Challenger annuities

Together, Netwealth and Challenger are providing advisers greater access to retirement solutions.

Together, Netwealth and Challenger are providing advisers greater access to retirement solutions.

By logging in to the Netwealth platform, you will be able to:

In this module we will cover:

In order to access Challenger annuities via the Netwealth platform you must be a registered Netwealth adviser and have a Netwealth adviser log in.

If you are not registered, you will need to complete the ‘Adviser Code Registration Form’ available via the main menu under Adviser> Forms and Documents > General Forms

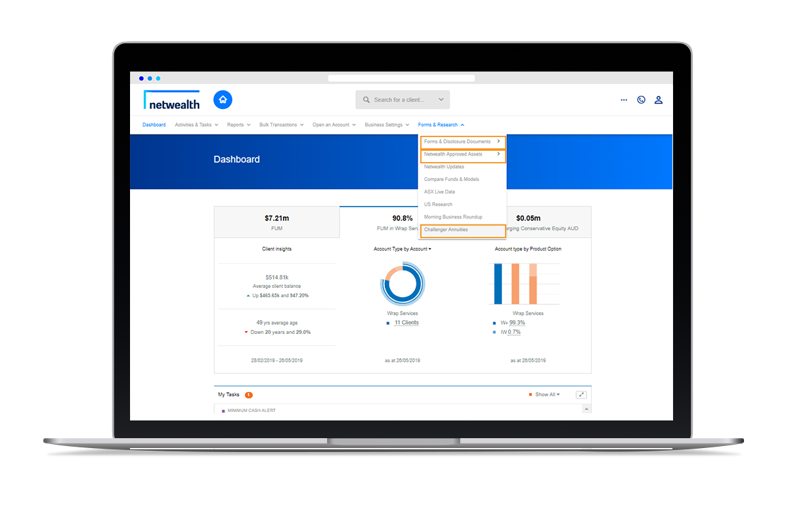

There are several resources available to you via the website including the product disclosure statement. Once you have logged into the Netwealth platform, explore Challenger’s tools and resources by navigating via the main menu to Forms and Research > Challenger Annuities.

Important: Ensure you do not have pop-up browser windows blocked.

If you would like to learn more about the role Challenger annuities can play in your business, speak to your Challenger BDM.

Read Challenger’s guide to transferring annuities upon policy maturity here.

Log in via the Netwealth platform and navigate via the main menu to Forms & Research and select one of the following resources:

|

Resource |

Detail |

Navigation |

|

Challenger tools and resources |

Annuity quotes, saved applications, technical articles and calculators. |

Forms & Research > Challenger annuities |

|

Challenger forms and documents |

Annuity PDS, forms and documents. |

Forms & Research > Forms & Disclosure Documents > Challenger Annuities |

|

View the current weeks rates via PDF. |

Forms & Research > Netwealth Approved Assets > Challenger Annuity Rates |

Applying for annuity happens once you have logged into the Netwealth platform, but also references Challenger web pages.

There are four simple steps to completing an annuity application:

Step 1: Netwealth application

Step 2: Quoting for the annuity

Step 3: Challenger application

Step 4: Challenger annuity established and confirmation letter

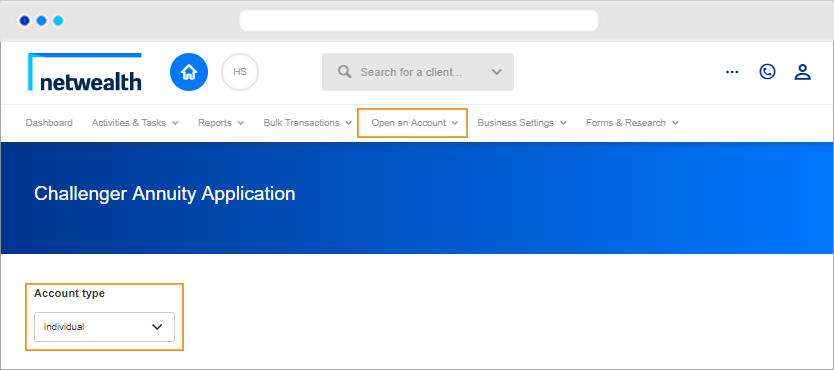

a) Log in via the Netwealth platform and navigate via the main menu and navigate to Open an Account > Annuity.

