Take outs

- Australian investors are known to gravitate to property and liquid assets

- High-grade bonds can help defend a portfolio in down markets

- Many consider Australian high-grade bonds one of most secure investment products

Many Australian investors are considering how to position their portfolios against potential downgrades in the late-cycle market. But how do they defend themselves against potential threats and enhance their yields?

Paul Chin, director and head of investment strategy and research at Jamieson Coote Bonds, shares some unique insight into financial sector risks associated with Australian investors’ portfolios in the recent Netwealth webinar: Generating income for your portfolio in a late-cycle market.

“Investors, particularly in this late cycle stage, are looking for yield in all the wrong places,” Mr Chin judges.

“The risky assets have appreciated strongly, and if you haven't rebalanced your portfolios, these risky assets have tended to dominate a lot of your portfolios such that it can be outsized relative to your defensive instruments.”

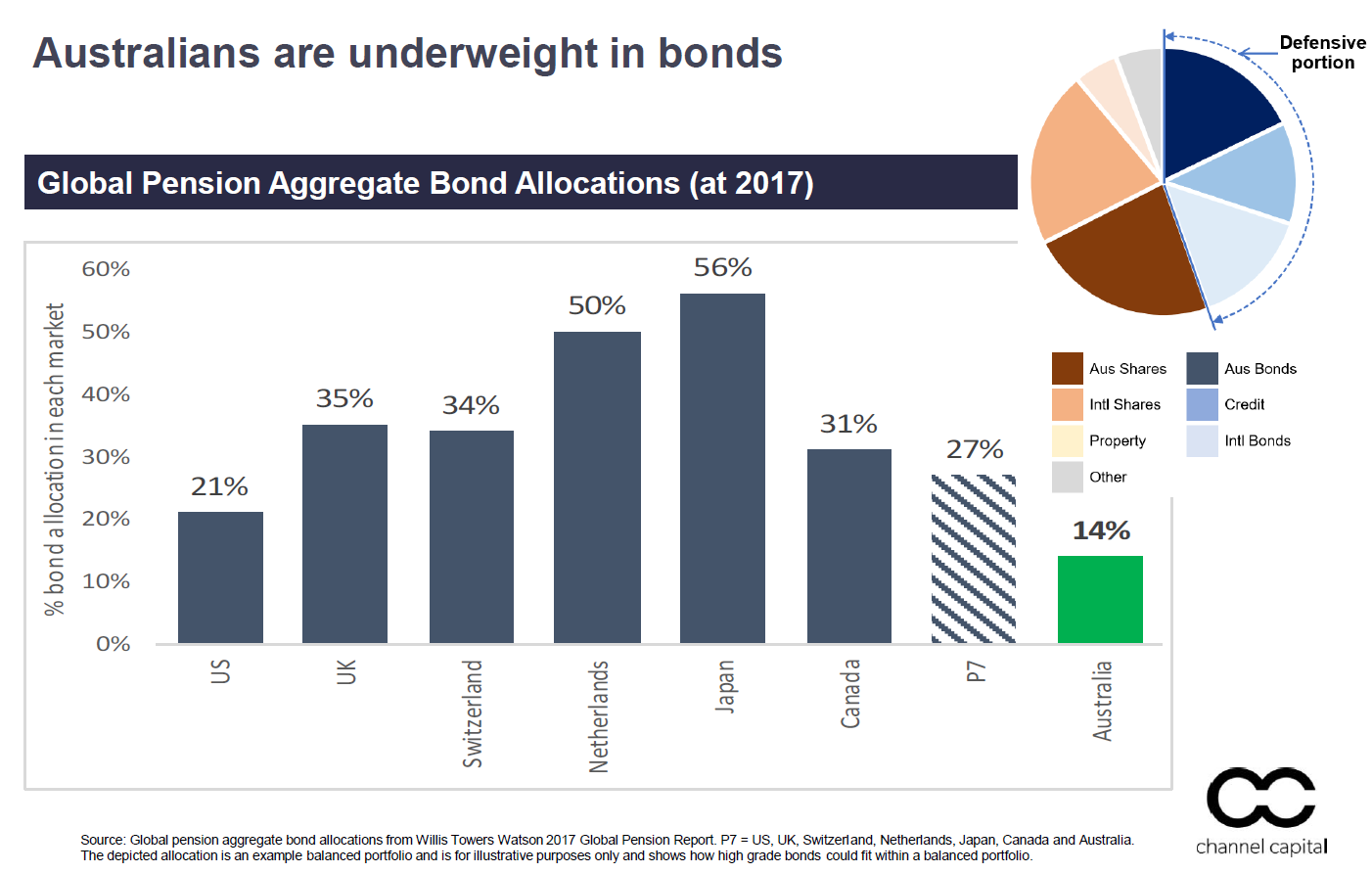

Mr Chin explains that Australians are chronically underweight relative to high-grade bonds, which consist of government, state-based and supranational paper. Instead, they take a high-risk approach to investing and mostly gravitate to property and liquid assets, which are subject to increasingly hidden perils.

“When I reflect on the common portfolio holdings, I typically have seen five common sort of assets which are within Australian investors' portfolios,” Mr Chin reveals.

“Term deposits and cash are very popular, particularly among self-managed super funds. Hybrids, credit-based investments, negatively geared property and, of course, the big four banking shares. We love the imputation credits, and we love taking advantage of the blue-chip nature of these securities.”

What is the underlying risk exposure attached to common portfolio holdings?

Australians' portfolios are tied to the financial sector and big four banks, with an underlining concentration on the housing market, which is where a lot of the risk is buried.

