Account based income streams

Set up and manage a regular income stream or pension payments.

In this module we will cover:

Moving to and from a pension can have financial, tax or social security implications. There are also strict rules and requirements regarding can start a pension, caps on the amount that can be used to start a pension and requirements on how much to draw down. Read our Super Information guides before opening a pension account https://www.netwealth.com.au/nw/Access/Forms/SW_Information-Guides. Please get in touch with us if you have questions for our technical support team.

If the account holder is seeking to claim a tax deduction for personal non-concessional contributions made to their Netwealth account, a tax deduction claim should be submitted online before transferring to an income stream. To do so, navigate to Transactions > Deposit and contribute > Claim a tax deduction.

If yes, and the applicant to the income stream would like to claim the tax-free threshold from the Netwealth income stream, they would need to complete a tax file number notification form.This form is located when logged in under Forms and research > Forms and disclosure documents > Super Accelerator.

Transfers to an income stream or pension are done on an ‘in specie’ basis with no changes made to the current investments. If an account holder wishes for these investments to be sold down, they can sell assets prior to the transfer via the online client portal or via their adviser.

Pension accounts have specific rules and requirements on the operation and the amounts that can be used to start an income stream or draw down from an income stream. We recommend you read our Super Information guide on pensions before opening an income stream account.

New applicants can open an income stream account by completing the Netwealth Super Accelerator online application available via the Netwealth website.

| Advisers and their clients | Investors |

| Advisers should login to the Netwealth website, navigate to Open an Account > Super Accelerator and follow the prompts to set up an income stream using the application wizard. | Investors can access the online application service by clicking on Open Account at the top right of the Netwealth homepage, choose a Superannuation account to open and follow the prompts to set up an income stream using the application wizard. |

Download the Transfer Between Accounts form or navigate to Resources and Tools > Forms and Documents > Super Accelerator and complete the form.

How to complete the form:

|

Step

|

How to complete this step

|

|---|---|

| Step 1. Provide member details |

Input the details of the applicants current Netwealth account, that is, the Client name and Client number and/or account number. This information can be found on any report letter or statement provided by us, or at the top right-hand side of the screen when any account has been selected. |

| Step 2. Transfer details - Account type to transfer to |

Select either: Standard income stream or Transition to retirement income stream. |

| Step 2. Transfer details - Amount to transfer |

Select either a full or partial transfer from your existing Netwealth account. For partial transfers, attach details of which investments to transfer by downloading a copy of the portfolio valuation outlining the assets to transfer. Note: Netwealth will transfer assets into a pension without the need for you to sell down your assets. |

| Step 4. Declare condition of release | To commence an income stream and therefore access preserved or restricted non-preserved benefits, a member must satisfy one of the conditions of release. Elect the appropriate condition here. |

| Step 5. Nominate your income stream details |

Input the frequency (monthly, quarterly, half-yearly or annually), the month and year when the payment is to commence, and the amount of the income stream to be paid into your nominated bank account. This figure should be the gross amount before any taxes and other deductions come out. Advanced tip: Regardless of the frequency, our income stream amounts are paid to account holders so that the payments are received on or before the 15th of each month. |

| Step 8. Provide notice of intent to claim a tax deduction for personal contributions | If the account holder has made a non-concessional contribution and would like to claim a tax deduction and have not yet, see How to get started tips above on how to process this online. |

| Step 9. Claim your tax-free threshold and/or notify your Tax File Number (‘TFN’) | If the account holder is under the age of 60 and would like to claim the tax-free threshold, see How to get started tips above for instructions. |

| Step 10. Nominate bank account details |

Only complete this step if the nominated account in which the income stream payments are to be paid differs from the nominated account details currently on file. If you are adding a brand new nominated account, please see our guide to adding new nominated bank details. |

| Step 13. Signatory | Investors (and in some instances adviser clients) must read and sign this declaration. |

| Step 14: Signatory - Advisers (acting on behalf of their clients) |

Advisers must read and sign the adviser declaration (to be completed by an Adviser Representative providing instruction on behalf of their client). As long as account existing details are being carried over from the existing account into the new account in steps 6, 10 and 11 of the form, no client signature is required on this form. If these details in these sections are being updated, client sign off is required in Step 13. |

Email your completed and signed form to contact@netwealth.com.au.

Use our simple online wizard to complete your transfer request form.

a) Select any super or pension account and navigate via the main menu to Activities & Tasks > Transfer Between Accounts

b) Follow the prompts in the wizard to commence your income stream

c) Download the completed application form

Important note: There are some instances where an adviser can sign off on this form. The ‘print forms’ section of the wizard will indicate who must sign.

