Take outs

- Advised investors are more confident about their future

- Advised investors tend to have a more balanced and diversified income

- Income investments are more likely to generate higher returns if advised

In its webinar Australian investor trends every financial adviser should know, Netwealth spoke to Andy Sowerby from Legg Mason who revealed some interesting findings about advised and DIY investments, and how generational gaps play a part in decision making, from their 2019 Global Investor Survey.

Out of the Australian investor respondents (“People who will be investing at least A$15,000 in the next 12 months and who have made changes to their investments within the last 5 years”), 45 per cent said they use an adviser for the majority or all of their decisions, 17 per cent admitted to consulting an adviser sometimes, while 39 per cent said they rarely or never turn to an adviser to help them with their investment decisions.

Andy explains that while the use of advisers overall wasn’t a surprise, the survey did uncover an interesting statistic unforeseen by Legg Mason.

“We were surprised to see a high percentage of the Millennial cohort using advisers for most or all of their investment decisions,” says Andy.

“It’s interesting to see the younger population coming through and valuing advice, and indeed relying on advice,” says Andy.

Advice matters

Andy also revealed that advised investors are more confident about the future.

Nearly three-quarters (71 per cent) of advised investors felt confident about their investment opportunities in the coming 12 months, compared with 55 per cent of DIY investors.

A contributing factor may be that advised investors tend to have higher investment knowledge.

43% see themselves as expert/advanced compared to 32% DIY investors and more likely to view volatility as a potential positive (42% vs 24% DIY)

“Advice matters and advice is valuable,” Andy concludes.

“That’s based on both the actual outcomes and experiences that investors have received. But also, an emotional sense to do with the confidence, security and indeed happiness of advised investors versus DIY investors."

With change comes your chance to explore new perspectives

We’ve developed a suite of resources to help you navigate this changing landscape – our Change/Chance Series. This selection of guides and articles delve into topics that are front of mind for advisers, now.

Income diversification

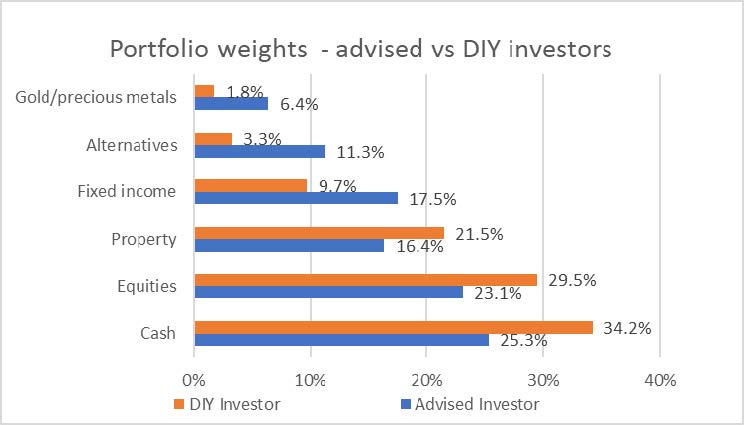

Advised investors tend to have a more balanced and diversified income compared with DIY investors, with significantly more fixed income exposure.

“What we do see through the data is advised investors have much more diversification in their portfolio, but also in their income-producing assets than DIY investors,” says Andy.

The data shows advised investors have 42.5 per cent of dividend paying shares, 22.8 per cent of rental property, 17.5 per cent fixed income and 17.2 per cent other assets.

Conversely, DIY investors’ income-producing assets are made up of 52.1 per cent of dividend paying shares, followed by other assets (24.2 per cent), rental property (19.3 per cent) and fixed income (4.4 per cent).

Source: Legg Mason Global Investment Survey 2018

Portfolio construction

Income investments also generate higher returns if advised, says Andy.

Average return on income investments for advised investors was 7.5 per cent versus only 6 per cent for DIY investors.

Advised investors also tend to be more versed in the ESG space, where investments in a company are measured based on environmental, social and governance factors.

Andy points out that advised investors are more than twice as likely to use ESG funds compared to DIY investors.

Similarly, global exposure is much higher for advised investors than it is for DIY investors.

“We tend to see more DIY investors being more dominated by local assets than global assets, but that also points to product development,” says Andy.

In fact, the survey discovered that 46 per cent of DIY investors do not invest in global markets versus only 15 per cent of advised investors.

“It just reinforces what I’ve already said. Advised investor, much more diversified, much more balanced. And the DIY investor, much more concentrated, particularly into dividend-paying shares,” explains Andy.

He confirms that advised and DIY investors also differ when it comes to their retirement strategies.

The data demonstrates that 67 per cent of advised investors expect to make portfolio changes for retirement, whereas 44 per cent of DIY investors say they are unlikely to change their investment portfolio at all.

“Advised investors have a plan, a strategy, and have an idea of where they are going to,” judges Andy.

“Whereas, DIY investors tend to not really have that, and are more likely to leave their portfolio actually completely unchanged through that transition into retirement.”

Find out more

To learn more you can watch the webinar recording Australian investor trends every financial adviser should know or speak to a member of the Netwealth team.

Views expressed are of the interviewee and may not be the opinion of Netwealth or its related companies.

Insights

Latest: Managed accounts during volatility and beyond

Four advisers share how managed accounts can enhance your client value proposition.

Special reports: Take a deep dive

Our collection of guides take a deep dive on topics including AdviceTech, managed accounts and cultural trends.

Podcasts: Between Meetings with Matt Heine

Netwealth's Matt Heine chats to industry thought leaders on the opportunities they see for financial advisers.

Webinars: Grow your Business IQ

Recordings from our monthly webinar series, covering a range of topics presented by industry professionals.