Take outs

- Cash flow and budgeting technology may be used by over 60% of advice businesses by 2020

- Customisable platforms make data and insights relevant to individual customers

- Every client has the potential to be a candidate for cash flow as a service

Technology is already part of everyday money management. We can pay for our lunch by swiping our phone or a wearable device, get cash from an ATM without needing a card, and have our transactions automatically categorised into spending types in our online banking.

Taking that a step further, cash flow and budgeting technology (also called cash flow as a service) as part of financial management and client engagement is on the agenda for advice businesses. Typically, bank account, investment and spending data feeds into a central program, with a user-friendly dashboard presenting a real time snapshot of where money is coming in and going out.

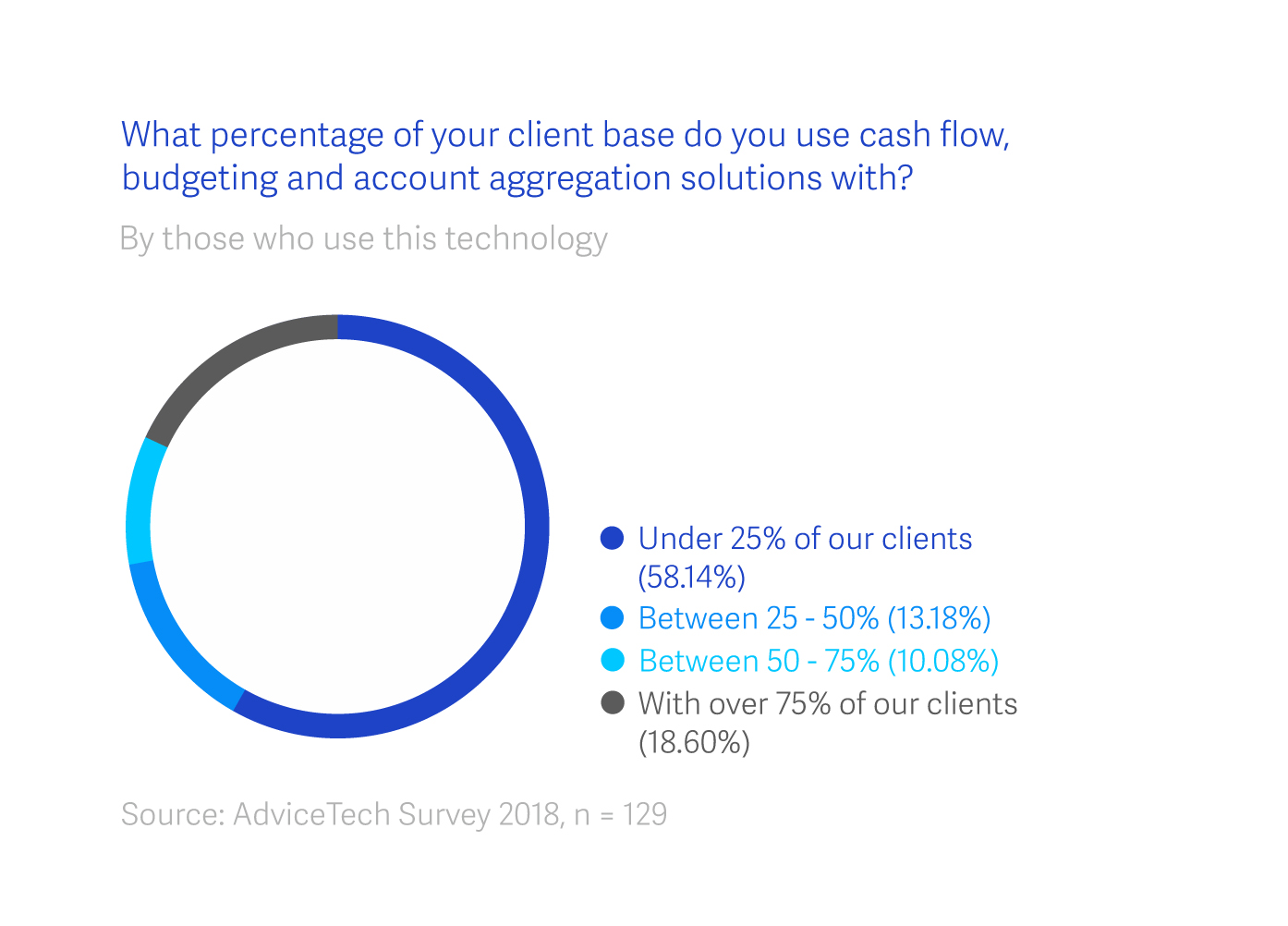

The 2018 Netwealth AdviceTech Research Report shows 42.30% of advice practices are using cash flow, budgeting and account aggregation software—with over 60% intending to use the technology by 2020.