Upload the completed form by logging into the Netwealth website and navigating to Activities and Tasks > Document Upload.

Income stream account maintenance is available online, making it simple to manage income requirements.

Choose from the below options to view instructions.

Important note: Once your income stream has commenced you cannot make any further contributions or rollovers into it. If you have received contributions or rollovers after commencing an income stream, you may choose to roll your existing income stream account balance into a new or existing accumulation account, and from there, some or all of your balance can be used to commence a new income stream.

You should seek financial advice before using this facility as there could be financial, tax or social security implications from moving your benefits between income stream and accumulation phase.

Download the Transfer Between Accounts form or navigate to Resources right-hand and Tools > Forms and Documents > Super Accelerator and complete the form.

| Step 1. Provide member details |

Input the details of the applicants' current Netwealth income stream account, that is, the Client name and Client number and/or account number. This information can be found on any report letter or statement provided by us, or at the top right-hand side of the screen when any account has been selected. |

| Step 2. Transfer details - Account type to transfer to |

Select to transfer to personal super.

|

| Step 2. Transfer details - Additional contribution/rollover expected |

Input the amount of your additional contribution/rollovers in this step. Netwealth will wait until the additional amount has been received before transferring to a new income stream. |

| Step 3. Additional transfer details- Account type |

Choose to transfer to a standard income stream or transition to a retirement income stream. |

| Step 3. Additional transfer details - Amount to transfer | Transfer some or all of the cash/investments to your new income stream account. If you are leaving an accumulation account open, the minimum amount to leave in super is the Netwealth minimum cash requirement of $5000 or 1%, whichever is greater. |

| Step 4. Declare condition of release | To commence your income stream and access preserved benefits or restricted non-preserved benefits, a member must satisfy one of the conditions of release. Elect the appropriate condition here. |

| Step 5. Nominate your income stream details | Input the frequency, and amount of income you would like to get paid, before any taxes and other deductions come out. |

| Step 8. Provide notice of intent to claim a tax deduction for personal contributions | If you have made a non-concessional contribution and would like to claim a tax deduction and have not yet, see How to get started tips above on how to process this online. |

| Step 9. Claim your tax-free threshold and/or notify your Tax File Number (‘TFN’) | If the account holder is under the age of 60 and would like to claim the tax-free threshold, see How to get started tips above for instructions. |

| Step 10. Nominate bank account details (optional) |

Only complete this step if the nominated account in which the income stream payments are to be paid differs from the nominated account details currently on file. If you are adding a brand new nominated account, please see our guide to adding new nominated bank details. |

| Step 13. Read and sign this client declaration | Investors (and in some instances adviser clients) must read and sign this declaration. |

|

Step 14: Signatory - Advisers (acting on behalf of their clients) |

Advisers must read and sign the adviser declaration (to be completed by an Adviser Representative providing instruction on behalf of their client). As long as account existing details are being carried over from the existing account into the new account in steps 6, 10 and 11 of the form, no client signature is required on this form. If these details in these sections are being updated, client sign off is required in Step 13. |

Send your completed and signed form to us at contact@netwealth.com.au

Use our simple online wizard to complete your transfer request form.

a) Select any super or pension account and navigate via the main menu to Activities & Tasks > Transfer Between Accounts

b) Follow the prompts in the wizard to transfer to accumulation, receive the depot, and commence your new income stream

c) Download the completed application form

Important note: There are some instances where an adviser can sign off on this form. The ‘print forms’ section of the wizard will indicate who must sign.

Upload the completed form by logging into the Netwealth website and navigating to Activities and Tasks > Document Upload.

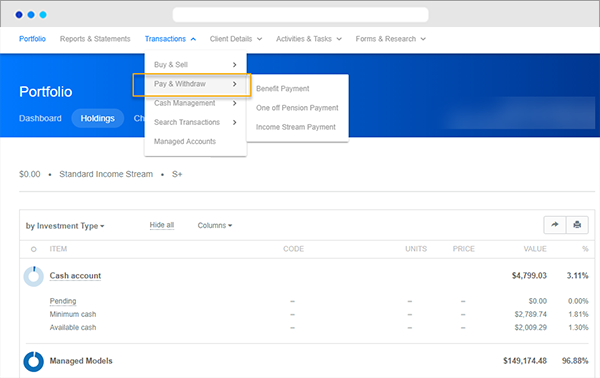

Select any income stream account and then navigate using the main menu to Transactions > Pay and Withdraw.

