Netwealth is excited to announce an exclusive platform arrangement with global fintech firm TipRanks (www.tipranks.com) to provide research on all major shares listed on US markets.

The tightly integrated offer allows you to see buy, sell and hold recommendations for major US stocks and view consensus price targets. You can also see trending stocks, for example at the time of writing Netflix was rated by 15 analysts with 8 buys, 5 holds and 2 sells.

The video below outlines the main features of the new service:

TipRanks is a financial accountability engine that uses machine learning and natural language processing algorithms to measure the performance of sources giving online investment advice for shares listed on the US markets.

TipRanks allows users to see the track record and performance of source stock analysts, bloggers, hedge funds, or corporate insiders dating back to January, 2009 and uses factors such as the Tipranks Star Ranking calculation which combines both the Success Rate and Average Return for each financial expert.

Some of the key features of the TipRanks integration are:

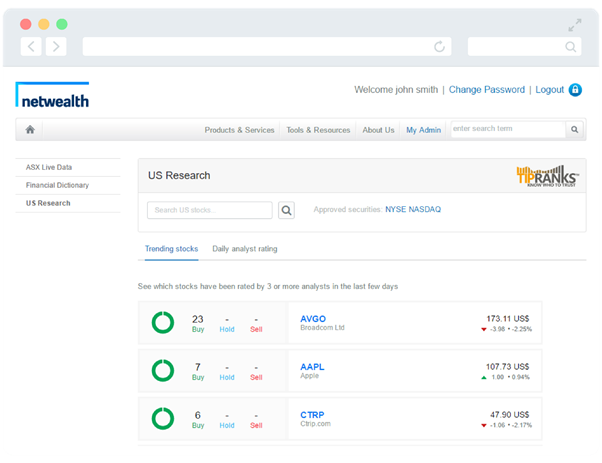

1. Review US stocks that have been rated by 3 or more analysts in the last few days

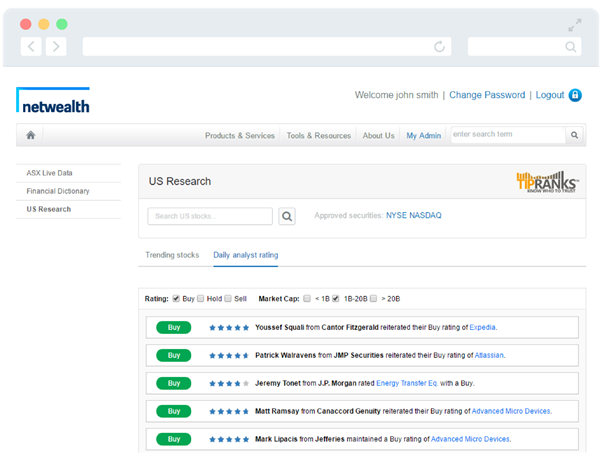

2. Review US stocks that have been rated by a TipRanks reported analyst in the last few days. This list can be filtered by such things as ‘Buy only’ or ‘Market cap between 1-2billion’

