Smart Beta investment strategies aim to capture the beta of a market in the smartest possible way.

Designed to maximise returns, the approach involves strategic selection, weighting and rebalancing of shares within an index based on factors the particular Smart Beta fund deems important.

It's a methodology being applied to Exchange Traded Funds (ETFs), an investment vehicle traded on the ASX like individual shares, but diversified and professionally managed like an investment fund.

Damon Gosen, Vice President of Business Development with VanEck, talks us through Smart Beta ETFs in the Netwealth webinar: Understanding, exploring and selecting Exchange Traded Funds.

To understand Smart Beta, it’s important to recap some investment basics.

Understanding market indexes

Market indexes are essentially benchmarks of how an exchange, such as the Australian Stock Exchange (ASX), or market is performing.

The ASX200 is a benchmark index of the 200 largest companies on the ASX, while the Standard & Poor 500 (the S&P) is an American index used globally based on the market value of the top 500 companies listed on the world’s two largest stock exchanges – the NYSE and the NASDAQ.

Market indices are measured daily and track the combined movements of the stocks within the index to provide a general outlook on business performance. Some indices have different weightings applied to how different companies are influencing the overall index.

Understanding active and passive funds

Active investment funds are managed by an investment team who decide how to invest the fund’s money. These can also be known as alpha funds.

“Alpha is financial jargon for outperformance. Active fund managers are trying to outperform an index,” says Gosen.

Passive investment funds are not actively managed. They follow a market index – usually the S&P or the ASX200. Your share portfolio is linked to the index performance – if the ASX200 climbs by six points, so does your stock. These can also be known as beta funds.

“In a financial sense, beta refers to the actual performance of the market index,” explains Gosen.

“Smart Beta is effectively a marketing term.”

Gosen says ongoing underperformance of active funds and their higher management fees has seen a huge switch from active funds to passive funds.

“This has happened over many years and has picked up speed globally and locally. Passive funds just offer a market performance, so ETFs are passive.”

Why Smart Beta?

While active management may imply a higher likelihood of better returns through applying investment skill, Gosen says the numbers tell a different story.

“Over the past 10 years, 85 percent of international equities active funds have underperformed on their index. And over 70 percent of Australian equity funds have underperformed on their index,” he says.

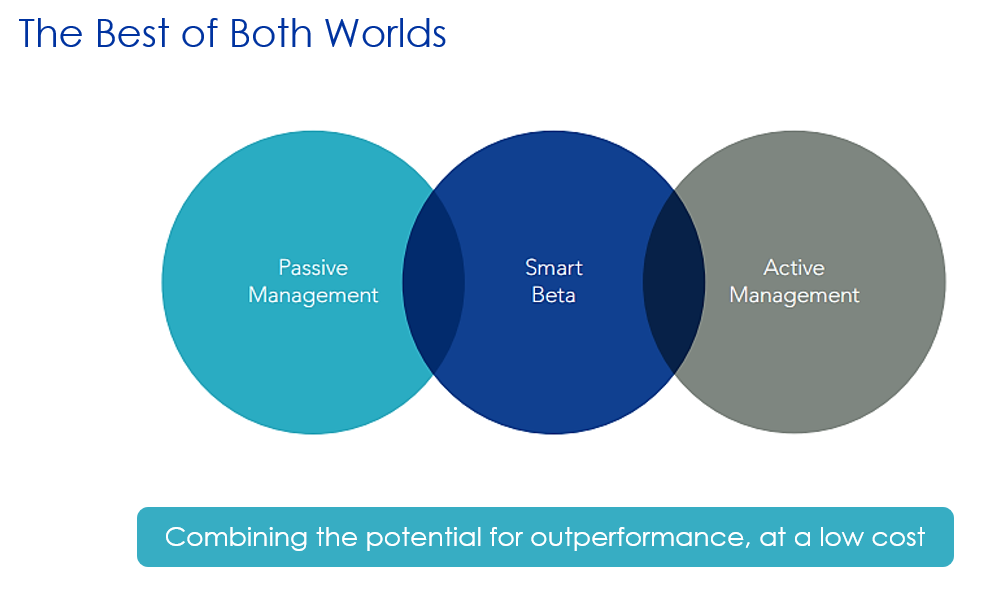

Gosen says the pitfalls of a purely active or purely passive investment approach led to the creation of Smart Betas.

“It’s protecting against the risks or distortions in market indexes, or capturing certain things that active funds do very well,” he says.

“We would describe it as being the best of both worlds.”

Hear more on ETFs

So, what are Smart Beta ETFs?