b) Select the type of annuity account to open.

c) Enter applicant details:

|

Existing Netwealth client |

New Netwealth client |

|

To add the annuity to an existing Netwealth client’s account, search for an account and the Netwealth application will be pre-filled with existing client data. |

To create an annuity account for a client who is not opening a Netwealth a Netwealth super or IDPS/wrap account, select ‘Add a New client’ and complete the form as required.

|

Important note regarding new clients: On clicking ‘Confirm’, the applicant will instantly receive a Welcome Letter from Netwealth with their username and login information for the Netwealth platform. This will be received via their preferred method of communication (email or post).

d) On selecting ‘Apply’ you will be taken to the Challenger eQuote process (Step 2).

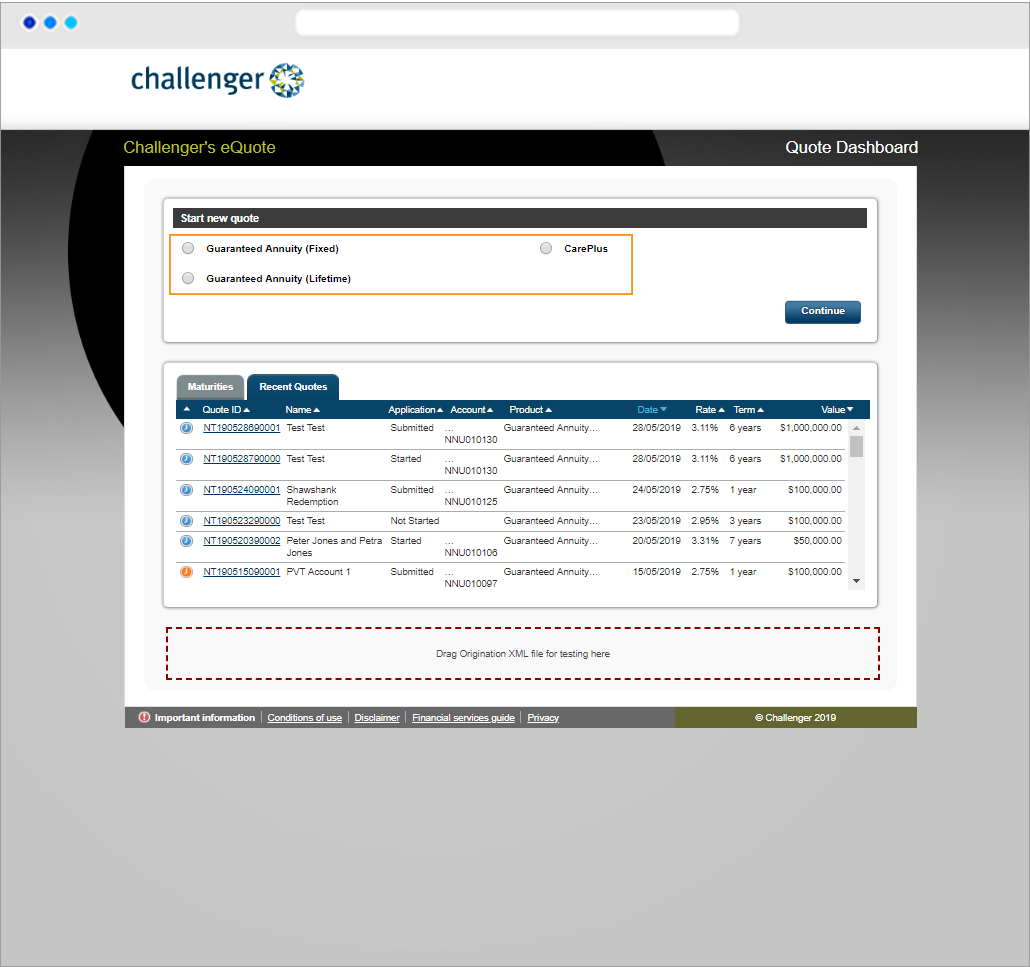

a) Select a Challenger annuity product and click ‘Continue.’

