Take outs

- The key to survival lies within each practices’ ability to adapt to change.

- In order to adapt to change, practices need to decide if they want to specialise or corporatise

- There are four immediate actions an advice business can do right now: Audit, Communicate, Segment, Rebuild

According to Jason Andriessen, managing director of CoreData, financial advice businesses are in an ideal position to capitalise on changing market conditions.

“The financial planning profession is absolutely in chaos and the winner will make sense of that chaos,” Jason says.

To decipher how best advisers can make their mark amidst a challenging environment, Jason presented on the Netwealth webinar, Adapting to change: How to future-ready your business.

In order to adapt to the change that’s happening, it’s important for financial advice businesses to understand where they fit into the market. By identifying this, businesses are in a better position to figure out what they need to do in order to survive and thrive.

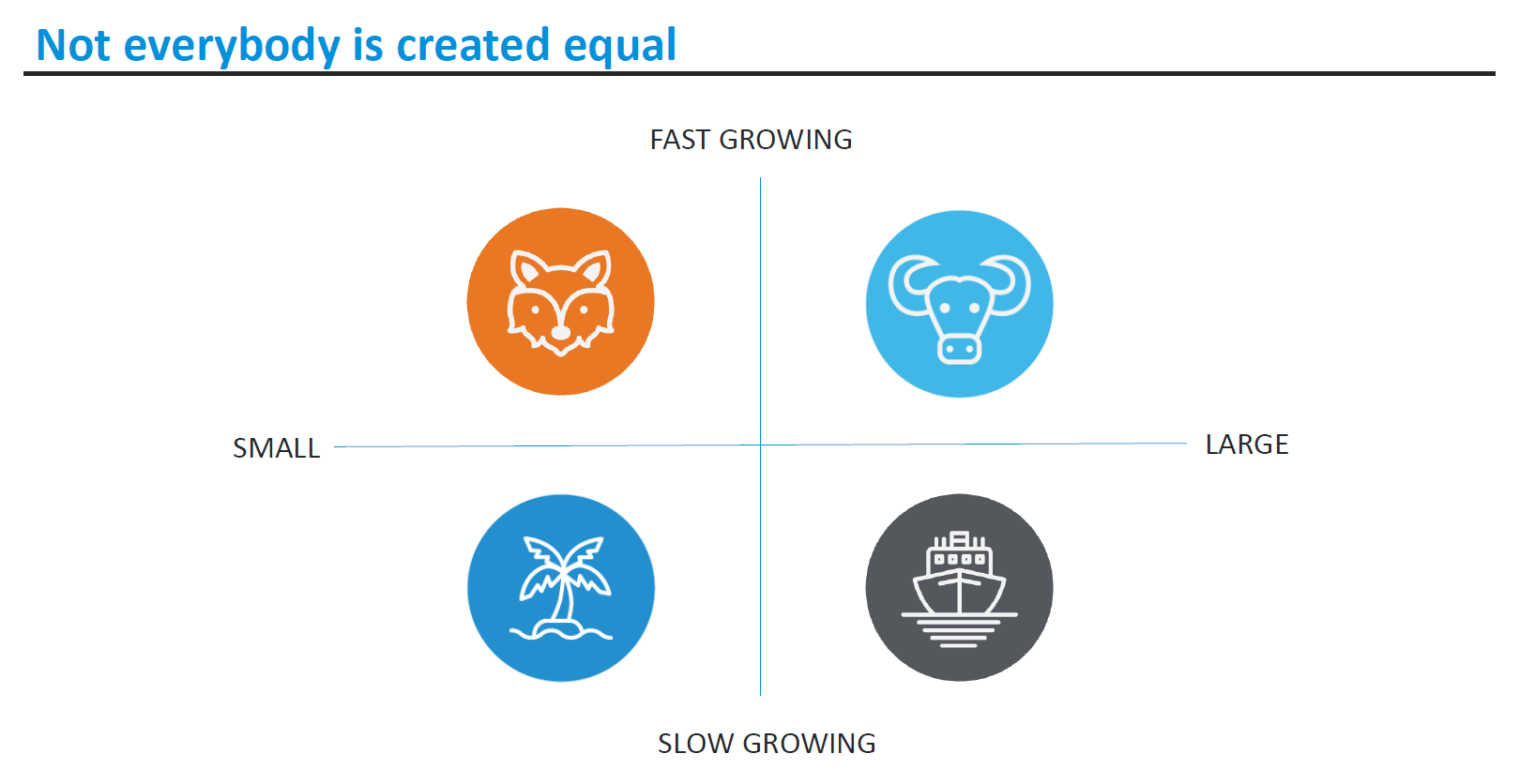

During the webinar Jason highlighted four segments to help practices distinguish where their business sits and what work may be needed in order to bolster business.

Foxes

This first segment can be identified as practices headed up by those aged around the 35-year mark – or younger.

“These guys are the future,” Jason says, noting foxes are high-educated, high-growth small businesses.

“They're the ones that are well-positioned and probably have already passed the FASEA requirements from an education perspective.”

Oxen

Oxen are the more mature foxes, according to Jason, who says these represent around 40 per cent of practices.

“They generally have several generations of principals and partners,” Jason says.

“There’s some tension between the young ones and the older ones. Those oxen practices will absolutely thrive in the future, but not every adviser within those business will choose to stay on. And the sooner we have those conversations, the better.”

Cruisers

Cruisers are the large practices that are comfortable. They’ve succeeded for a long time and rest on their laurels.

“These cruises need to change their thinking,” Jason says.

