Take outs

- Infrastructure tends to be financed and managed on a long-term basis, generally resulting in predictable financial outcomes and dependable returns.

- Infrastructure assets are not get-rich-quick investments, rather they are defensive.

- Being resilient, infrastructure assets can help to protect a portfolio against inflation and market fluctuations.

For investors building a well-balanced investment portfolio, including infrastructure could play a stabilising role. But what exactly is infrastructure, and what can it do for their portfolio?

For Ofer Karliner, portfolio manager with Magellan Asset Management’s infrastructure, transport and industrials team, the defining attribute of infrastructure is that it provides a service essential for the functioning of the community.

“By that I mean you switch on a light switch and have the lights come on, you turn the tap and see water come out, you hop in your car and you can find a road to drive on,’’ explained Ofer in the Netwealth portfolio construction webinar Protecting your portfolio with infrastructure.

Solid, dependable returns

Infrastructure includes utilities (such as water and gas utilities, and power generators); transport (such as airports, pipelines and toll roads); and social (which includes schools, prisons and hospitals).

If you’re thinking that these don’t sound like particularly sexy, high-growth investments, you’d be right – but that’s the whole point.

Because these assets tend to have high development costs and very long lives, they are typically financed and managed on a long-term basis. This means predictable financial results and therefore solid, dependable returns.

“What we're trying to achieve with infrastructure investing is not to get rich quick,’’ says Ofer. “It's to generate stable cash flows and grow wealth with certainty. It’s a highly defensive portfolio with inflation protection and low correlation with other asset classes.’’

The Netwealth Porfolio Construction Podcast

In this series, we pick the brains of key wealth management professionals to uncover unique insights on the potential opportunities and considerations in the investment area they are most passionate about.

Inflation and interest rates

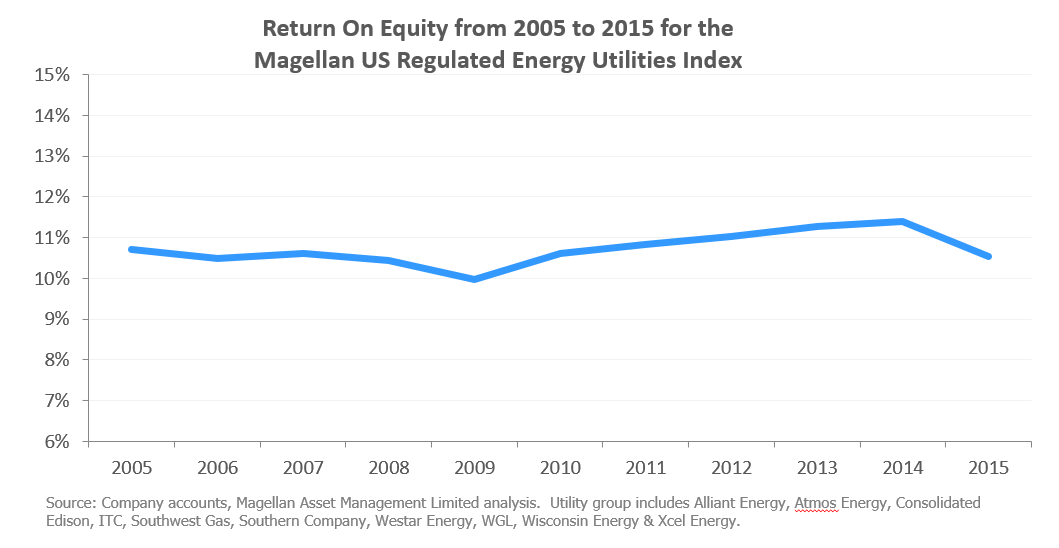

A key attraction of infrastructure for investors is the way it protects them from such fluctuations in economies and markets. Their essential service nature means demand is resilient, and infrastructure assets are generally monopolies or quasi-monopolies, meaning they can easily adjust the prices they charge to compensate for inflation and, depending on regulation, other input costs such as rising borrowing costs. This is particularly pertinent in the case of utilities, which are generally guaranteed a fair return on investment.

“In terms of utilities, generally speaking you're allowed to have a fair return on capital,’’ says Ofer. “That means you're insulated from changes in demand, changes to inflation, changes in interest rates, changes in wages, etc.

“You can pass all that through to your end customers. It then becomes an issue of understanding that regulation, and the way the regulation can change over time.”

“In most Western markets that regulation is fairly transparent. That makes valuations for these businesses relatively simple. You should be able to see and understand the cash flow to this business through time.’’

Low correlation

Another way that infrastructure investment can add stability to a portfolio is by increasing diversification. Because infrastructure earnings tend not to move in the same cycles as traditional asset classes such as equities, fixed income and real estate, they have a smoothing effect on long-term returns.

“One of the reasons you look to invest in infrastructure is to diversify and provide stability,’’ says Ofer. “The correlation (of the Magellan Core Infrastructure index) against the MSCI World index is 0.4, it's extremely low. We've even seen over the last five years the downside capture has been negative. So that means when the MSCI world has fallen, we've gone up.’’

In the case of the tech wreck of 2000 that followed the dot-com bubble, and the global financial crisis of 2007/8, the infrastructure index fell more slowly and then recovered more quickly than the MSCI World index.

“It did what it's supposed to do, it was defensive,’’ says Ofer. “It protected value.’’

Want to know more about investing in infrastructure?

Looking to increase the stability and diversity of your portfolio? Listen to the complete Protecting your Portfolio with Infrastructure webinar, or contact Netwealth to find out more.

Compare managed funds and models

Get the latest research data and commentary to search and compare managed funds and managed account models. See performance data, costs and use powerful filtering tools to identify funds by manager and asset classes.

The information in this article is general in nature. Any financial advice it contains is general advice only and has been prepared without taking into account the objectives, financial situation or needs of any particular person. The article content is not intended to be a substitute for professional advice, so before you act on it you should determine its appropriateness having regard to your particular objectives, financial situation and needs, and seek any professional advice you require. Any reference to a particular investment is not a recommendation to buy, sell or hold the investment. The relevant disclosure document should be obtained from Netwealth and considered before deciding whether to acquire, dispose of, or to continue to hold, an investment in any Netwealth product.