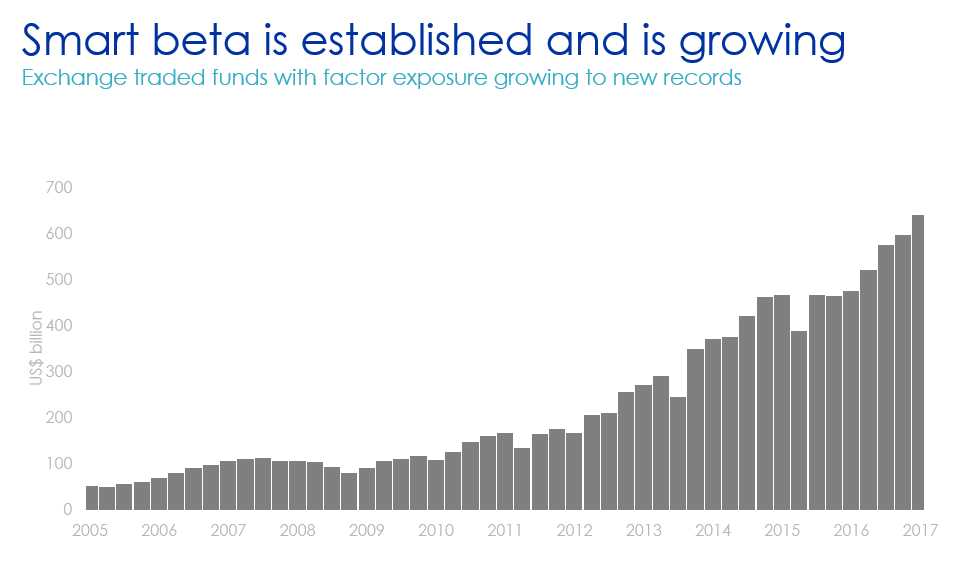

“Smart Beta is any index construction methodology different from market capitalisation. Smart Beta is established and it's growing at record rates. It’s the fastest growing part of the global investment management landscape, and shows no signs of letting up,” Gosen says.

Source: VanEck

“Smart Betas are the fastest growing funds management sector, and it's capturing some of the smart things that active funds do at a much smaller management cost as well.”

Smart Beta ETFs are using investment strategies to improve returns and reduce risk on market indexes like the ASX 200 or the S&P.

They are set up with transparent rules on how they will invest funds and generally cost less than active management.

Rules for the Smart Beta ETFs can be based on a range of models, including equal weighted where funds are invested evenly across a market index i.e. funds invested equally across all 200 companies listed in the ASX. Or quality weighted models invest according to the quality of each stock’s returns.

Source: VanEck

Equal-weighted Smart Beta fund: How it works and is it right for you?

VanEck Vectors Australia Equal Weight ETF trades on the ASX as MVW.

“This addresses stock and sector concentration issues in the Australian market. The ASX 200 is skewed to a very small number of stocks,” says Gosen.

“The top 10 stocks are getting close to 50 percent of the market and more than half of the Australian share market is from two sectors, financials and materials. Our view is if there's a risk or distortion in a particular asset class then it makes sense to do an index approach that's sensibly diversified.”

An equal-weighting approach aims to reduce the concentration of investment in only a few sectors. Research supports equal weighting as not only a sensible diversified approach but a way of boosting returns over the standard market index in the long term.

Gosen says equal-weighted Smart Beta funds can form part of a smart long-term strategy and quarterly rebalances keep the fund healthy.

“We’d see this working in a portfolio as part of a core passive strategy, a low-cost, high performing, well-designed index that should add value over time,” he says.

“Every quarter, every stock that's held in the index is held in the exact same proportions. By the end of the quarter, some stocks have outperformed and some have underperformed. That rebalance means you're actually taking profits on the best-performing stocks and you're topping off those that have underperformed, which creates this contrarian trading strategy and a value bias that tends to add value over time.”

Quality-weighted Smart Beta: How it works and is it right for you?

Quality-weighted or quality factor index is a well-recognised strategy used by many famous investors, says Gosen.

“Every stock gets given a score based on three quality factors – higher returns on equity, stable year on year earnings growth, and low financial leverage.”

The quality scores of the stocks determine which stocks are included in the Smart Beta fund. Gosen says this type of ETF works on the premise that in the long-term, quality companies tend to do better than other companies, but you don't have to go and pay an active manager to identify those quality businesses.

“This index tends to tilt towards mature tech businesses, consumer staples and healthcare, and away from financials, energy and materials,” he says.

“It's effectively the opposite of the Australian market, so gives exposure to the sectors that Australian investors find difficult to tap into on the ASX. You get exposure to things like Microsoft, Apple, Johnson & Johnson, Nestle, Alphabet – a whole range of companies that have got very strong balance sheets and very sticky earnings profiles.”

Gosen highlights that quality businesses weather downturns like the GFC much better.

“During market downturns, there’s a flight to quality. The best businesses tend to hold up a lot better. If you think of the GFC, equity markets fell enormously, while the quality index fell a lot less and recovered a lot quicker.”

Want to know more about Smart Beta ETFs?

Listen to the complete Understanding, exploring and selecting Exchange Traded Funds webinar, or contact Netwealth to find out more.

Compare managed funds and models

Get the latest research data and commentary to search and compare managed funds and managed account models. See performance data, costs and use powerful filtering tools to identify funds by manager and asset classes.

The information in this article is general in nature. Any financial advice it contains is general advice only and has been prepared without taking into account the objectives, financial situation or needs of any particular person. The article content is not intended to be a substitute for professional advice, so before you act on it you should determine its appropriateness having regard to your particular objectives, financial situation and needs, and seek any professional advice you require. Any reference to a particular investment is not a recommendation to buy, sell or hold the investment. The relevant disclosure document should be obtained from Netwealth and considered before deciding whether to acquire, dispose of, or to continue to hold, an investment in any Netwealth product.