).

Intestacy is becoming a significant problem. It is a problem that requires a solution that can potentially be delivered by advisers.

An industry in flux

While 48% of Australian adults have indicated they have unmet financial advice needs1, the big banks are exiting the advice space, which leaves a substantial revenue opportunity on the table.

The major players stepping in to fill that space are superannuation funds, which are boosting their advice capabilities. Some are even building law practices within their organisations, specifically to engage members through estate planning.

“There's significant unmet demand there,” says Brandon. “That's why you're seeing super funds bolster their adviser numbers.

“They will deliver a portion of robo-advice to simple opportunities, or simple estate planning needs or financial advice needs. But at the end of the day, the unmet demand is for face-to-face advice.”

All of this points to an opportunity for advisers in the years to come.

“Clients are looking for solutions they can trust. Clients are looking for advice solutions they can afford and see value in. People are happy to spend money on advice. They just need to see value in it.”

Speaking directly to advisers, Brandon suggests the opportunity is clear.

“You are best placed to seize the opportunity, whether it's attracting new clients, generating new revenue, or implementing new services,” he says.

“You have those existing client relationships, with your current clients and the beneficiaries of your current clients. You already have a much deeper understanding, and a much better relationship with those people, than banks or superannuation funds do.

“The benefits of implementing a dedicated estate planning product are that you can realise benefits in the short term, with the benefits also persisting in the long term. Your benefits are realisable, almost immediately, and it doesn't cost a lot of money.

“If you do this properly, you can establish estate planning as a profit centre, not a cost centre, within your business.”

Find out more about the benefits of building an estate planning service offering

Listen to the Netwealth webinar Practical steps to building an estate planning offering for additional insights, read about the do's and don'ts of estate planning, or contact Netwealth.

You may also enjoy

Business management

The business opportunity of estate planning as a core service

Explore why financial advisers are well placed to capitalise on a dedicated estate planning offering.

Business management

Managing culture, client and technology during volatility

Discover ways you can maintain meaningful client relationships and keep your team motivated.

Business management

Key factors in the transition of advice to a profession

Find out three key elements the advice industry needs to achieve for advisers to complete their career makeover.

Sources:

1 Productivity Commission, Draft Report: Competition in the Australian Financial System (January 2018)

2 Australian Financial Review, December 2017

Views expressed are of the interviewee and may not be the opinion of Netwealth or its related companies.