Fee management flexibility

Manage fees and disclosures, discounts and releasing clients from fees.

We have a range of fee functionality available on our platform providing you the flexibility to tailor client fees and run your business they way you want. Link accounts of family members, related trusts, companies and SMSFs to reduce administration costs.

Platform functionality also extends to managing fee disclosures, releasing clients from fees and online fee rebates.

In this module we will cover:

Netwealth allows for a range of advice fee types including % or $ fees to allow you to establish the type of fees that best suit you and your clients. If you charge your clients tiered advice fees, please contact your training and relationship manager to have these set up prior to completing your first application.

Family fee linking lets related parties link their Netwealth Plus accounts*, so that when the administration fees are calculated, the larger combined account balance is used rather than the smaller individual account balances.

Example: Jane and Bill are married and both have Super Accelerator Plus Personal Super accounts with balances of $100,000 and $600,000 respectively. By linking their accounts, annual administration costs are charged at the combined $700,000 balance. Jane and Bill are able to save $340 on administration costs, or nearly 10% of their combined administration costs. (This example assumes that the average daily balances do not change and provides an estimate only of the effect of grouping family accounts).

Accounts that are grouped together at any time in a given month, will begin to receive a rebate on a monthly basis from that month forward. For example: If a family fee group is crated on the 28th of January (and collectively the balance allows for a rebate) each account will receive rebates from 1 January, until such time the accounts are removed from that group.

a) To link family accounts, which may reduce platform administration costs, log in and navigate using the main menu to Business Settings > Family Fee Groups.

b) Click 'Create new group'

Advanced tip: In the Family Fee Group screen, you can search for existing groups by entering an identifier such as group ID, client name or account name. If the client is in an existing group (whether an administration fee group, advice fee group or both), the group/s will display.

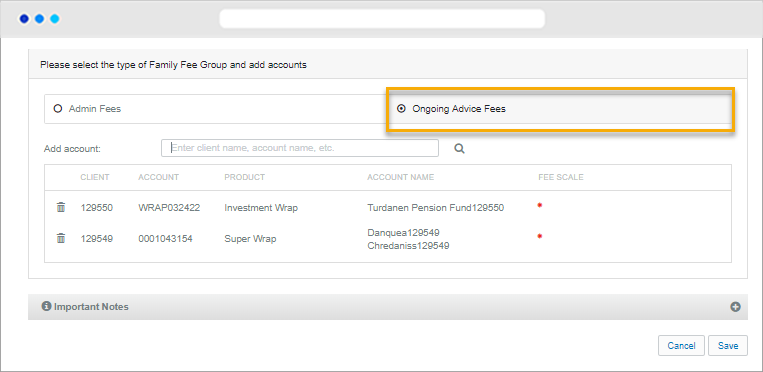

Select the fee type applicable to the family group you are creating - either:

a) Search for an account using any account identifier you choose.

b) Click on the account name and it will be added to the group (in the table below).

c) Repeat for additional accounts you wish to add to the group.

Advanced tip: If you wish to modify or use an existing group of clients, you can by using the search functionality by entering an identifier such as group ID, client name or account name. If the client is in an existing group (whether an administration fee group, advice fee group or both), the group/s will display for selection.

a) Search for a client using any account identifier you choose.

b) Click on the account name and it will drop into the field list below

c) Repeat for the remaining clients so that they drop into the list below

d) if (Netwealth) Admin Fees are selected:

For each account, select the relationship type within the table:

Important notes on establishing a family fee group:

d) If Ongoing Advice Fees are selected:

For each account, ensure they have the same tiered fee scale. If not, you will not be able to proceed.

