Take outs

- For Gen X&Ys, advice is about goals and not just about the financial product

- Use real numbers when constructing a budget and benchmark it against peer groups

- Building an X&Y brand is more than posting to your Instagram account

A common misconception among advisers is that Gen(eration) Y are too young to target for financial advice.

If you believe this you should think again. Looking ahead, Gen Y, combined with the slightly older Gen X, will very soon make up the largest market for financial advice in the country.

According to recent research into the changing face of Australian employment, commissioned by human capital manager Kronos, by 2021 Gen Y and X will make up 50 per cent of our workforce - growing to 75 per cent by 2025.

In its webinar, Attract, retain and advise Gen X&Y clients, Netwealth spoke to Steve Crawford, Money Coach and owner of Experience Wealth, who revealed how to attract Gen X&Y to your advice portfolio.

“We can’t just recycle our existing financial planning offers that have worked for their parents, being the Baby Boomers and the retirees. We can't just rehash that and expect that it's going to work for younger generations,” he explains.

Steve believes that Gen X&Y are steering clear of financial advice for several reasons, the most common being that:

- they feel their financial situation doesn’t warrant it

- they are not convinced of the value that a financial adviser can add

- they plan to wait until they are older

- they don’t trust a financial adviser

“When I put all of this together, what it says to me is Gen X&Y, first and foremost, believe that financial advice is still heavily weighted and heavily anchored in superannuation and insurance and, in particular, superannuation and insurance product advice,” says Steve.

So how do you capture their interest?

With change comes your chance to explore new perspectives

We’ve developed a suite of resources to help you navigate this changing landscape – our Change/Chance Series. This selection of guides and articles delve into topics that are front of mind for advisers, now.

Goal-based advice

Steve reveals that whilst the industry has traditionally built their offers around investment management, Gen X and Y are looking for someone to help them figure out their specific goals and how to save for them.

Steve suggests engaging in a goal planning session and a value exercise, both of which will allow the client to decide on a process of prioritisation and give you valuable insight.

