Take outs

- Successful firms use more AdviceTech than the industry average

- It pays to choose AdviceTech carefully, and deliberately

- AdviceTech investment should meet the present and future needs of a business

Any financial advice firm worth its salt is built on a solid foundation of advice technology (AdviceTech). But the most successful firms use more types of AdviceTech and choose and implement AdviceTech in a more structured and disciplined way, than the average firm.

Netwealth’s 2019 AdviceTech Research Report reveals the characteristics that set successful AdviceTech businesses (SATBs) apart from the industry overall, they include:

- an openness to investing in technologies to improve business processes

- looking to spend more on advice delivery and client engagement

- a formal budgeting process for investment and development

- dedicated internal resources for implementing AdviceTech

- a clear 12 and 24 technology roadmap.

In other words, SATBs deploy AdviceTech carefully and deliberately, to reflect both the current and likely future needs of the business, based on size and number of clients to whom they provide services.

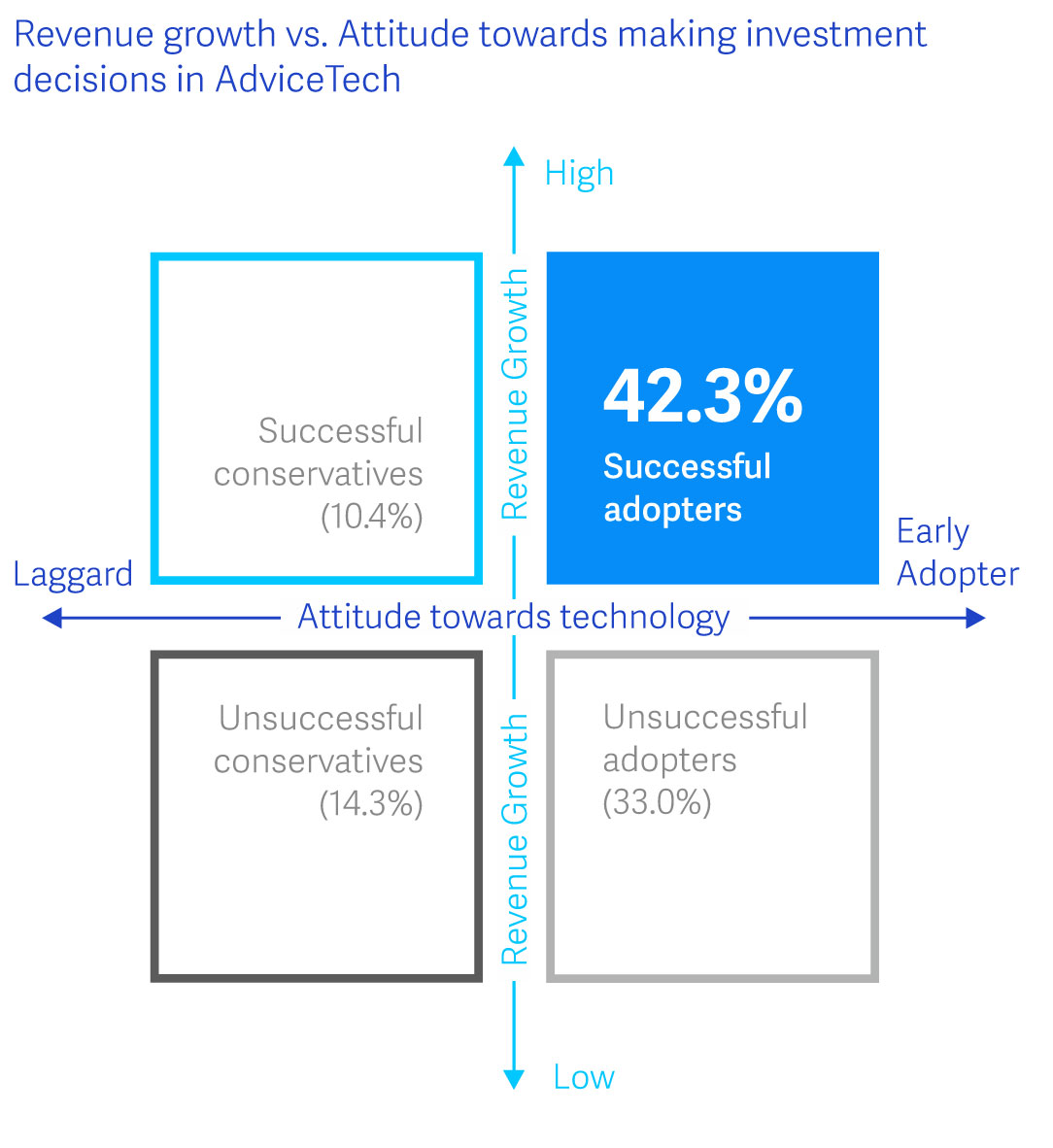

According to the Report, just over 40 per cent of all advice businesses are SATBs. They are defined, in part, as having enjoyed revenue growth in the 2017-18 financial year (by contrast, only around one in five advice firms overall experienced revenue growth in the same period).

