Cash settings

Automate cash account liquidity requirements through configurable buy/sell triggers and settings.

This feature provides users with transact capabilities a simple, efficient way to manage monthly cash liquidity requirements for all types of accounts.

Cash settings allows users to manage their excess cash via a set of investment instructions. It also provides users with the ability to establish rules for when cash balances fall below defined limits.

The ability to set rules or triggers for the points in which cash should be invested or sold, and the investment instructions for buys/sells provides users comfort that regular withdrawals such as pensions or insurance payments are always able to be met or that client's continue to invest cash inflows.

In this module we will cover:

Before using this tool, consider:

Consider pension payments, insurance payments or other regular payments.

Using this tool you can reinvest into a managed fund or managed model, pay cash to an external nominated account or leave it as cash.

Assets will be sold to ensure there is always enough cash to meet Netwealth's minimum cash amount. Use the Auto-Sell feature to nominate the order in which assets are sold.

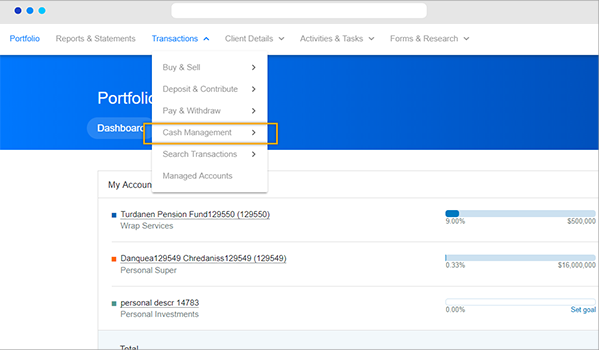

Select any account and then navigate using the main menu to Transactions > Cash management > Cash Settings.

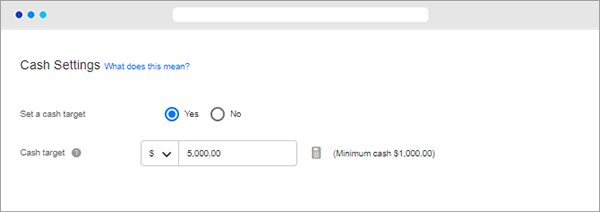

Unless a cash target is automatically set as the Netwealth minimum cash requirement as per the normal rules of the platform.

If you would like to set a higher cash target, select 'Yes' and then input your cash target using one of the following options:

(%) Set a cash target that is a % of the total portfolio account balance. If you set a % cash target, triggers will need to be set on a % basis.

($) Set a cash target that is a $ figure. If you set a $ cash target, triggers will be all based on a $ amount.

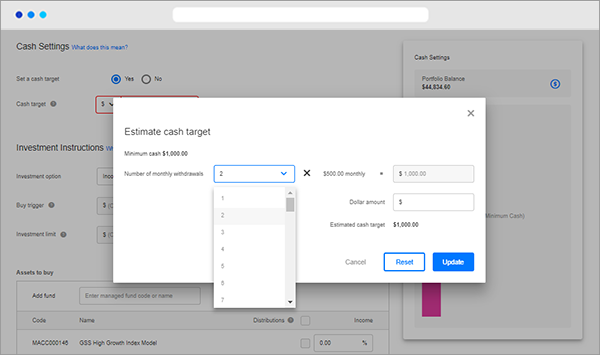

Advanced tip: If you have a pension account or a wealth account with a regular pension payment, withdrawal plan, or insurance payment use the calculator to set a cash target based on numbers of withdrawals. Click on the calculator icon to access.

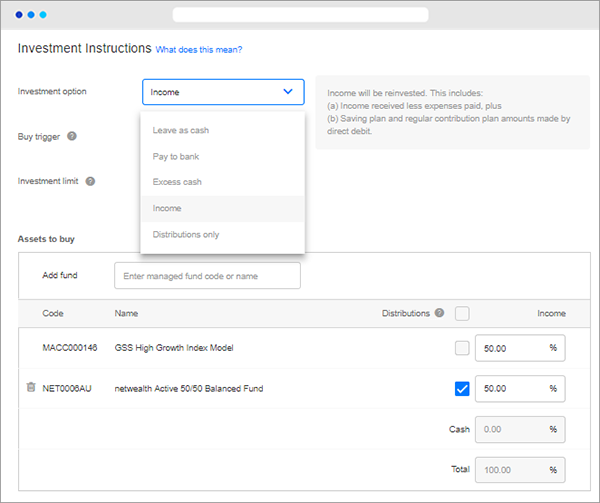

a) Select your reinvestment method

When you receive income, distributions, sell an asset or receive other inflows into your cash account, Netwealth needs instructions as to how to deal with this excess cash. Select from the following options:

| Investment option | Explanation |

| Leave as cash |

All income and contributions received will be left in your cash account and not reinvested. Advanced tip: Use this When removing all settings if you already have a reinvestment plan set up and want to turn it off. |

| Pay to bank | The net of income received less expenses paid between the 16th of the previous month to the 15th of the current month will be paid to your nominated bank account. This amount will exclude distributions reinvested. This option is only applicable to Wealth Accelerator accounts. |

| Excess cash |

All excess cash at the date Netwealth run the reinvestment process will be reinvested. Advanced tip: Set an investment limit here to avoid spending large cash inflows intended for other strategies. |

| Income |

Only income received will be reinvested. This includes: (a)The net of income received less expenses paid between the 16th of the previous month to the 15th of the current month, plus. (b)Saving plan and regular contribution plan amounts made by direct debit. |

| Income and contributions |

Income and contributions will be reinvested. This includes: (a)The net of income received less expenses paid between the 16th of the previous month to the 15th of the current month, plus. (b) Saving plan and regular contribution plan amounts made by direct debit, plus (c) Employer contributions (including Super Guarantee and Salary Sacrifice). |

| Distributions only | Distributions received from a managed fund will be reinvested back into the same fund. |

b) Select your buy trigger (optional)

This option is only relevant for excess cash and income options.