“When you look at their books, the big four banks, for instance, are tied towards the housing market. This means there is a big concentrated position on the housing market within people’s portfolios,” Mr Chin says.

He suggests that Australians momentarily “step back” and potentially reconstruct their portfolios, making sure that their defensive portion is comprised of a range of assets, preferably with lower correlation.

“You've got the ability to step back, right now with your portfolios, and try and diversify out that risk, or at least exposure, with, say, high-grade bonds,” Mr Chin says.

High-grade bonds can provide protection for risky portfolios, particularly on the downside, he says.

“High-grade bonds can provide principle and income stability, and diversify against your risky assets. They have been there to defend and protect your portfolios, just when you need them,” Mr Chin adds.

He notes that Australian high-grade bonds are considered to be one of the most secure investment products.

“The Australian government is one of 10 issuers who remain triple-A rated, and relatively speaking have a strong financial position and are well rated by the three ratings agencies as well. It's a reasonable position”.

Hear more on late-cycle investing

What are the returns we can expect out of high-grade bonds over a range of scenarios?

Real concerns about the RBA surfaced at the start of the year, with uncertainty surrounding whether there would be a change to their policy setting for 2018. At the time, commentators were predicting two rate hikes.

Mr Chin explains that as of Nov 2018 the Australian 10-year yield sits at around 2.73 per cent, meaning it is on track for a return of between 3.4 per cent and 5.7 per cent, given that there are no changes to RBA.

“I think you'll have to agree that this is a constructive return. But you don't look at this defensive portion as being a return asset per se, but something you have in the bottom of the drawer, ready to protect your portfolio, in case the proverbial hits the fan,” he says.

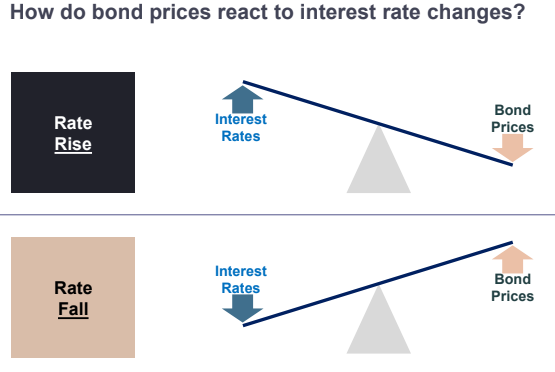

An increase in interest rates will broadly lead to a fall in bond prices, and vice versa, Mr Chin explains.