Important notes:

To establish or maintain a family group that you wish the family fee rebate to be applied to, the following criteria will apply:

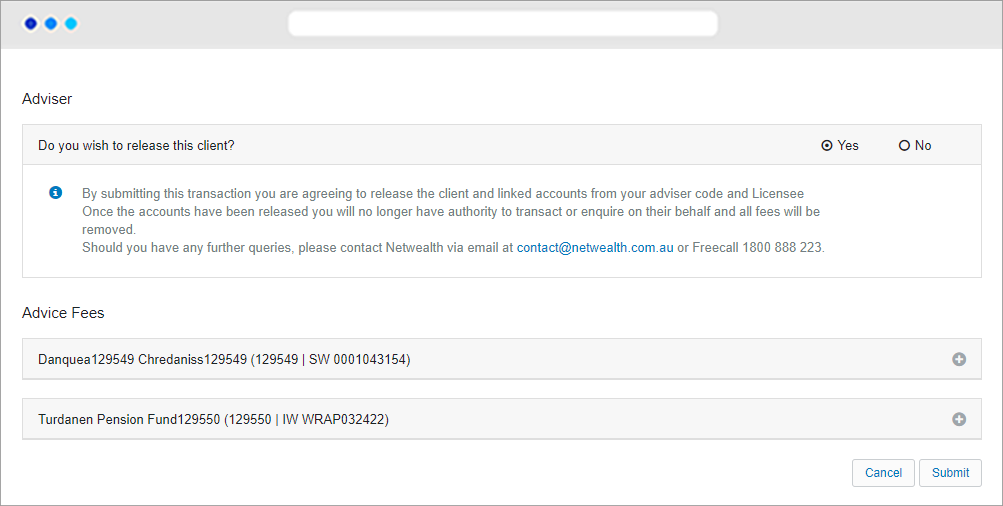

You have the ability to release clients from your portfolio and Licensee.To do so select the client you would like removed and navigate using the main menu to Client Details > Fees > Fees Disclosure/Opt-in.

Tick 'yes' to agree to release the client and linked accounts from your adviser code and Licensee.

Once you submit the release, a summary screen will appear for confirmation. Once the accounts have been released you will no longer have authority to transact or enquire on their behalf and all fees will be removed.

A confirmation letter will be sent to the client notifying them they have been removed from their current adviser.

Netwealth fee-disclosure feature assists advisers keep track of clients annual fee disclosure statement (FDS) disclosure obligations, via a simple reporting tool.

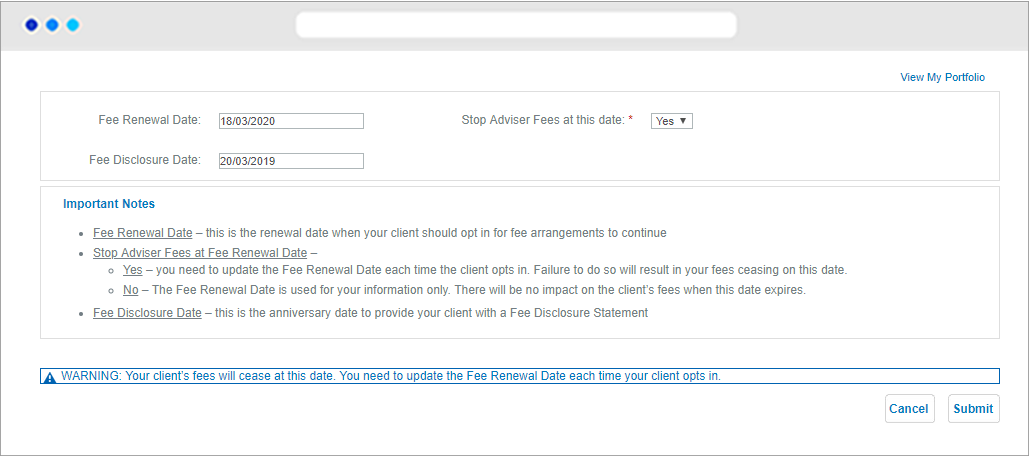

Navigate using the main menu to Client Details > Fees > Update Fees/Release.

a) Enter the Fee Disclosure Date. The fee disclosure date is the anniversary of the date that the ongoing fee arrangement was entered into.

b) Enter the Fee Renewal Date. The fee renewal date is the date when your client should opt in for fee arrangements to continue.

c) Select whether to automatically cease fees at the renewal date. By selecting this all ongoing advice fees will stop automatically at the fee renewal date. Please be aware that if fees cease, you will need to amend ongoing client fees and update the fee renewal date.

