Results for: Investment strategies

Why investing in emerging markets makes sense?

Learn how a growing middle class in emerging markets is creating a need for investment in global infrastructure, creating unique investment opportunities for years to come

Dissecting diversification: Techniques used by hedge fund managers

Explore four common techniques used by hedge fund managers that have the potential to help smooth portfolio returns through diversification.

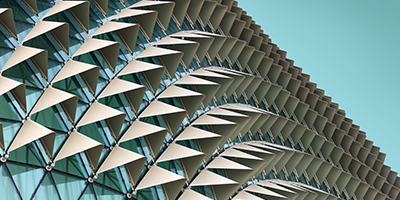

How our demand for data is creating investment opportunities

Learn about how a global increase in data consumption is creating unique investment opportunities in listed infrastructures.

How to safeguard your investment portfolio

Learn how to develop an investment approach that considers many future scenarios (both positive and negative) and how portfolios should be adjusted to address potential risks and return.

Re-focusing on fixed income in a low-yield environment

Learn about how including fixed income strategies in your investment portfolio can help diversify sources of return and allow for more robust risk management.

How climate change and ESG factors are driving an investment shift

Learn about how climate change, ESG and other intangible factors are helping investors make better company valuations and more informed investment decisions.

Economic outlook: what risks and implications investors need to consider

Hear from Schroders as they provide a macro analysis of the global economy and share their views on what a post-COVID-19 recovery might look like.

Finding balance in a low-interest environment

Hear from Perpetual as they draws on lessons from the GFC to help investors navigate the current market conditions and develop portfolio construction strategies to achieve income and lifestyle goals in the current low-interest environment.

Dissecting listed infrastructure in the new world

Hear from Daintree Capital as they share their insights on building a fixed income portfolio, considering term deposits, fixed income funds, absolute returns funds, listed hybrids and more.

Building a fixed income portfolio using index and alpha strategies

Learn how to construct a considered fixed-income portfolio combining multiple return drivers, including capital preservation, portfolio diversification and income.

Exploring the opportunities and challenges in fixed income investing

Hear from Plato and Firetrail as they share their insights on the opportunities, risks and considerations for investors when building a portfolio with Australian equities.

How to construct a balanced portfolio in a challenging investment environment

Learn Perpetual’s framework for building a balanced investment portfolio to deliver income in a low-interest rate environment.

Micro-cap companies and their investment potential

Hear from Ellerston Capital as they share an outlook on the Australian micro-caps sector, where the investment opportunities lie in the next 12 months and the key criteria to consider when researching and selecting micro-caps.

What investors should know before choosing a fixed income product

Learn about some of the key concepts to consider when building a fixed income portfolio and how to avoid potential pitfalls when choosing fixed income products.

Explore the income and total return opportunities in Australian equities presentation

Hear from Plato and Firetrail as they share their insights on the opportunities, risks and considerations for investors when building a portfolio with Australian equities.

2021 investment opportunities with Roger Montgomery

Hear from Roger Montgomery on whether there is a silver lining to the uncertainty of recent times and if conditions are set to boom in infected economies.