2019 Netwealth AdviceTech research report

SATBs are also generally led by decision makers whom are defined as “early adopters” or “pragmatists”. Early adopters are open, often enthusiastic, adopters of AdviceTech, who willingly work with suppliers to develop leading-edge technology to fundamentally reshape their businesses. Pragmatists will commonly adopt stable, if not yet common, technology to develop a competitive advantage.

But whichever definition they meet, the leaders of SATBs recognise that spending money and investing willingly in AdviceTech is a critical part of their business success.

2019 AdviceTech Research Report

The third Netwealth AdviceTech research report highlights the key benefits of adopting technology intelligently within an advice business. This year's report we share the the survey findings from over 330 advisers on 26 technologies.

The AdviceTech Gap

While all advice firms use some form of AdviceTech or another, SATBs demonstrate that not all use it equally effectively. SATBs use, on average, 15 different types of AdviceTech. The industry average is 12, but just those three extra AdviceTechs, on average, chosen and implemented well, are enough to set SATBs apart from the pack.

It’s instructive to look at where the gap in the take-up of AdviceTech between SATBs and other firms is greatest:

- SATBs have greater take-up of fact-find and risk-profiling tools, which is an essential element in getting an advice relationship and process off on the right foot.

- They have greater take-up of online surveys, reviews and ratings tools, providing feedback from clients and creating a virtuous loop of continual improvement.

- SATBs demonstrate greater take-up of online meeting tools and social media platforms, harnessing new technologies to maintain contact with clients.

The path ahead is clear

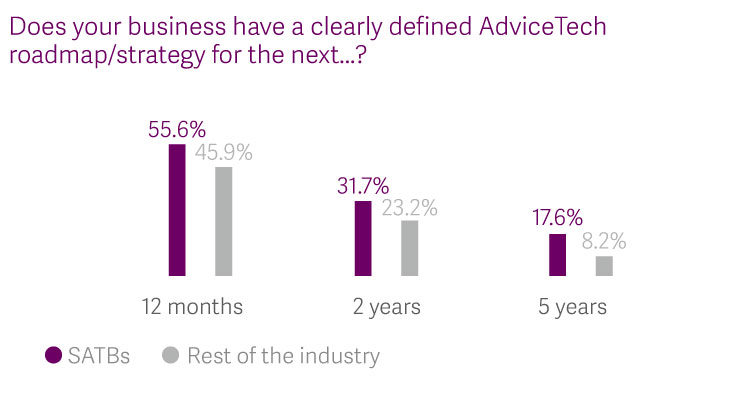

SATBs don’t just splash money around. For them, investing in AdviceTech isn’t about meeting an immediate need or solving a problem today. It is about thinking ahead, anticipating the needs of the business and its clients, and preparing accordingly. Most (55.6%) of them have a clear plan for at least the year ahead, and some even plan as far ahead as five years out. In fact, they’re twice as likely as the average advice firm to be thinking that far ahead, underlining the impact they expect smart investment in AdviceTech to play in their future growth.

2019 Netwealth AdviceTech research report

Investment is carefully directed to AdviceTech that is likely to generate the greatest business benefit – whether that be by automating repetitive tasks, engaging with clients more effectively or delivering advice more efficiently. Compared to the industry average, SATBs are more likely to have clear plans in the current financial year to invest in client-engagement, advice and planning, and operations and workflow AdviceTech.

Tech-savvy client

SATBs are more likely to report having tech-savvy clients, and more likely than other advice firms to experience demand for AdviceTech from clients. Whether they’re driven by tech-savvy clients to adopt AdviceTech more readily, or whether SATBs’ ready adoption of AdviceTech attracts more tech-savvy clients is a moot point. What matters is that the SATBs identified in the Netwealth report are the financial advice industry’s leading exponents of adopting AdviceTech to meet the present needs and to anticipate the future needs of clients.

Learn more about the traits of a successful AdviceTech business and how you can emulate them - Download the 2019 AdviceTech research report and access the resources.

More AdviceTech resources

2020 Netwealth AdviceTech report

Get a comprehensive view of all 25 AdviceTech. Access our research report, articles, videos and team workshop.

Build an effective AdviceTech stack

Discover a framework that all advice firms can use to develop with their AdviceTech strategy and investment roadmap.

Create an AdviceTech roadmap

A team activity to help you prioritise technology solutions and develop an AdviceTech roadmap for your business.

A logo map of technology suppliers

Your guide to AdviceTech suppliers across 25 categories, as featured in the 2020 Netwealth AdviceTech research report.

Insights

Latest: Managed accounts during volatility and beyond

Four advisers share how managed accounts can enhance your client value proposition.

Special reports: Take a deep dive

Our collection of guides take a deep dive on topics including AdviceTech, managed accounts and cultural trends.

Podcasts: Between Meetings with Matt Heine

Netwealth's Matt Heine chats to industry thought leaders on the opportunities they see for financial advisers.

Webinars: Grow your Business IQ

Recordings from our monthly webinar series, covering a range of topics presented by industry professionals.