Take outs

- High percentages of Millennials are very switched on to making choices which align with their values.

- Investors have a really distinctive and powerful voice to influence both companies and governments.

- The growing desire to tackle global problems by redirecting spending and investment dollars means significant new investing opportunities.

Smashed avo for breakfast, renting rather than buying - millennials have their own ideas about a lot of things, and that includes money.

For this generation, the wider impacts of their spending and investing are every bit as important as good value or high returns, and their determination to use their growing financial clout to tackle pressing global problems is creating significant new investing opportunities.

But this is not exclusively a generational phenomenon. Over 90 percent of Australians say they want to invest responsibly and ethically, says Stuart Palmer, Head of Ethics Research at Australian Ethical Investment, Australia’s leading ethical superannuation fund and investment manager.

“Overwhelmingly, Australians are saying that responsible investing is important to them,’’ says Stuart, in Netwealth's webinar Green is the new black: The different shades of responsible investing.

“Millennials, those turning 18 around the turn of the century and in the decade after that, are a driver of this. High percentages of Millennials are very switched on to making choices which align with their values, whether that’s in terms of the jobs that they do, the products and services they buy or what they do with their investment dollars.’’

Jargon alert

Responsible investing, ethical investing, sustainable investing, ESG (environmental, social, corporate governance) investing – there’s a lot of jargon in this area, warns Stuart. But it all relates to investing that looks beyond the very important financial aspects of investing to also consider the impacts it has on the planet – on people, animals and the environment.

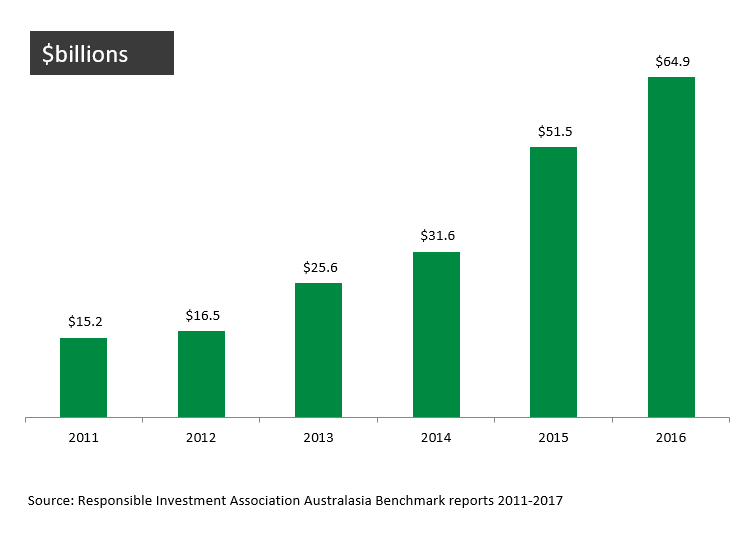

No matter what you call it, the amount of money flowing into responsible investing is are worldwide, and Australia is no exception. Since the beginning of the decade, responsible investing has been doubling every three years.

People increasingly want to help tackle the great problems they see facing the world today, whether that is climate change, deforestation or ageing demographics.

The growth of ethical investing

“There is a growing realisation that government is not going to fix these problems, so they are thinking about how private capital can help to solve them,’’ says Stuart.

“Investors have a really distinctive and powerful voice to influence both companies and governments, so we think it's really important as a responsible investor that we use that power and credibility and a positive way.

“For example, we as an ethical investor screen out fossil fuels because we think continued investment in them is inconsistent with the urgent changes we need to reduce emissions and limit world warming. We recognise the need to shift capital to clean energy, renewable energy such as battery storage so we positively seek that out.’’

The Netwealth Porfolio Construction Podcast

In this series, we pick the brains of key wealth management professionals to uncover unique insights on the potential opportunities and considerations in the investment area they are most passionate about.

New opportunities

The growing desire to tackle global problems by redirecting spending and investment dollars means significant new investing opportunities. Responsible investing makes good financial sense because consumers and investors are driving change through their behaviour.

“We’ve seen that most recently with the publicity around (troubled financial services company) AMP,’’ says Stuart. “The missteps it’s made, as revealed by the banking royal commission, and the concerns people have about that, are reflected in its share price.’’

By identifying problems that we need to solve, we can also uncover future growth areas. For example, the world’s ageing demographics mean there will have to be significant new capital directed towards aged care, medical technology, and health and welfare in general.

Concerns about climate change are driving strong growth in renewables and clean energy, and increasing demand for metals like lithium and cobalt that are used in for batteries.

No trade-off

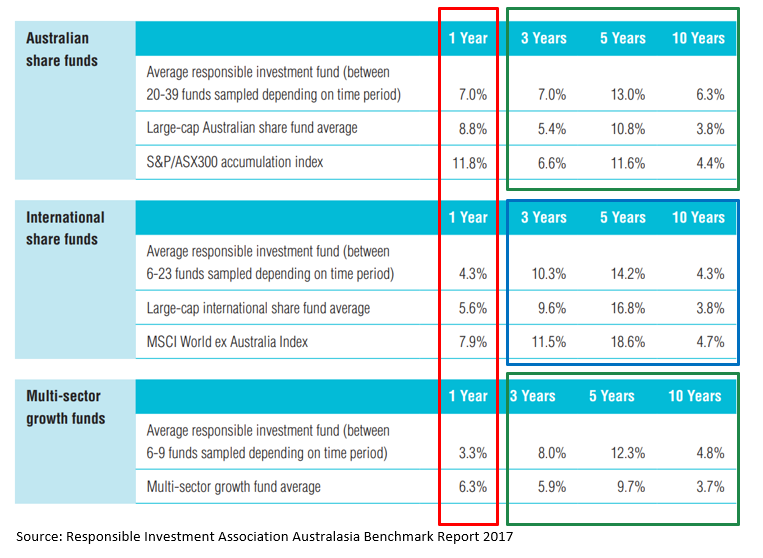

“The ethical investment myth is it there must be some sort of trade-off or financial downside to paying attention to environmental and social issues,’’ says Stuart.

“That has not been our experience. Ethical investing is directing you towards sectors with long-term growth prospects and trying to keep you out of the ones which face headwinds, whether they are increasing government regulation or customer backlash against unsustainable practices, so you can see the alignment between ethical and financial investing.’’

Core responsible fund outperformance

While short-term returns are volatile, over time responsible investment funds have outperformed major indices in dollar terms while at the same time giving investors the peace of mind that comes from knowing they are part of the solution when it comes to making the world a better place.

Want to learn more about responsible investing?

Listen to the complete Green is the New Black: the Different Shades of Responsible Investing webinar, or contact Netwealth to find out more.

Compare managed funds and models

Get the latest research data and commentary to search and compare managed funds and managed account models. See performance data, costs and use powerful filtering tools to identify funds by manager and asset classes.

The information in this article is general in nature. Any financial advice it contains is general advice only and has been prepared without taking into account the objectives, financial situation or needs of any particular person. The article content is not intended to be a substitute for professional advice, so before you act on it you should determine its appropriateness having regard to your particular objectives, financial situation and needs, and seek any professional advice you require. Any reference to a particular investment is not a recommendation to buy, sell or hold the investment. The relevant disclosure document should be obtained from Netwealth and considered before deciding whether to acquire, dispose of, or to continue to hold, an investment in any Netwealth product.