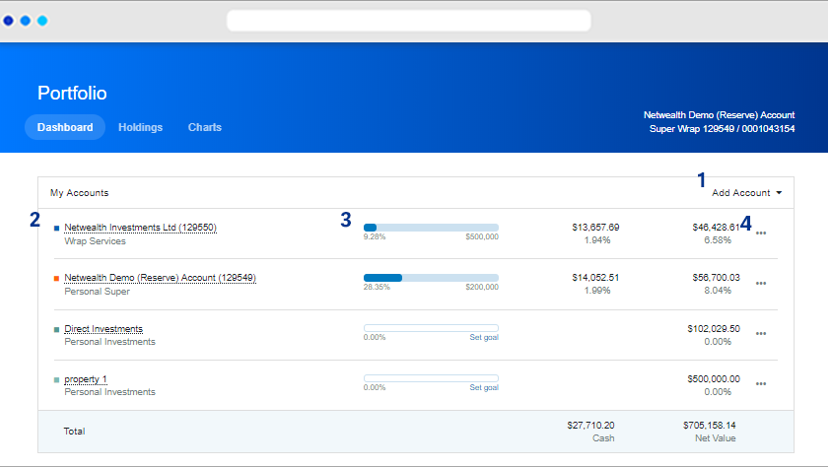

Portfolio dashboard

View your Netwealth accounts alongside annuities, bank balances and other personal portfolios.

Netwealth's online portfolio tools provide annuity, super and investment account holders the ability to view and analyse their accounts and holdings. There are three Portfolio tools available:

In this module we will cover the features available on the dashboard tab.

Once logged in, you'll see the Portfolio dashboard, which is divided into two sections:

a) My Accounts

b) My Tasks

This section lists all Netwealth accounts (and annuities), and their cash and net value position, plus and any added external assets (non-Netwealth) accounts.

| Reference | Action | Details |

| 1 | Add External Bank Accounts |

To add or manage an external bank account: a) Select Add Account > Bank feeds |

| 1 | Add a personal portfolio |

To add or manage a personal portfolio: a) Click Add Account > Personal Portfolio Advanced tip: Listed Australian shares and managed funds prices and values will be maintained by Netwealth. |

| 2 | Select an account |

Click on any account to navigate and view the underlying holdings of that account. |

| 3 | Set goals |

Set a financial goal for your account balance/s. To create a goal: a) Click the ‘…’ icon in the far right for the account you would like to set a goal for |

| 4 | Buy/Sell Assets* |

For Netwealth accounts, use the one-click navigation to buy or sell investments. Click the ‘…’ icon in the far right for the account you'd like to transact on. |

This section provides a list of tasks and notifications for the selected account, issued by the platform when relevant.

| Task category | Tasks and notifications for: |

| Corporate action |

|

| Asset management |

|

| Rollover management |

|

| Cash management |

|

| Actionable tasks or adviser-initiated proposals |

|

*Transact users only

illion Open Data Solutions (formerly Dunn & Bradstreet) is a market leader in financial data and credit management solutions. illion acquired Proviso an Adelaide based finTech in 2017. illion’s clients include major banks and credit unions and their service is used by over ~700,000 end users every month.

illion’s credit policies and procedures are in line with ISO27001. Online banking credentials are encrypted and can only be used for the purpose of providing this service. Illion’s service is independently tested and audited by external security experts. Data is encrypted with bank level 256-bit encryption, secured by 2048-bit keys

You should always look for a locked padlock icon and green site information near our website's URL in the address bar of your browser to ensure that your connection is secure. When you access various other sites by clicking on links from our website or the Netwealth app, you should be aware that these other sites are not subject to our privacy and security standards. Please ensure you contact them if you have any concerns. More information is contained on the providers website https://www.bankstatements.com.au/about/security. Netwealth has measures in place to ensure a high level of privacy, security and protection of your personal information when you connect to our website or use our mobile application (Netwealth app). However, no measures can guarantee complete protection, and Netwealth will not be responsible for any loss if our measures fail or are breached.We call the illion service real-time. When you or your adviser opens the dashboard for the first time during that session it will be current.

Your current BankFeed would fail and you would need to reconnect your accounts using your updated details.