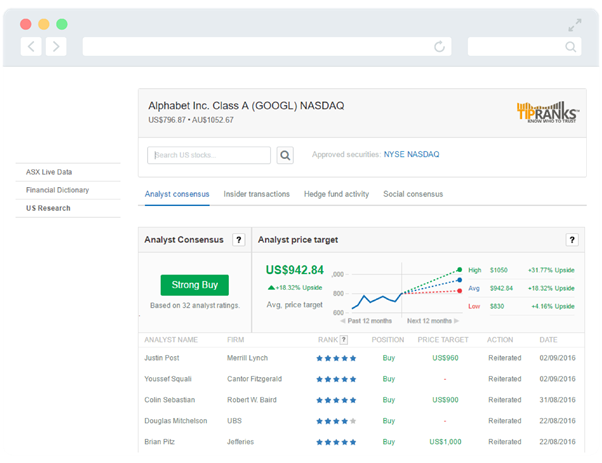

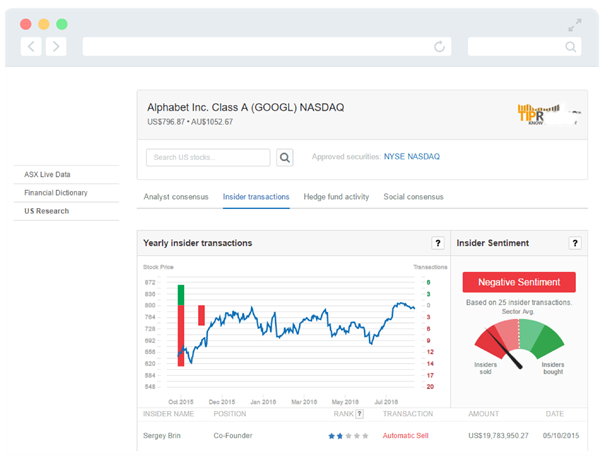

3. For a specific stock, such as Alphabet (Google), TipRanks provides:

a. An aggregated view or consensus of analysts, including target price consensus

b. A list of insider transactions

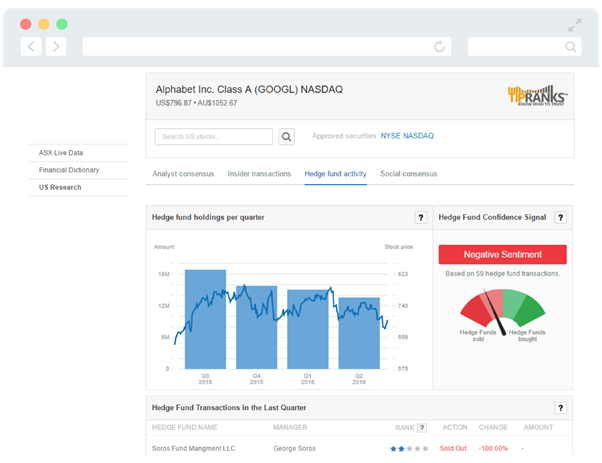

c. Hedge fund activity for the last quarter

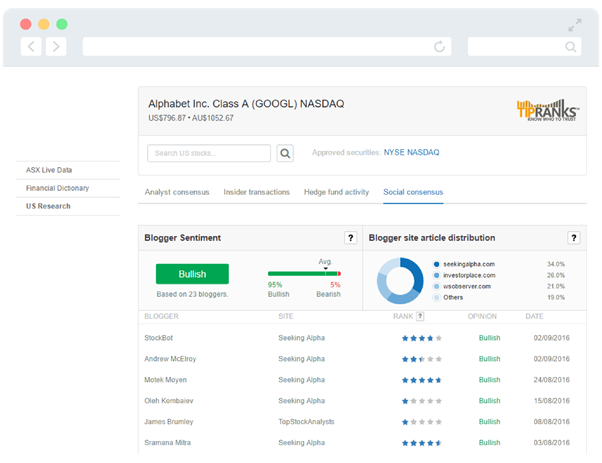

d. Blogger and social sentiment

If you require further assistance with this exciting new feature, please feel free to contact your Netwealth Training & Relationship Manager.

Some frequently asked questions (supplied by TipRanks)

How is TipRanks Star Ranking™ calculated?

- Buy = 1

- Hold = 3

- Sell = 5

- Strong Buy: less than or equal to 1.5

- Moderate Buy: more than 1.5, but less than or equal to 2.5

- Hold: more than 2.5, but less than or equal to 3.5

- Moderate Sell: more than 3.5, but less than or equal to 4.5

- Strong Sell: more than 4.5

A stock can have a Strong Buy/Strong Sell consensus only if it received 3 or more ratings in the last 3 months. If a stock has only 1 or 2 ratings from the last 3 months and is a Strong Buy/Strong Buy, it will be normalized to Moderate Buy/Moderate Sell, respectively.

The content available through the TipRanks Service is general information only. It is not and should not be regarded as a recommendation by netwealth or anyone else to buy, hold or sell any financial product referenced therein. Any financial product advice it contains is general advice only and does take into account your individual objectives, financial situation or needs. Before making any investment decision, you should evaluate its appropriateness to your particular objectives, financial situation or needs, and seek independent financial advice. The relevant product disclosure statement or other disclosure document should be obtained from netwealth and carefully considered before deciding whether to acquire, or continue to hold, an investment in any netwealth financial product.

Disclaimer

This information has been prepared and issued by Netwealth Investments Limited (Netwealth), ABN 85 090 569 109, AFSL 230975, ARSN 604 930 252. It contains factual information and general financial product advice only and has been prepared without taking into account your individual objectives, financial situation or needs. The information provided is not intended to be a substitute for professional financial product advice and you should determine its appropriateness having regard to your particular circumstances. The relevant disclosure document should be obtained from Netwealth and considered before deciding whether to acquire, dispose of, or to continue to hold, an investment in any Netwealth product. While all care has been taken in the preparation of this information (using sources believed to be reliable and accurate), no person, including Netwealth, or any other member of the Netwealth group of companies, accepts responsibility for any loss suffered by any person arising from reliance on this information.