Both from businesses specialising in cash flow and budgeting tools to help advisers manage and monitor client finances, Peter Malekas—founder and Managing Director of Moneysoft— and Chris Ridd—CEO of myprosperity—recently talked to Netwealth about making the most of this evolving space in AdviceTech.

1. Go with what works

Using a program that’s user-friendly for advisers and clients is crucial to both sides being engaged and making proper use of a cash flow tool.

Chris says that finding a program that can feed in the right data is crucial. Clients typically have multiple accounts, so being in the Cloud, with APIs and data feeds provides a seamless way of bringing information together.

“Clients won't go out and find that data. Most have logins everywhere. It’s a real pain to get all this information, so this takes away the heavy lifting,” he says.

Understanding what your advice business wants to get out of introducing this technology is key to choosing the right tool, says Peter.

“What are you trying to achieve by using this type of tool with your clients? Is it part of your core offering standard to every client, or only those who opt-in?” he asks.

“For these tools to be successful, you have to bring the client on board and ensure they know how to use the tool and what data needs to be plugged in for it to work. It's not like an investment product, it won’t work without client input,” he says.

2. Champion the change

Like any new way of doing things in a business, taking time to involve staff and ensure they know how to actually use the technology is an investment worth making.

Chris says having a champion within the advice business to lead implementation of a cash flow and budgeting technology platform can be the difference between success and failure.

“Technology doesn’t just happen, it needs somebody to champion that cause. Someone who is forward thinking, embraces technology and has influence,” he says.

“Take ownership and be clear that this is a tool we’re now using with our clients. A definite position gives advisers the best chance of succeeding with the cash flow platform.”

Netwealth 2018 AdviceTech research report

The second Netwealth AdviceTech research report examines twenty-six technologies used by advisers in their practice – their adoption, benefits and key suppliers.

3. Do something with the data

We’re surrounded by all kinds of data, but having it isn’t enough. It's what we do after we analyse it that’s important.

Peter says while the first step is getting the data into a system, it’s important advisers using it pay attention to how the information connects to their client’s goals and overall financial future.

“The information is useless on its own. That's where the adviser comes in. You need to drive the service and show its value,” he says.

Chris says client access to data becomes a truth serum for acknowledging where a client’s money is really going.

“Automatically categorising spending is powerful. It’s there in black and white if you need to explain why savings aren’t growing, or where the belt could be pulled in to reduce debt”, he explains.

“Clients can see for themselves on their mobile phone exactly where their budget is at.”

4. Know the real story to build engagement and compliance

It’s not just about the data you can get relating to your client, says Peter, but how you use it to boost their money management and stay compliant.

“Use that data to educate your client about the decisions that they're making and how that's impacting their overall financial circumstances,” he says.

“From a regulatory point of view, an accurate and ongoing set of client data makes you more compliant. You’re seeing their circumstances and not relying on their version of events. That means advice that’s relevant and appropriate for their circumstances.”

5. See every customer as a user

While advice businesses must get comfortable with the technology that Gen X and Y clients expect, every client is a candidate for this type of tech.

Peter says his experience as a former adviser is that every client can benefit from a real time, bird’s eye view of their money. And it’s not based on their financial assets.

“It's not an extended offering. Embedding a basic program across the overall business brings the most value. Then, customise it to suit.”

Chris agrees the client base is broad and crosses generations.

“There's a few obvious categories. Property owners (there’s 1.8 million of them in Australia), business owners (2.1 million) and retirees… they’re after the peace of mind of having everything in one place,” he says.

“And don’t forget the millennial accumulator that's really interested in cash flow and money management. They're saving, they may have just bought a home and they're looking to reduce debt. Make their money visible.”

Not just ‘nice to have’

Cash flow and budgeting tech that clients can engage with is likely to become non-negotiable when someone looks for an adviser.

“Where we’re going is an automated advice framework with money management as it's basis,” says Peter.

“For some of our most successful advisers money management is what makes them stand out from what their peers are providing.”

Chris says as this technology becomes more widespread, there’s potential for data to provide some interesting insights around consumer economics; where are people spending their money?

“That’s the future. But right now, let’s arm advisers with the technology and data that's actually going to make a difference and help them drive revenue.”

Find out more

Read more about cash flow, budgeting and account aggregation use in the 2018 Netwealth AdviceTech Research Report and ‘How cash flow and budgeting tech can boost your business’.

Recommending reading

AdviceTech Report

A comprehensive view of AdviceTech with special reports, articles, video and podcast interviews.

Glossary of AdviceTech

View a summary of 25 adviser technologies, highlighting key tech providers and benefits to advisers.

Lessons from the US

Find out which US trends in tech and innovation are set to impact the Australian advice industry.

AdviceTech landscape

Get your copy of the logo map created by Netwealth, as featured in the 2020 AdviceTech research report.