Netwealth IQ Report

2024 AdviceTech: Buyer's Guide

Discover emerging technology trends and explore those suppliers most frequently used by firms

Download the guide

The 2024 AdviceTech Buyer's Guide aims to provide advice firms with a practical tool to help advisers build their ‘tech stack’ and future technology roadmap.

It is an easy to read report that provides:

A list of specific technologies that have experienced notable shifts in adoption, which are worth keeping an eye on as you build your future roadmap.

A benchmark for your firm, by looking at the usage for each technology and comparing it to the usage by AdviceTech Stars (those that enjoy greater commercial success than most, whilst also being greater adopters of technology).

Netwealth’s 2024 AdviceTech research uncovered four trends that may impact the advice industry that advisers should be aware of.

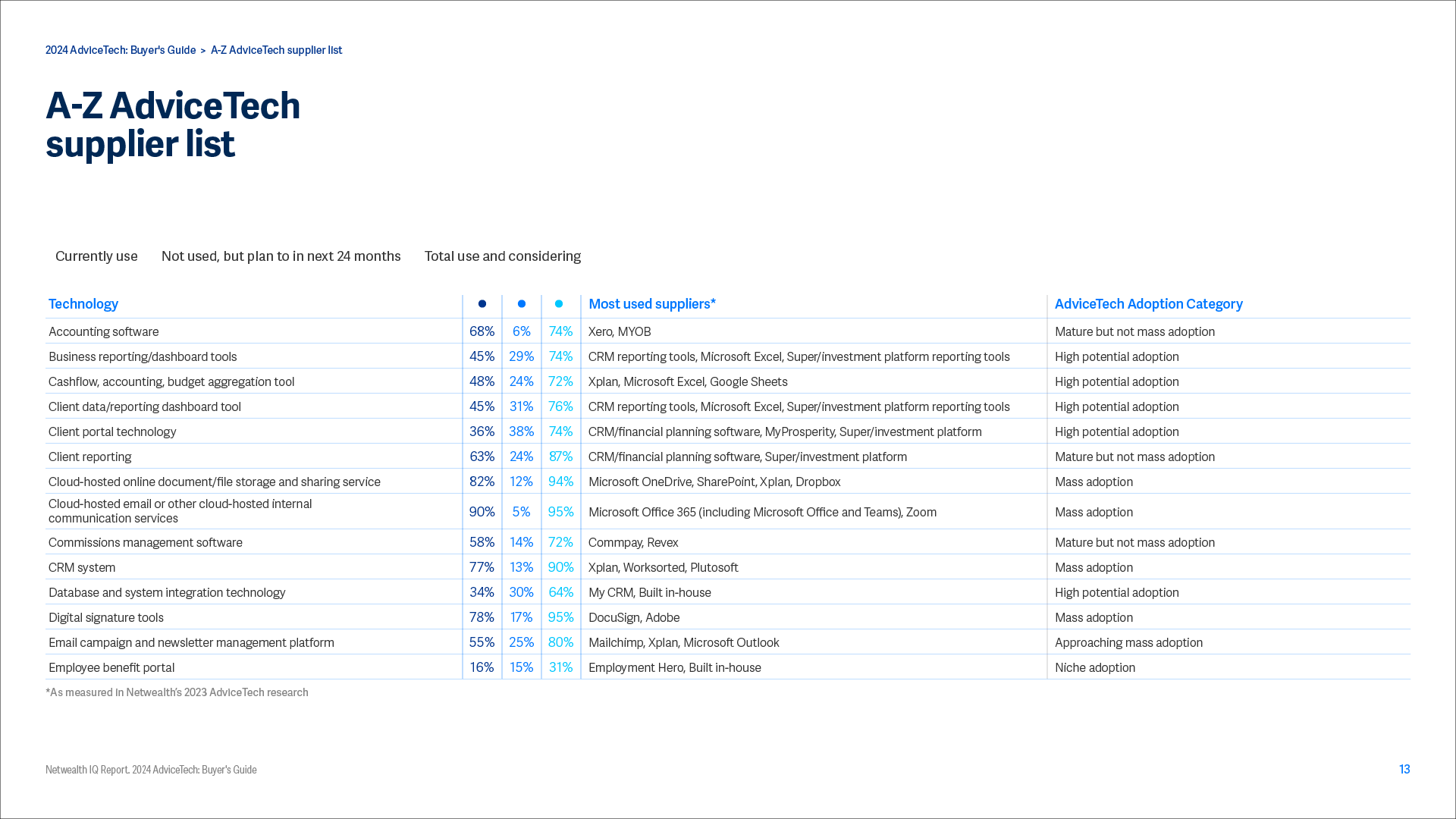

Several technologies were added to our ‘'high potential’' adoption categorisation including: Online surveys to capture client feedback, Cashflow and budgeting tools, Off-platform asset management technology, Stand-alone Regtech solutions, Client portal technology and Online fact-find/risk profiling tool.