To generate an excel report with a list of all clients along with their fee disclosure date:

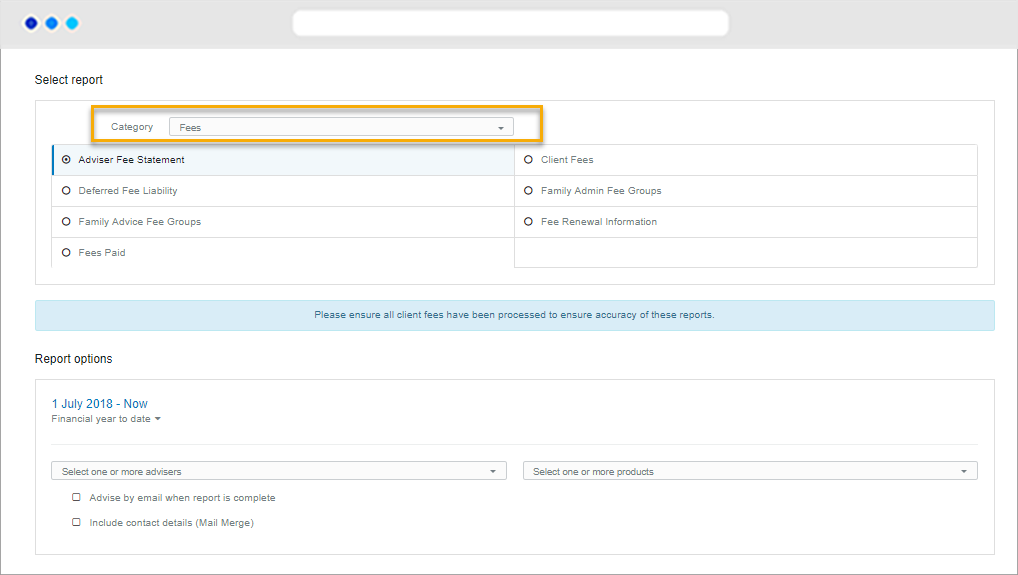

a) Navigate via the main menu to My Business > Reports > Adviser Reports.

b) Select the 'Fees' category and select the 'Adviser Fee Statement' report.

c) Click Submit and your report will download automatically. You can find it your downloads folder on your computer. If you are on your mobile, the report will pop up into a new browser tab.

d) Using Microsoft excel you can sort the appropriate column with the fee disclosure date to identify clients that require action.

If you have determined a FDS is required for one or more clients:

a) Navigate via the main menu to My Business > Reports > Client Reports

b) Select 'Adviser Fee Statement' - this will show all fees payable by the client.

c) Change the date range to the preferred date range for the FDS (12 months) using the quick date selector.

d) Search for and select each account you would like to generate a FDS for.

e) Click submit.

f) To retrieve and download the client FDS navigate to My Business > Reports > View reports. Where more than two accounts have been selected they will in a .zip file. The file will be available for 7 days.

Advanced tip: You may choose to set up reporting groups to manage running client reports in bulk. Click here to find out how.

You can check for upcoming fee renewal dates and automation cease status at any time by running the Fee Renewal Information report.

a) Navigate using the main menu to My Business > Reports > Adviser Reports

b) Select the 'Fees' category and select the 'Fee Renewal Information' report

c) Click submit.

d) To retrieve and download the report navigate to My Business > Reports > View reports. Where more than two accounts have been selected they will in a .zip file. The file will be available for 7 days.

Clients will see the adviser service fee and the fee rebate reported separately.

When an adviser fee group is created it applies for the entire month, even if the group was created part way during the month. In the above example, the grouping would apply from 1 January. Any applicable rebate for the month of January would be applied to the accounts in early February. This would continue each month, with February’s rebate to be applied in early March and so on.

Yes, we are now paying admin fee rebates monthly.

Yes. The groups are completely independent from each other. That is, you will need to create two separate family groups - one for the ongoing advice fee group and one for the admin fee group. On this basis, if an account is removed from one family group it will have no effect on the other group.

No, family fee groups should be set up online once the accounts have been created.

For an in depth look at this great feature, or any of our other platform enhancements, request for one of our team to contact you.