The buy trigger is the amount cash levels can rise to without triggering the reinvestment action selected above, in 3a). This provides a buffer for the cash target and helps manage the frequency of trading.

Example: $2,000 of income is received and $500 fees are deducted, leaving a net income of $1,500 to be reinvested.

|

No buy trigger |

Buy trigger selected |

|

I currently have $5,000 in cash A cash target of $5,000 Reinvesting income only No buy trigger is selected. |

I currently have $5,000 in cash A cash target of $5,000 Reinvesting income only Buy trigger is set to $7,000. |

|

$1,500 income will be reinvested |

$1,500 income will remain in cash (until the cash value rises to/above $7,000) |

c) Select your investment limit (optional)

This option is only relevant for excess cash and income options.

If the total reinvestment amount is greater than the investment limit, the reinvestment instructions will not be executed, and you will receive a notification confirming the trade has not been placed. This is useful to set when expecting one or more large cash inflows.

Example: $3,000 of income is received monthly and a one-off contribution of $50,000 is received.

|

No investment limit

|

Investment limit

|

|---|---|

|

I currently have $2000 in cash A cash target of $5,000 Reinvesting excess cash No buy trigger is set No investment limit is set |

I currently have $2000 in cash A cash target of $5,000 Reinvesting excess cash No buy trigger is set Investment limit is set to $10,000 |

| $50,000 will be invested | The entire trade of $53,000 will not be processed because it is above the investment limit of $10,000. |

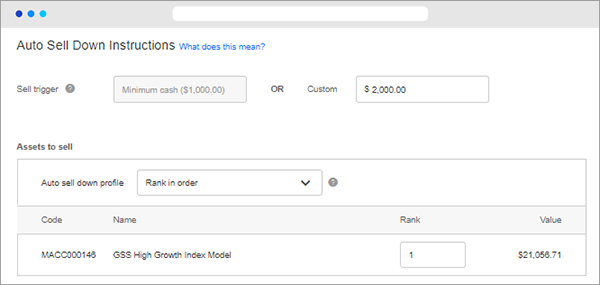

a) Select your sell trigger (optional)

If you set a Cash Target in Step 1, you can also set a sell trigger (which should be between the Netwealth minimum cash amount and the Cash Target) whereby assets will be automatically sold to top the cash account up to the Cash Target amount.

If you do not set a cash target, your trigger to automatically sell down assets will be the Netwealth minimum cash requirement.

b) Select your auto sell down profile:

|

Auto-sell option |

Explanation |

|

Default |

The default profile will sell units from liquid managed fund investments first, with the largest to smallest amount invested. If the minimum cash requirement is still not met, the default profile will then sell down holdings from ASX listed securities, followed by investments in Managed Accounts, and finally holdings in international securities until the minimum cash requirement is met. |

|

Rank in order |

You can rank the assets in preferred order of auto-sale, except for international securities or individual assets with a managed account model. |

|

pro-rata |

Auto-sell units from all assets proportionately. |

Advanced tip: Users can check their 'my tasks' dashboard at any time to view a list of accounts that are below their sell trigger/minimum cash requirement at any time.

Between the 22nd and the 29th of every month, Netwealth will execute the Cash Settings instructions in accordance with your set investment option as listed in Step 4, Section A.

Once the trades have been executed, pending buys and sells are able to be viewed by selecting an account and then navigate using the main menu to Transactions > Search transactions.

The calculation for automatic investment/sell down take place between the 22nd and the 29th of every month, the automatic investment sell down will take place in accordance with your Auto Sell Down profile after Re-investment is completed as per your Cash settings instructions.

Part of your cash is reserved as the Netwealth ‘minimum cash requirement’, which is equal to the sum of: 1% of your account balance or $500, whichever is greater, up to a maximum of $5,000; and where you have a monthly withdrawal plan/pension, the amount equal to one monthly payment; and where you have selected the LifeWRAP facility, the amount equal to one monthly or one quarterly insurance premium payment (as applicable).

The funds in your cash account earn monthly interest at a rate set at no less than 0.50% p.a. less than the target cash rate set by the Reserve Bank of Australia during the month (which is often referred to as the ‘official cash rate’). The current cash rate can be found on the website by navigating to Resources and Tools > Term deposits and cash.

If you are utilising our pension payment calculator to work out your cash target, when you update your pension payment amount under transactions > pay & withdraw > income stream payment you will see a warning message reminding you that your cash target will also be updated.

For an in depth look at this great feature, or any of our other platform enhancements, request for one of our team to contact you.