According to Netwealth’s Adoption Maturity Framework, several technologies are now “approaching ‘mass adoption’' so should likely be part of every adviser’s tech stack today. Technologies like email campaign and newsletter management platforms, or virtual client meeting tools fit within this category.

AI continues to attract attention and is increasingly being adopted by advice firms. Many firms are still in the early stages of adoption, with most implementing AI in a limited capacity or as a pilot within their operations (44%), a significant increase from last year’s 11%. Among the segments, AdviceTech Stars (69%) and adopters (55%) have the most widespread use of the technology. Consideration for AI adoption is highest among Conservatives (42%).

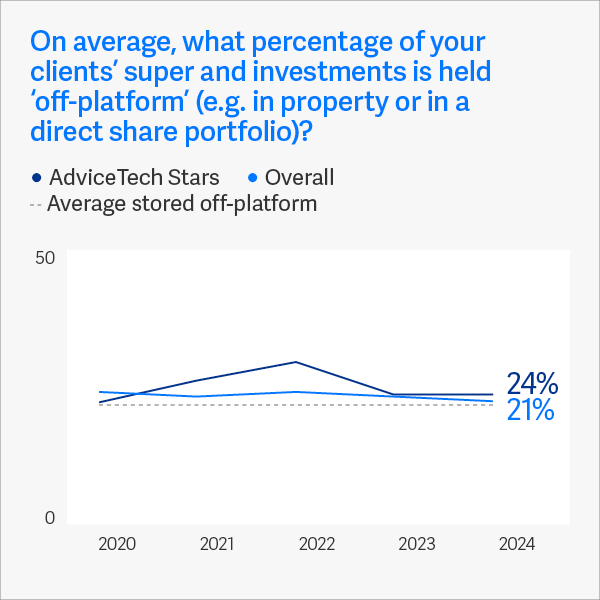

Off-platform asset management is technology and administrative services for managing and reporting on non-custodial assets. According to Netwealth’s AdviceTech research, around one quarter of client super and investment portfolios are held in off-platform assets such as property, private equity, direct property, and private debt funds, a trend that has remained stable.

Over half of advice firms have difficulty implementing digital projects. In Netwealth’s 2024 AdviceTech report, we explore how top-performing advice firms and innovative companies overcome these challenges and build their digital capability to unlock success.

At Netwealth, we're continually expanding and enhancing our platform features to help advisers increase business efficiency and staff productivity. Below are some of our latest features to help:

Don’t just run reports for individual clients, access all reports (including summary chart reports) and any reports you create for multiple accounts at once.

Find out howUse an intuitive drag-and-drop interface to create your own reports to highlight the most relevant information and charts for your clients.

Find out moreEasily view, approve, manage, filter and archive activities for you, your team and clients.

Learn moreWith Wealth Exchange and Data Integrations, you can easily set up and manage third-party data feeds with over 25 data integrations.

Find out howAccess workshops and tools to help your team innovate and deploy technology more effectively.

AdviceTech Roadmap workshop

Develop your AdviceTech roadmap by investigating and prioritising the different technologies available to your business.

Customer journey workshop

Use this full-day workshop to identify pain points in your customer’s experience with you, and identify digital solutions to address them.

Prioritisation matrix

When there are lots of technologies how do you prioritise them? Using this simple tool you can, by plotting them on our 2x2 prioritisation matrix.

Building a digital-ready organisation

Digital transformation is a challenge for many advice firms, but some businesses do it better. Based on Netwealth’s 2024 AdviceTech research, we look at the attributes of leadership and culture that impact a firm’s digital maturity.

Why your technology offer matters to family offices

Learn how your firm’s investment in technology can be offered to family offices to improve their operational efficiency, elevate reporting, support better portfolio and investment decisions, and improve family communication.

Sharpening advice firms for a competitive edge

Dean Lombardo, Founder & Principal of Effortless Engagement explains how re-engineering adviser processes could lead to better client outcomes and suggests that the best businesses are already using AI and other tools to enhance their client engagement and value proposition.

Based on Netwealth’s 2024 AdviceTech research this presentation will provide you with the building blocks to embed digital and technology transformation into the DNA of your firm. Explore how to digitally transform your firm with Netwealth’s new Digital Maturity Framework, a tailored approach that ensures that your firm can leverage the full potential of AdviceTech to stay ahead in the industry.

By submitting your details, you agree to receive further marketing communications from Netwealth. It is, however, possible to unsubscribe from within each communication received, by clicking the unsubscribe link at the bottom of the email. Alternatively, you can visit the following webpage or contact us on 1800 888 223 and ask to be unsubscribed. Please visit our website www.netwealth.com.au to read our Privacy Policy. By clicking Download or Submit, you agree to our Terms & Conditions.