Advanced Tip: You can open a recent quote or re-commence an annuity application by clicking on the Quote ID hyperlink under ‘Recent Quotes’ tab.

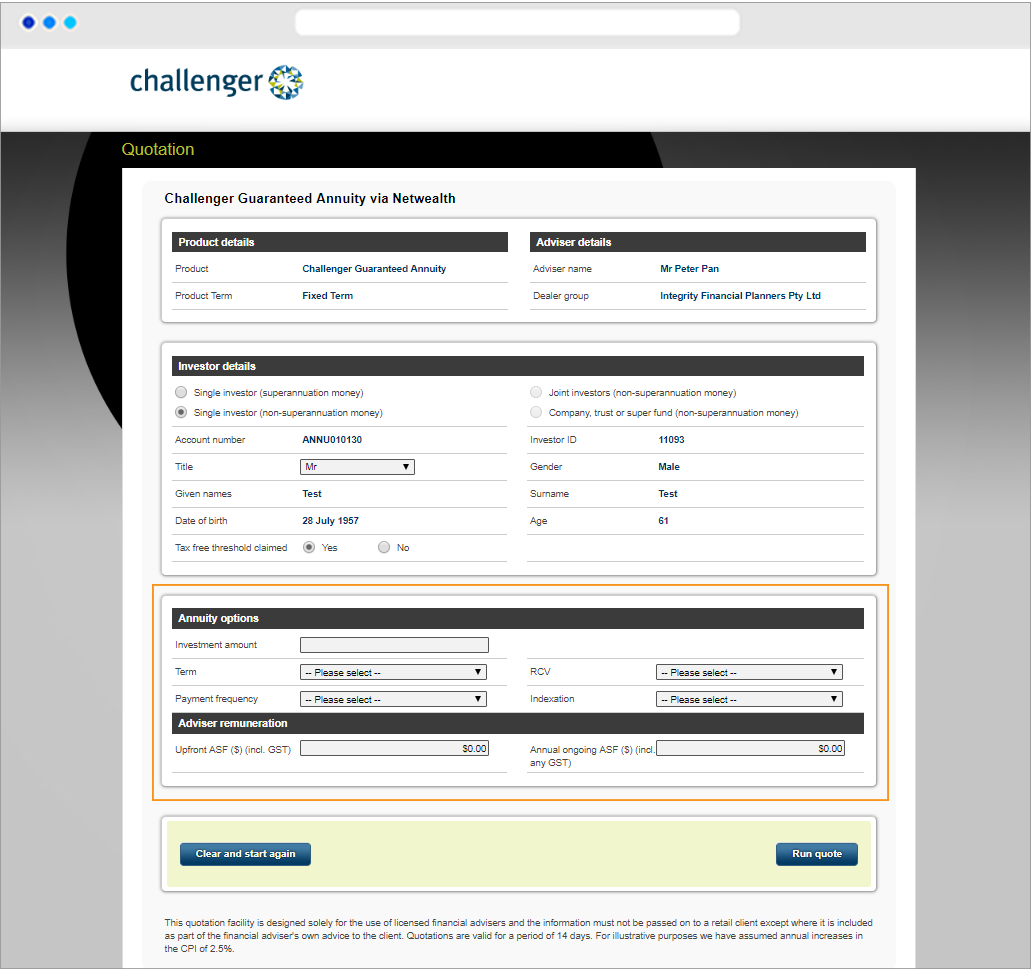

b) All applicant details already entered in Step 1 will flow through to this quote.

c) Enter the annuity options, including Investment amount and Term.

d) Add any adviser remuneration fees.

