Take outs

- Advisers must build an optimal fee in the wake of the Royal Commission

- Transparency is key in a post-Hayne world

- Advisers must understand their own value

Building an optimal fee model has become a sore spot for advisers, as they struggle to balance the needs of their clients with their own profitability.

In a post Royal Commission world, financial advisers are fearing potentially significant changes amid forecasts that the industry may shrink and relatively quickly.

Rob Jones, CEO and managing director of Peloton Partners, joined us recently for the Netwealth webinar, ‘Pricing in a post Royal Commission world’.

With several years of experience in financial services, Rob shares his views on pricing considerations and the importance of “finding latent value in your business”.

Rob tells us that despite the looming changes, he is confident that the advice industry will weather the storm and come out on top.

“Where there is a service, there is value, and where there is value, it can be articulated, packaged, priced (including profit) and communicated effectively to clients and they will be happy to pay for it,” Rob assures.

Let’s build a fee

There will, however, be a requirement to effectively “re-sign” clients to the service they are entitled to each year, and detail the total fees they will be charged, Rob says.

But before making any fee related choices, advisers must recognise their own value.

“Understanding your business is obviously critical. The good bits, bad bits, the ugly,” Rob advises.

He reminds advisers that their clients make an informed decision to be advised.

“Most often this decision stems from an overwhelming need to feel safe financially,” Rob states.

However, too often, advisers underplay their value.

In order to mend this, Rob recommends that advisers regularly reconnect their clients to the reason they sought advice in the first place.

“This is so important for a two-way valued and valuable relationship to exist,” he says.

With change comes your chance to explore new perspectives

We’ve developed a suite of resources to help you navigate this changing landscape – our Change/Chance Series. This selection of guides and articles delve into topics that are front of mind for advisers, now.