Choose to make a one-off pension payment or update your income stream payments:

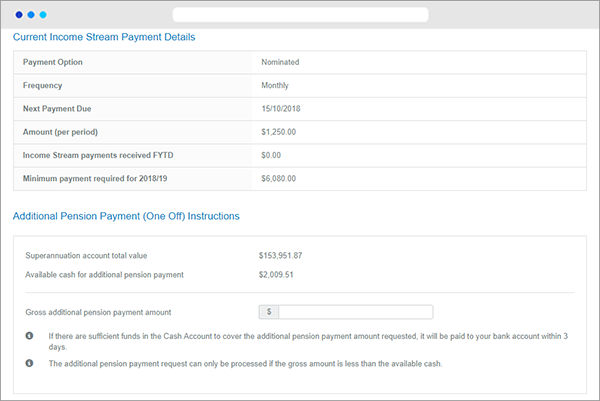

a) Review your current income stream payment details

b) Check that there is enough available cash and if so, enter the one-off pension/income stream payment amount to be paid into your nominated bank account overnight (in most cases).

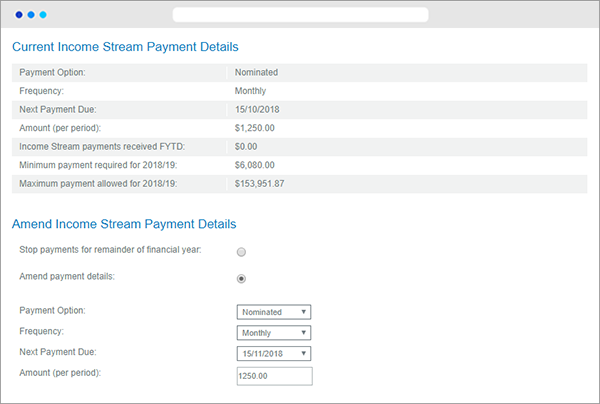

a) Review your current income stream payment details

b) Either choose to stop payments for the remainder of the year or to amend payment details

c) You may choose to change the payment option to the minimum or to a nominated amount of your choice. You may also amend the frequency of payments, the next payment date and the amount to be paid.

Note: If you are amending payments, you will need to amend the amount prior to the 13th in order to be picked up by the pension payment run. Pension Payments from our Income Stream Accounts are paid to ensure that they are received by the 15th .

If there is insufficient cash for the annual nominated pension payments when the pension is run, the pension payment will not be paid. We will send a letter to the adviser, or where direct to the pensioner, notifying them that the pension has not been paid due to insufficient cash. Once sufficient cash is available, a catch-up payment can be requested online or by sending through an instruction to Netwealth.

Where an income stream commences part way through the financial year, the minimum income payment is pro-rated based on the days remaining in the year. The 1 June rule may also apply, which means that no payments are required to be made until the following financial year for an account-based pension or annuity commenced after 1 June in a financial year.

No new Term Allocated Pensions (TAPs) can be opened however you can transfer existing TAP's to Netwealth using the income stream application form.

You can add a reversionary beneficiary on your initial application or on the transfer between accounts. If your account is already set up, please use the 'Change of Details' form and is also located under Resources and Tools > Forms and Documents > Super Accelerator.

Superannuation legislation requires that each July income stream payments be recalculated to ensure total payments are over the minimum amount for the financial year. A client’s minimum payment amounts are determined by their percentage factor and account balance as at 1 July each year Netwealth will commence the new pension with the account balance as at 30 June. At this time, we will check for any additional required pension payments and send communications to investors and/or advisers of advised clients notifying them or the change and additional payment. Occasionally in September once Netwealth has received all the necessary income, taxation and price information from fund managers to allow us to complete processing for the financial year, 1 July account balances may be amended. At this time, we will send a second notification including a schedule outlining the changes to the income stream payments for the remainder of the new financial year.

Yes, when you submit an application or transfer between accounts clearly outline your intention on the form or attach a cover letter to your application.

If you are under age 60 any lump sum benefit may be subject to tax. The amount of tax may depend on factors including your age, previous benefit payments made and the condition of release under which the benefit is being paid (eg. tax concessions may apply for benefits paid under “permanent incapacity”). For more information about tax on lump sum payments refer to Information Guide 10: Tax and Social Security. You should seek personal tax advice regarding the tax treatment of benefit payments.

Yes. However, the account will remain in accumulation phase until all assets have been received, at which point it will be rolled forward to pension. If any distributions or dividends are paid during this time, they will incur tax and so it is advisable to consider the expected timing of distributions from investments held. June is when majority of investments funds will pay distributions.

If there is insufficient cash to process the pension payment, the payment will not be paid. Once there is sufficient cash the account holder or their adviser can notify our investor services centre via email contact@netwealth.com.au and the payment will be processed as soon as possible.

For an in depth look at this great feature, or any of our other platform enhancements, request for one of our team to contact you.