“A lot of them already have or make intentional inroads to become these oxen, and to actively seek to reengage their client relationships to make sure they're in better health when the economics change with the evolution of grandfathered investment commissions.”

Islands

Islands are independent advisers and arguably the type of practice most at risk.

“They are about 7 per cent of the market, and they have probably left already,” Jason says.

“The economics of their business are heavily reliant to the point of solvency on the investment commissions that as we know have been abolished, or will be.”

Repositioning your business

The key to survival lies within each practices’ ability to adapt to change.

There are three types of change:

- Change driven by technological leaps

- Change driven by behavioural leaps

- Change driven by process leaps

“They're all equally important,” Jason says.

“Process should be driven by client need; technology should support the process.

“The behaviour change is the most difficult and really requires sustained effort.”

Financial advice businesses should ask themselves: Knowing what I know about our target market, is it time to reposition our offering?

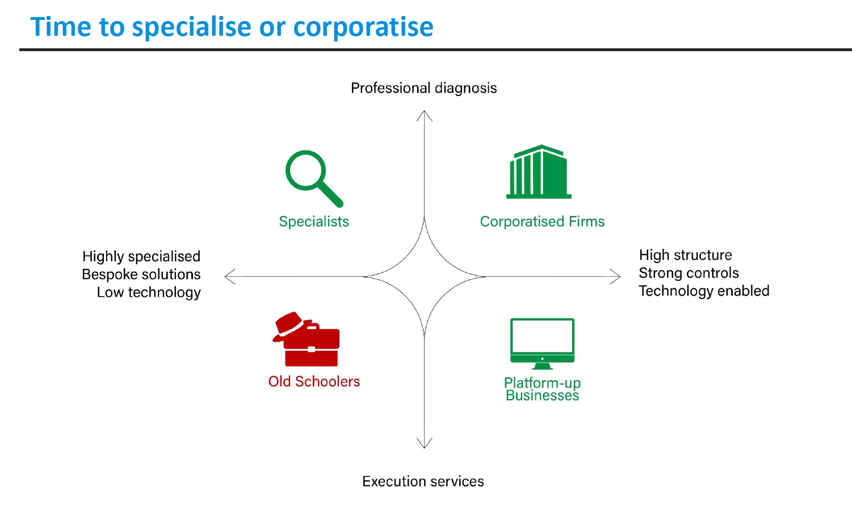

Specialise vs corporatise

In order for a business to be a specialist, they need to be highly-customised, highly-visible and have high client contact services in place.

“Specialists may focus on the wealthy or they may focus on a life stage, age care, divorce or in other particular areas,” Jason says.

Specialists thrive in their respective areas but can’t be generalists, therefore risk missing out on a wider pool of prospective clientele.

“Obviously, the generalist model will shift to the corporatised firms,” Jason says.

“These are the ones that maybe foxes and oxen gravitate to. They’re probably non-institutional, but they are corporatised and they think like corporates.“

Corporatised firms have good structures in place, complete with solid frameworks and well-articulated advice processes that allow their advisers to work for their clients within the structures.

“They’re certainly not process driven but framework driven, with strong controls and strong technology enablement,” Jason says.

Other players on the scene are what Jason calls “platform-up businesses”.

Neither generalists nor corporatised firms, these businesses are those that generally fall into the super funds space.

“They might have previously advised clients that have lost an active relationship with an adviser because the adviser's changed their business model or they've left the industry.

“They’re not competing with the corporatised or specialist firms, not competing with the professionals but solving the advice gap in a different way.”

The key to adding greater value

When looking to adapt to change, its vital for financial advisers to make the most of the opportunities being presented to them.

A key way to do this is by responding to client demand and upskilling yourself.

“Moving forward, the opportunity is extraordinary. We've just seen that there are issues with the supply of financial advice - you're going through it and probably transitioning as we speak,” Jason says.

“There's a small number of advisers who are already there, have met the FASEA Education Standards, have moved on from their grandfathered investment commissions and they're ready to take on the world. Once they do, the demand for advice will never have been higher.”

The ability to effectively mould oneself to appeal to different client demographics remains essential.

“The opportunity and the conversations for each client are different. How do you engage with the matriarch of the family, as opposed to the patriarch, so the wife should the husband die? And then how do you engage the next generation? That's what we should be thinking about,” Jason says.

Four things to do right now

When looking to adapt to change in the financial advice industry, advisers are urged to follow a four-step approach:

- Audit your business

- Be easy to choose Articulate and communicate your value to a clearly defined segment or target market. Do not try and be everything to everyone. If you value is relevant it will be much easier for the prospect to choose you.

- Segment your clients – Understand the key drivers and demographics that make up your client base. Segment based on client needs, the behaviours of the client, what they find valuable and how they want to be served.

- Rebuild – Do not waste a good crisis. Be proactive in adapting to change.

“We believe that a significant percentage of the financial adviser market is in flux. They'll either leave or they'll transform and we're hoping that they transform because demand is not going away and the opportunity is extraordinary,” Jason says.

To learn more

Listen to the Netwealth’s webinar, Adapting to change: How to future-ready your business, or contact Netwealth to find out more.

You may also enjoy

Business management

The business opportunity of estate planning as a core service

Explore why financial advisers are well placed to capitalise on a dedicated estate planning offering.

Business management

Managing culture, client and technology during volatility

Discover ways you can maintain meaningful client relationships and keep your team motivated.

Business management

Key factors in the transition of advice to a profession

Find out three key elements the advice industry needs to achieve for advisers to complete their career makeover.

Views expressed are of the interviewee and may not be the opinion of Netwealth or its related companies.