He, however, judges that rate surges are unlikely given the “enormous debt levels”, meaning that central banks and policy makers are constrained to how much they can raise rates without causing real damage.

Considering the performance of high-grade bonds over the past three decades, Mr Chin reveals that there were only three negative years – 1994, 1999, and 2009, prompted by the RBA’s rate lift. The negative movements were, however, quickly annualised throughout the subsequent period.

“If you have a rapid and material rise in rates, then that's probably going to lead to a soft year for high-grade bonds. But, if that does occur, then the subsequent years after that rate rise is likely to contribute to a constructive set of outcomes for high grade bonds, and that's a good news story,” Mr Chin clarifies.

Source: JCB team analysis and Morningstar Direct. Morningstar reports on an after-fees basis. Past performance is not an indicator of future performance.

He adds that if we did, for instance, have more hikes or a continued risk on spectrum, the returns from high-grade bonds would be a little tempered, but wouldn't be dramatically bad along the way.

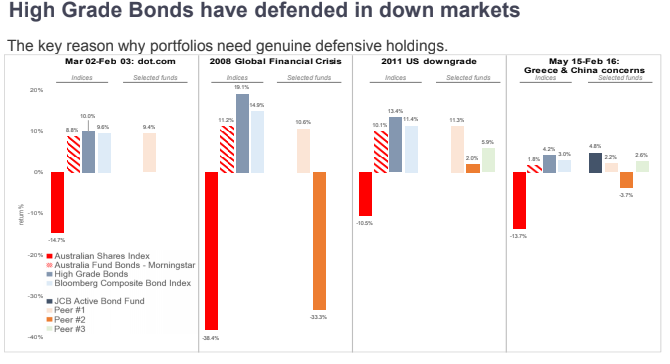

On the upside, high-grade bonds tend to perform particularly well in down markets.

This was best illustrated over the most recent stressful periods – the dotcom bubble, the GFC in 2008, the US downgrade in 2011, and the Greek and Chinese concerns from 2015 and 2018.

“Over each of these stressful periods the market returns from high-grade bonds were the best performing. And this is one way of preserving wealth, in terms of having that ballast and having something to defend and protect just when you need it as well,” Mr Chin says.

He concludes that it is time to rebalance in preparation for an impending impact to portfolios.

Want to know more about high-grade bonds?

Listen to the complete Netwealth webinar, Generating income for your portfolio in a late-cycle market.

Insights

Netwealth portfolio construction podcast

We pick the brains of wealth management experts to uncover insights on the investment areas they are most passionate about.

Exercising discipline when building a portfolio

Learn how to form a disciplined process for analysing investments, an essential step when building a successful portfolio.

What you need to know to wind up a SMSF the right way

Understand the changes to SMSFs and what to consider if you're thinking about winding one up.

Build a resilient portfolio for all stages of the economic cycle

Learn strategies to navigate an evolving world by building your portfolio for any economic condition.

Compare managed funds and models

Get the latest research data and commentary to search and compare managed funds and managed account models. See performance data, costs and use powerful filtering tools to identify funds by manager and asset classes.

The information in this article is general in nature. Any financial advice it contains is general advice only and has been prepared without taking into account the objectives, financial situation or needs of any particular person. The article content is not intended to be a substitute for professional advice, so before you act on it you should determine its appropriateness having regard to your particular objectives, financial situation and needs, and seek any professional advice you require. Any reference to a particular investment is not a recommendation to buy, sell or hold the investment. The relevant disclosure document should be obtained from Netwealth and considered before deciding whether to acquire, dispose of, or to continue to hold, an investment in any Netwealth product.

This webinar guest is a financial product issuer. Netwealth and the guest have a commercial arrangement that enables investment in products managed by the guest through Netwealth’s platform. Under that arrangement, Netwealth may receive fees from the webinar guest. More information about the fees Netwealth receives is provided in our Financial Services Guide, which is available on our website or by contacting us