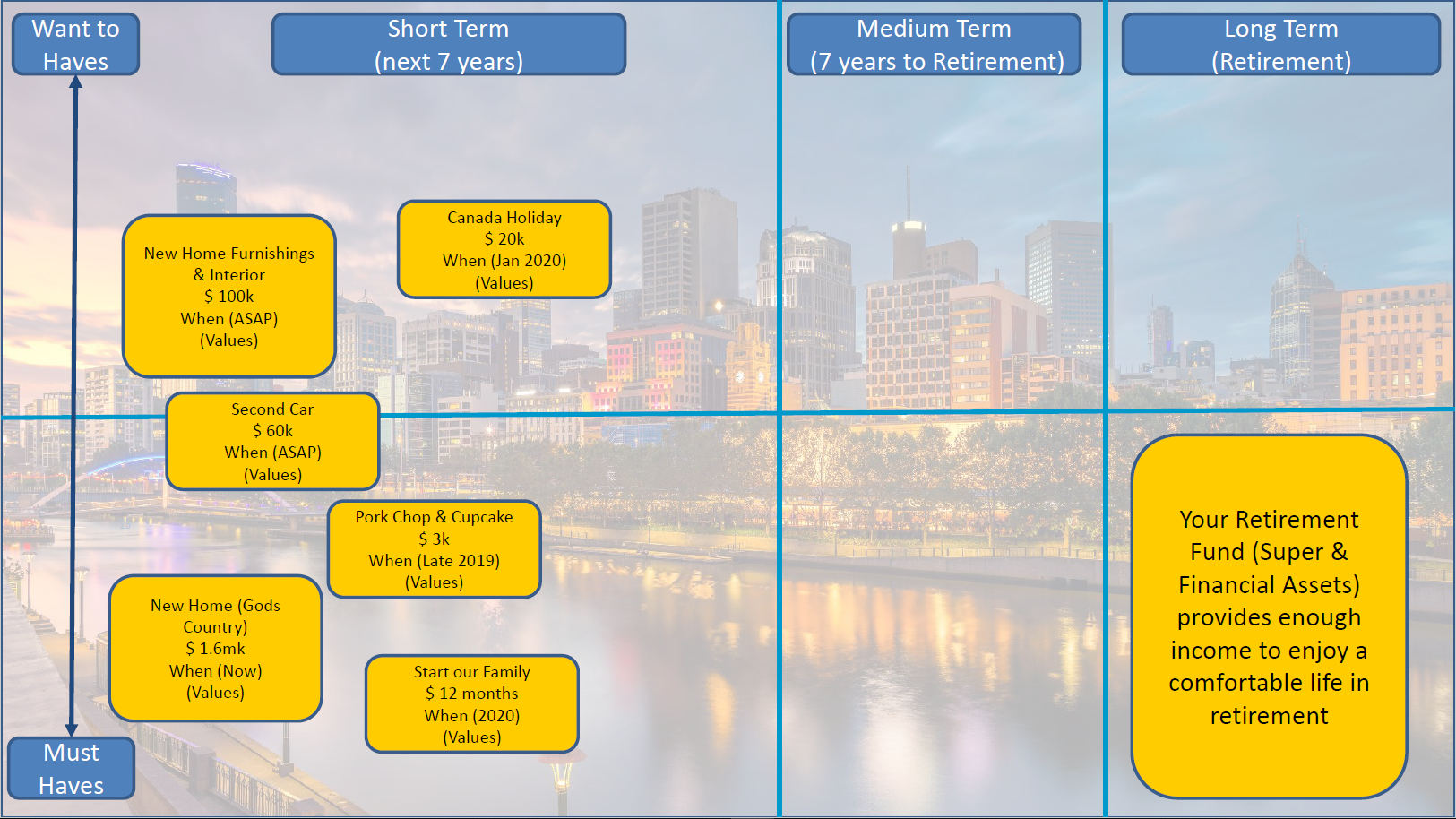

Steve’s goal planning session is divided into three steps:

- He kicks it off by asking his client/s to identify their strongest values.

- Second, he advises them to make their wish list real by using a goals board.

- Next, Steve’s client links their goals to a desired timeframe based entirely on their subjective importance.

Source: Example goals board by Experience Wealth

This exercise, he explains, is particularly powerful as having a couple working through it together helps uncover their shared values

“So, from a goal planning session, your objective from a client point of view is to help them move the conversation forward, from, 'This is what we think we want to do,' to, 'This is what we're actually going to do.' Building a structured process in an actual meeting with the clients. Not just leaving it in a fact find,” Steve advises.

A benefit to the adviser is that this exercise helps weed out those clients that won't last.

“If they get to this point and you can feel that it's all sort of superficial, and they're not really on the same page, they're not going to go forward,” he says. “But the ones that do go forward, well, they move to the next stage.”

Download Steve's goal planning template

Use real numbers and benchmark them

Now that you have a clear view of their goals, it is time to start planning for their realisation.

Steve suggests approaching budgeting, banking and reporting from an angle that interests Gen X&Y.

“Give them scenarios and comparisons against peer groups and how their numbers stack up. By doing so, you're giving them a way to be able to make a measurement and a judgement call on what they want their budget to look like,” he says.

By creating a money management program, Steve explains that you can walk clients through stages of accepting their budget and understanding what it costs to be them.

“The whole point of this is that you've got a programme and a process that allows them to set a real budget. Not just some made-up thing.,” he says.

Next, think about “pushing reporting” or, in other words, what information and insights you want to give your client on a weekly, monthly, quarterly, and yearly basis so that they can track their progress.

“Understand what your objective is. What they are trying to get out of this data, and what you are trying to get them to do,” he concludes.

Your digital appeal

Steve suggests bringing products and services to Gen X&Y on their terms. This involves authentic and consistent “social stalking”.

“Understand that when somebody refers you to a friend or colleague of theirs, they have got their phone out and they've already started cyber stalking,” he explains.

“So everywhere that you show up online, you don't have to have the best image in the world, but make sure it's consistent.”

Steve adds that an adviser that wants to work with Gen X&Y can’t adorn their LinkedIn profile with the words ‘retirement planning’ or ‘financial planning expert’. Instead, they need to make sure they speak the same language as their future client.

“That means on your website, on your Instagram account, on your Facebook account, you have to have talked about the thing that's relevant to them at least once or twice. Have an opinion on childcare. Have an opinion on paid parental leave. Have an opinion on the new changes to lending,” he advises.

Find out more

Listen to the Netwealth webinar, Attract, retain and advise Gen X&Y clients, for more tips on how to build an offer for Gen X&Y.

Views expressed are of the interviewee and may not be the opinion of Netwealth or its related companies.

Insights

Latest: Managed accounts during volatility and beyond

Four advisers share how managed accounts can enhance your client value proposition.

Special reports: Take a deep dive

Our collection of guides take a deep dive on topics including AdviceTech, managed accounts and cultural trends.

Podcasts: Between Meetings with Matt Heine

Netwealth's Matt Heine chats to industry thought leaders on the opportunities they see for financial advisers.

Webinars: Grow your Business IQ

Recordings from our monthly webinar series, covering a range of topics presented by industry professionals.