Take outs

- Spreading your risk is seen by many as an essential investment strategy.

- Investing in global companies provides access to a diverse set of opportunities around the world.

- In the event of a recession in Australia, offshore holdings could be the key to protecting your nest egg.

When it comes to successfully riding out the inevitable ups and downs of financial markets, nothing is more important than spreading your money across different asset classes.

In the Netwealth webinar Investing Globally: Key Benefits & Considerations, Jonathan Shead, the Australian Head of Retirement Solutions at State Street Global Advisors, explains that this is the reason a well-structured investment portfolio should always include an element of international exposure.

Investing offshore allows you to access a range of new opportunities while spreading your risk, he says.

“There are three key ways investing overseas helps you manage your risk’’ says Jonathan.

1. Smooth out the peaks and troughs

The first is that when you invest overseas, you gain exposure to other economies and economic cycles, which can help smooth out the peaks and troughs of Australia’s performance.

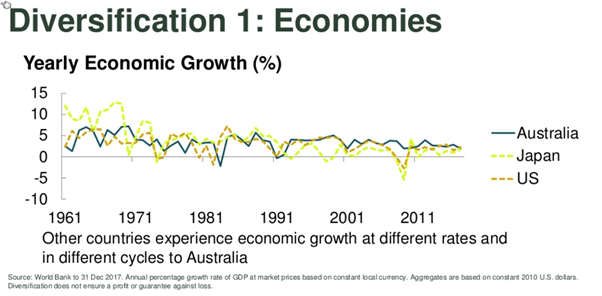

For example, Chart 1 below shows the economic growth rates of Australia, Japan and the US from the 1960s through to the present time.

“You get periods where some economies grow better than others, where Japan and the US either underperformed Australia or outperformed,’’ says Jonathan.

“For example, in 2007 and 2008, we had a period where Japan and the US both experienced recessions.’’

Australia managed to dodge that bullet, and has now not seen a recession since 1991, the longest continuous period of growth in world history, but it is not immune to market cycles.

“We're not forecasting anything in the near horizon, but if there was an economic recession in Australia, it's always good to have exposure to economies outside of Australia,’’ says Jonathan.

2. Reduce risk

The second reason investing offshore reduces risk for Australian investors goes to the industries that make up the local economy.

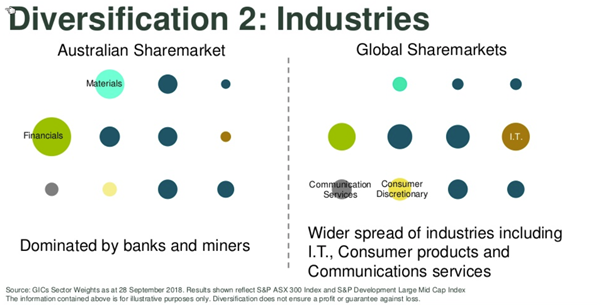

Chart 2 below compares the Australian share market with global share markets. Each of the circles represents a key investment sector or industry sector, and the size of the circle represents the significance of that sector for the overall market.

“If you look in the Australian share market, there are two circles that stand out: the materials sector, and the financial sector,’’ says Jonathan.

“The financials are dominated by the big four banks, and materials by BHP Billiton, Rio Tinto, South32 and so on.

“In global markets you can see that there's a much more even spread of opportunities, and in particular there are industry sectors which you just can't get exposure to in Australia in any meaningful way.’’

For example the communication services sector here is dominated by Telstra, whereas globally it includes dozens of large companies ranging from AT&T and Verizon to Facebook, Google, Netflix and Disney.

The Netwealth Porfolio Construction Podcast

In this series, we speak to wealth professional experts in the investment area they are most passionate about, with the view to uncover potential investment opportunities and unique investment insights.

3.Diversification at the individual company level

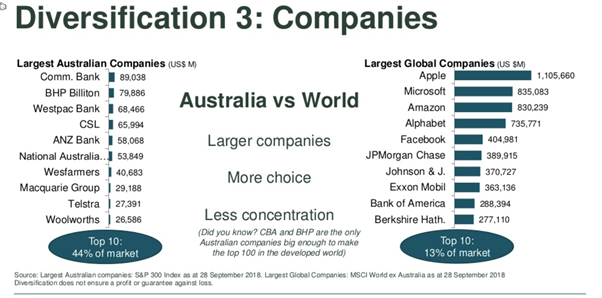

Investing overseas also enables you to add diversification to your portfolio at the individual company level. One of the problems with investing in the Australian share market is that it is difficult to hold a diversified basket of large companies, simply because there are so few.

As Chart 3 below shows, the top 10 names in Australia account for almost half of the total market. The top 10 names globally, even though they are 10 times larger than the equivalent Australian companies, only make up 13 percent of total market capitalisation, says Jonathan.

“In fact if you were to list global companies that you can buy on the share market by order of size, Commonwealth Bank and BHP Billiton would be the only two companies to make the top 100,’’ he says.

“So your opportunity to build well-diversified risk-controlled portfolios without having to buy smaller companies is much wider in global share markets than it is in Australian share markets.

“The ability to invest in a much wider range of individual companies is a good reason to consider investing offshore.’’

Investors looking to benefit from global exposure need to know what they are doing. Investing overseas can introduce new risks, such as currency fluctuations, and new considerations, such as whether to invest in developed or emerging markets.

But by allocating a portion of your funds to offshore investments you can reduce your overall portfolio risk by spreading more widely, while also benefiting from the chance to participate in new opportunities.

Want to know more about investing overseas?

Listen to the complete Netwealth webinar, Investing globally: Key benefits and considerations or learn about our international securities.

Compare managed funds and models

Get the latest research data and commentary to search and compare managed funds and managed account models. See performance data, costs and use powerful filtering tools to identify funds by manager and asset classes.

The information in this article is general in nature. Any financial advice it contains is general advice only and has been prepared without taking into account the objectives, financial situation or needs of any particular person. The article content is not intended to be a substitute for professional advice, so before you act on it you should determine its appropriateness having regard to your particular objectives, financial situation and needs, and seek any professional advice you require. Any reference to a particular investment is not a recommendation to buy, sell or hold the investment. The relevant disclosure document should be obtained from Netwealth and considered before deciding whether to acquire, dispose of, or to continue to hold, an investment in any Netwealth product.

This webinar guest is a financial product issuer. Netwealth and the guest have a commercial arrangement that enables investment in products managed by the guest through Netwealth’s platform. Under that arrangement, Netwealth may receive fees from the webinar guest. More information about the fees Netwealth receives is provided in our Financial Services Guide, which is available on our website or by contacting us