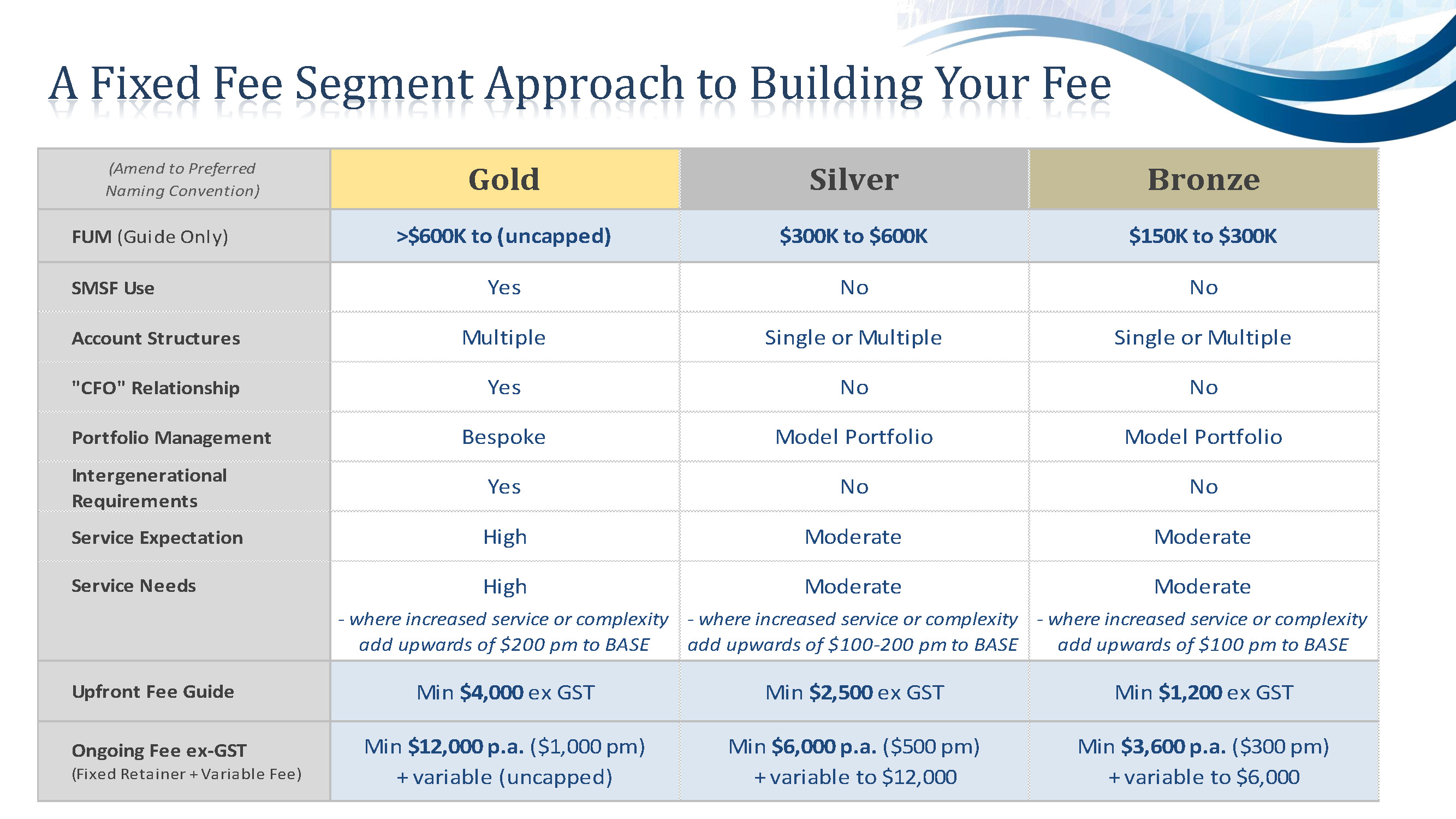

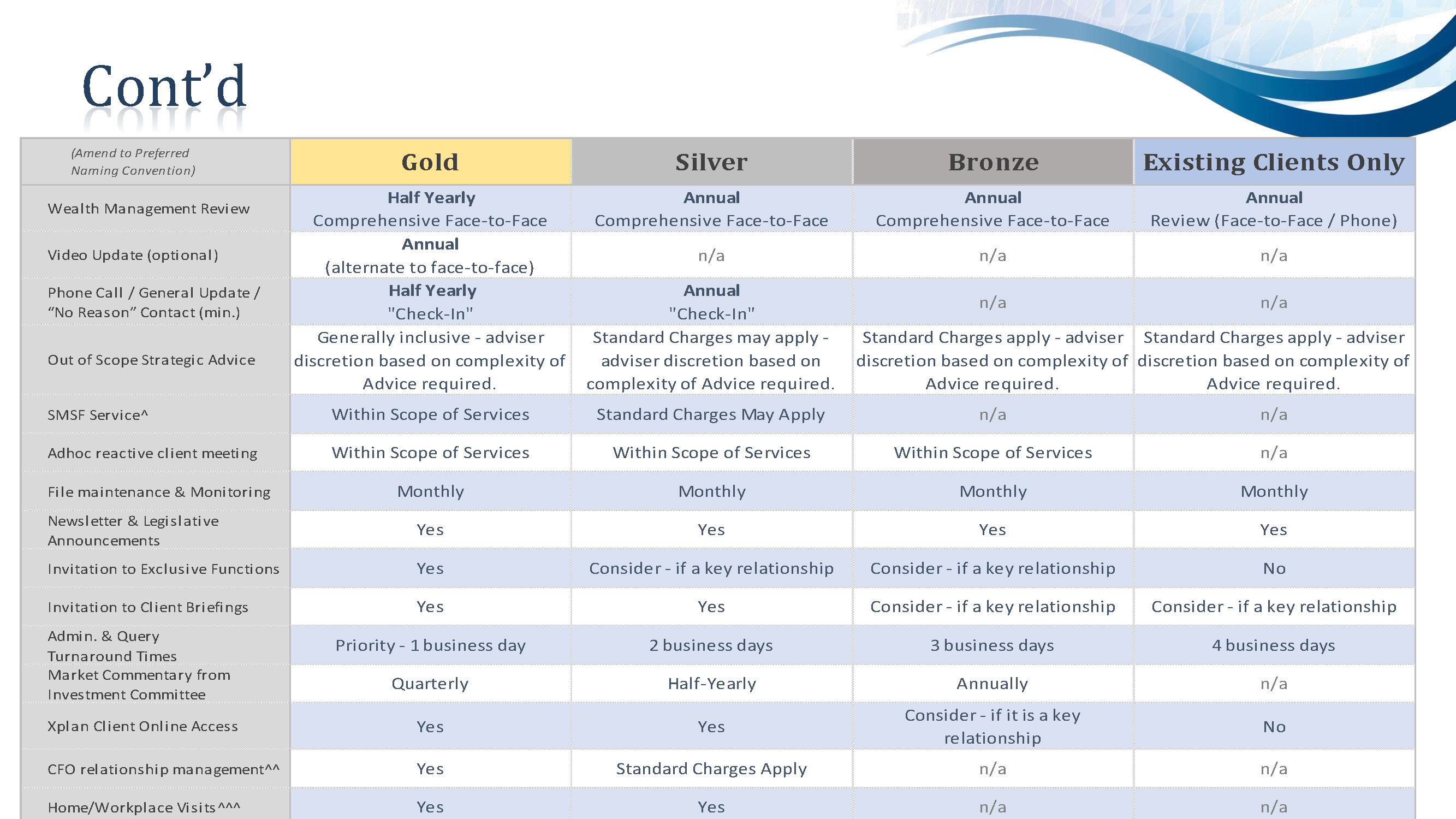

Fixed fee segment approach to building your fee

Rob explains that advisers are naturally progressing towards an authentic fixed fee model, which can flex with the changing circumstances of clients, while still allowing advisers to earn a profit.

Under this model, the fee is directly linked to the value of advice a business delivers. It is transparent, easy to understand and calculate, and is tailored to each client.

“Having a pricing model that can change as clients change, in my view, maintains a perfect alignment between adviser and client,” says Rob.

“And that philosophy again is simple. No two clients are identical in their needs and complexity, so neither should the fee be.”

The fixed fee model is divided into several categories based on the clients’ size, and fees for services are charged accordingly.

Pricing examples provided by Peloton Partners:

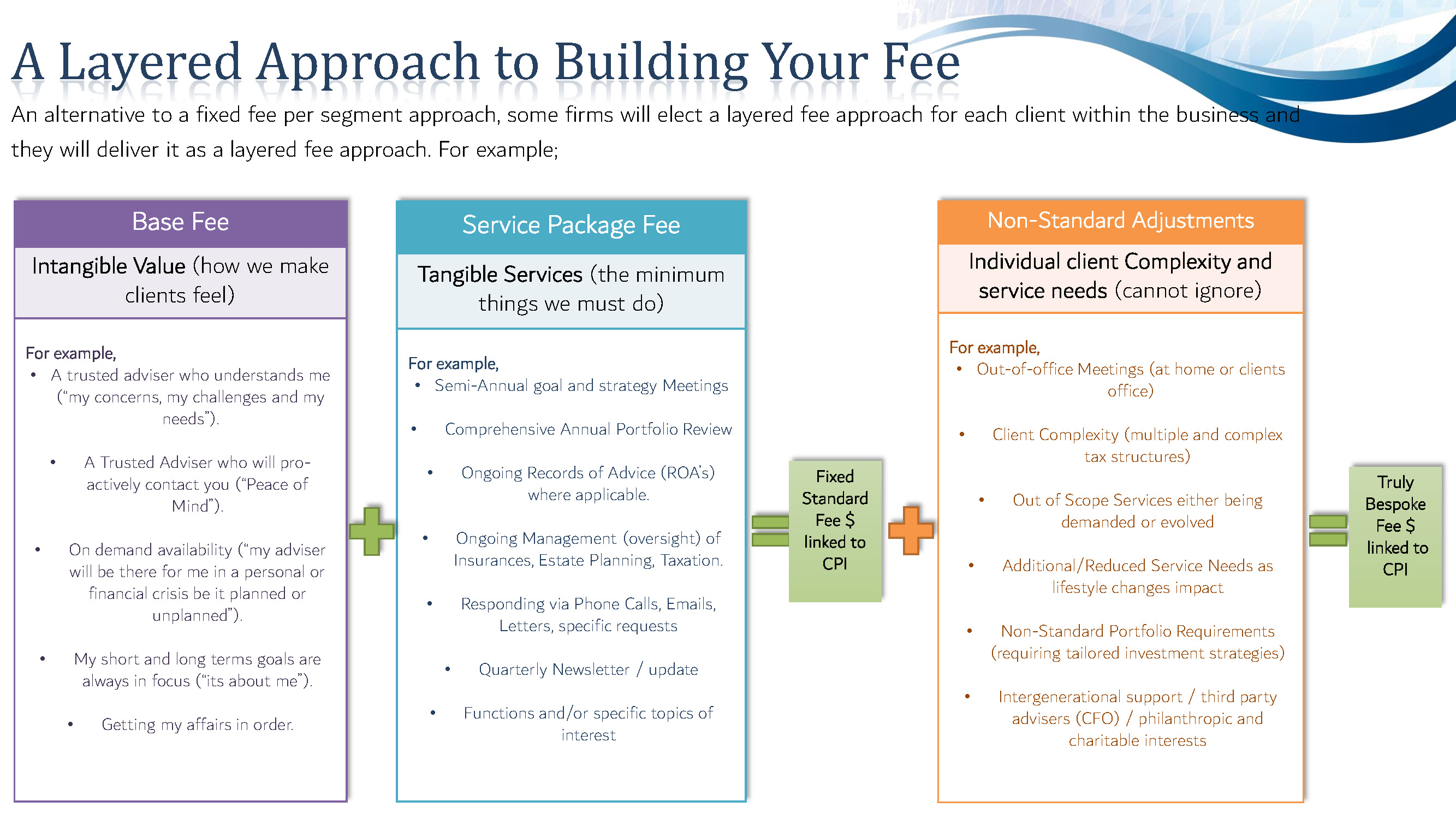

Layered approach to fee building

As an alternative to a fixed fee per segment approach, some firms will elect a layered fee model for each client within their business.

This approach sees advisers build up their fee, layer by layer, starting with the base fee and arriving at a bespoke fee linked to CPI.

“We’re building the fee, we’re not coming in with ‘Here’s your $6,000 fee, that’s it’,” Rob says.

“We’re coming with a natural approach of how we break the fee down into its constituent parts so that we take a client on the same journey.”

Out-of-office meetings, non-standard portfolio requirements and out-of-scope services being demanded or evolved should all be charged extra.

Any additional or reduced service needs, as the client’s lifestyle changes, should be revisited each year, he adds.

“Some clients present with multiple complex tax structures, they should pay more,” advises Rob.

He reiterates that there is nothing wrong with charging more as long as all costs are transparent and made known to the client.

Pricing examples provided by Peloton Partners:

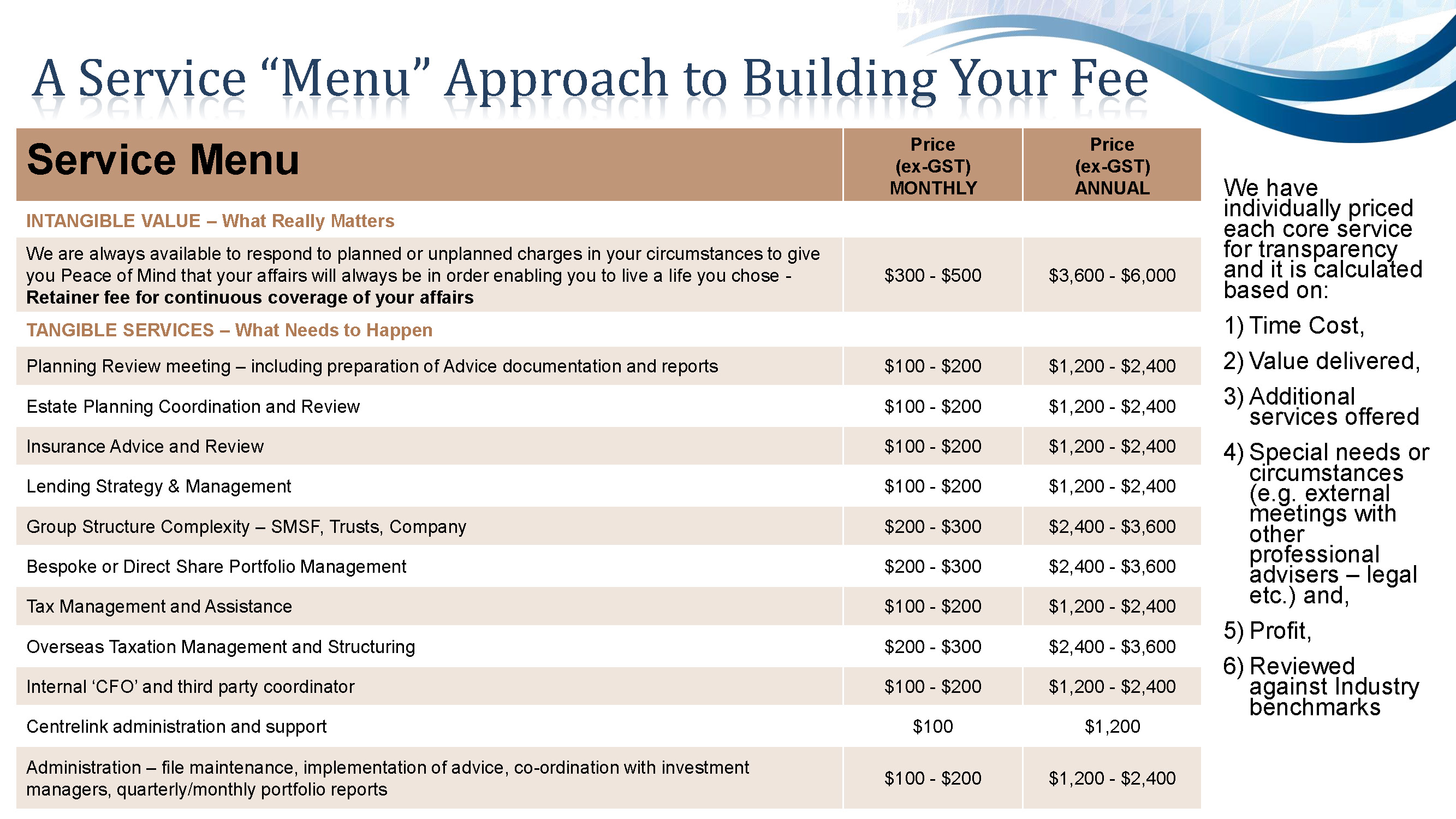

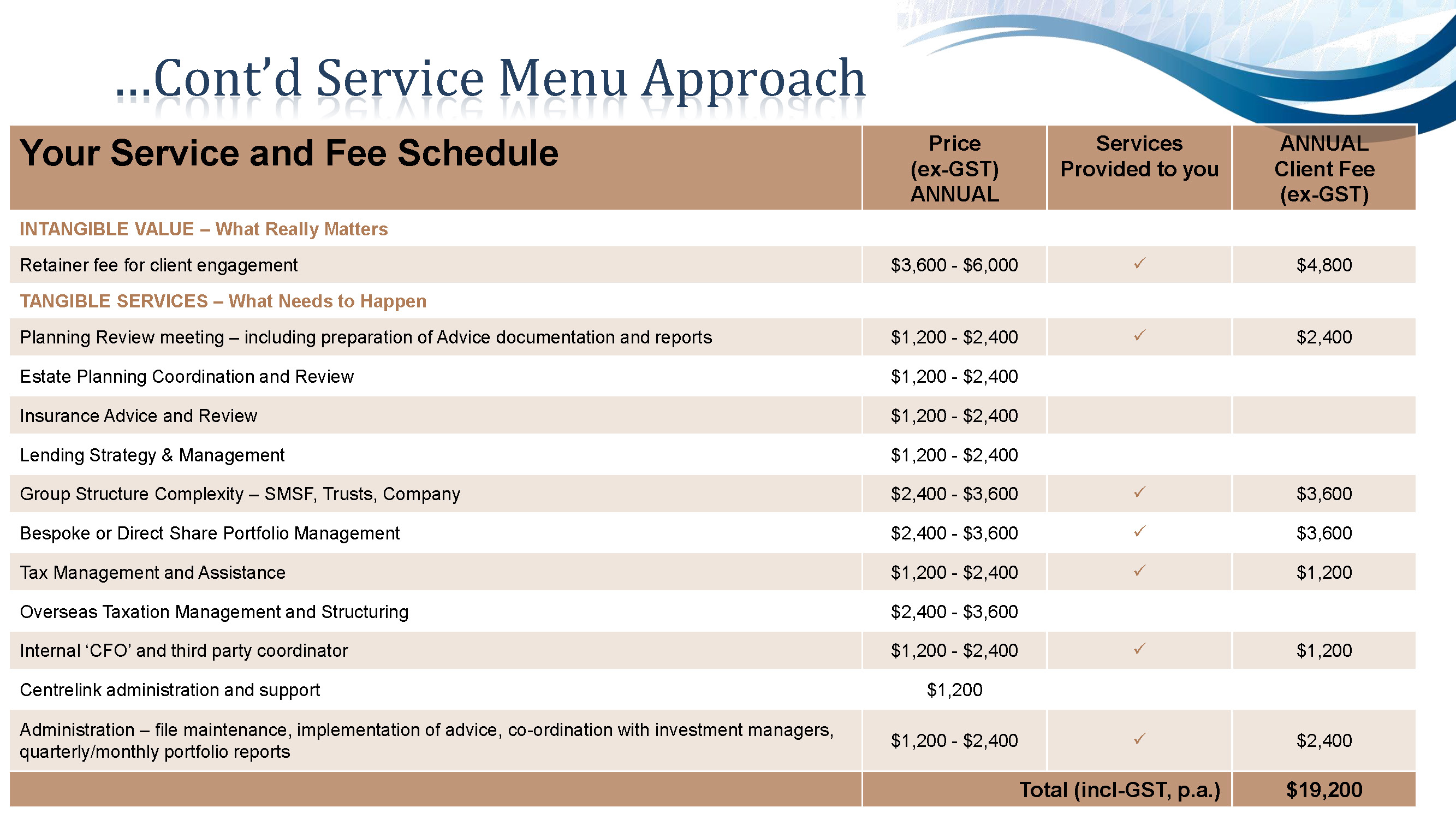

Service menu approach

The service menu approach is used to price clients at the top-end of the market.

Under this model, advisers individually price each core service based on:

- Time cost;

- Value delivered;

- Additional services offered;

- Special needs or circumstances (e.g. external meetings with other professional advisers – legal etc) and;

- Profit.

According to Rob, the adoption of a service menu approach requires companies to unpack their capabilities and analyse them.

“Often it fixes up issues in the back-office,” he says.

This model provides unrivalled transparency and fairness, meaning that clients know exactly what they’re paying for and why.

It also gives advisers the room they need to recognise their latent value.

“The evidence is clear that there is significant latent value sitting in the average firm across our industry and it is due to the inability of pricing models to price all the factors,” Rob says.

Pricing examples provided by Peloton Partners:

Conclusion

Rob stresses that advisers must urgently reconnect their clients with the reason why financial advice is so relevant for them.

“When you are open, honest and fully convicted about what you do, and what you need to charge, your clients will pay a higher correct fee when the facts are presented to them and the value you deliver is clear to them,” he says.

Rob concludes that while uncertainty abounds in the advice industry, nothing can impact the value of an advice business if their relationship with their clients is established and maintained on a framework of transparency, authenticity and two-way honesty.

Listen to the Netwealth webinar, ‘Pricing in a post Royal Commission world’, or contact your local BDM for more information.

Podcast with Rob Jones

What is your advice worth? Michael Harrison and Rob Jones from Peloton Partners discuss the challenge and importance of truly understanding your business and how to effectively value your offering.

Insights

Latest: Managed accounts during volatility and beyond

Four advisers share how managed accounts can enhance your client value proposition.

Special reports: Take a deep dive

Our collection of guides take a deep dive on topics including AdviceTech, managed accounts and cultural trends.

Podcasts: Between Meetings with Matt Heine

Netwealth's Matt Heine chats to industry thought leaders on the opportunities they see for financial advisers.

Webinars: Grow your Business IQ

Recordings from our monthly webinar series, covering a range of topics presented by industry professionals.

Views expressed are of the interviewee and may not be the opinion of Netwealth or its related companies.