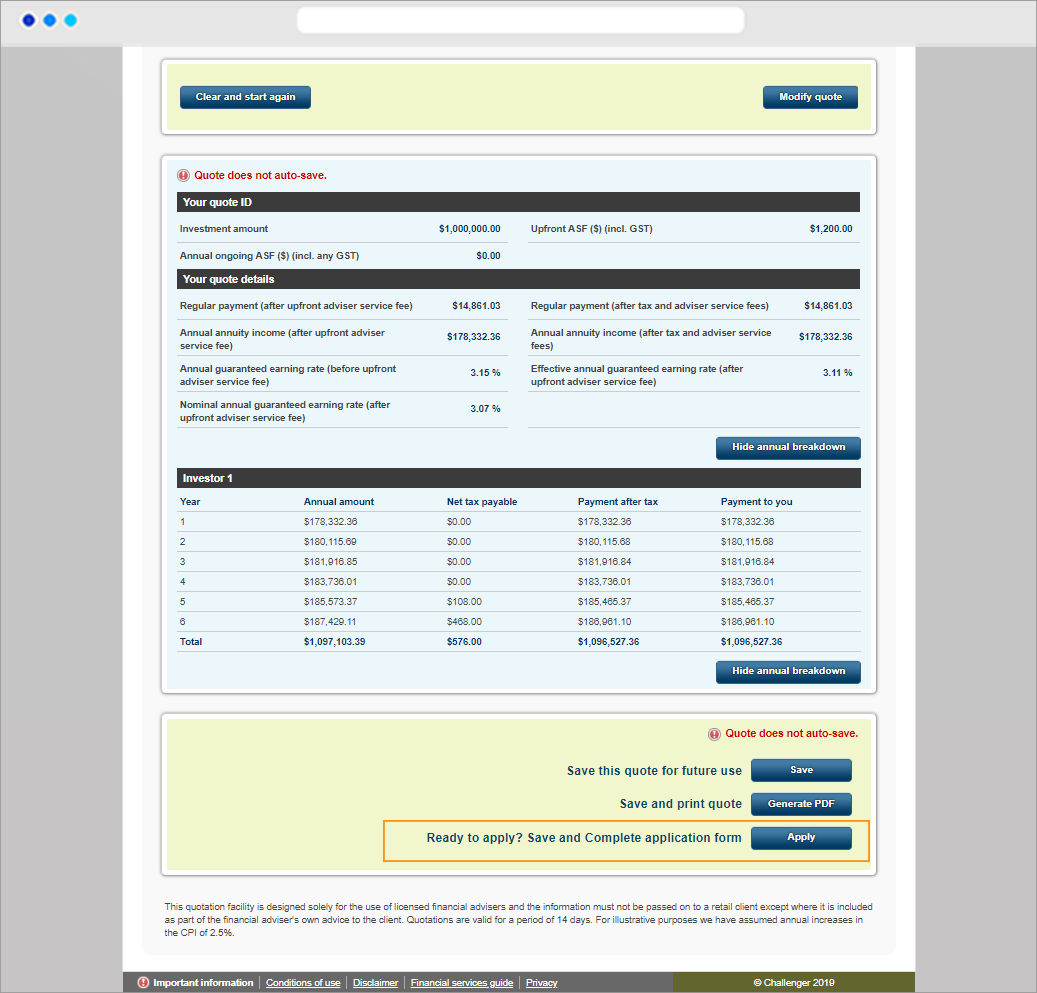

e) Click ‘Run quote’ and a summary quote will display.

f) Review the quote details and click ‘Apply' you will be taken to the Challenger online application process (Step 3) to complete the Challenger application. This will also save the application for later access.

Advanced tip: You can save the quote for future use or download it as a PDF.

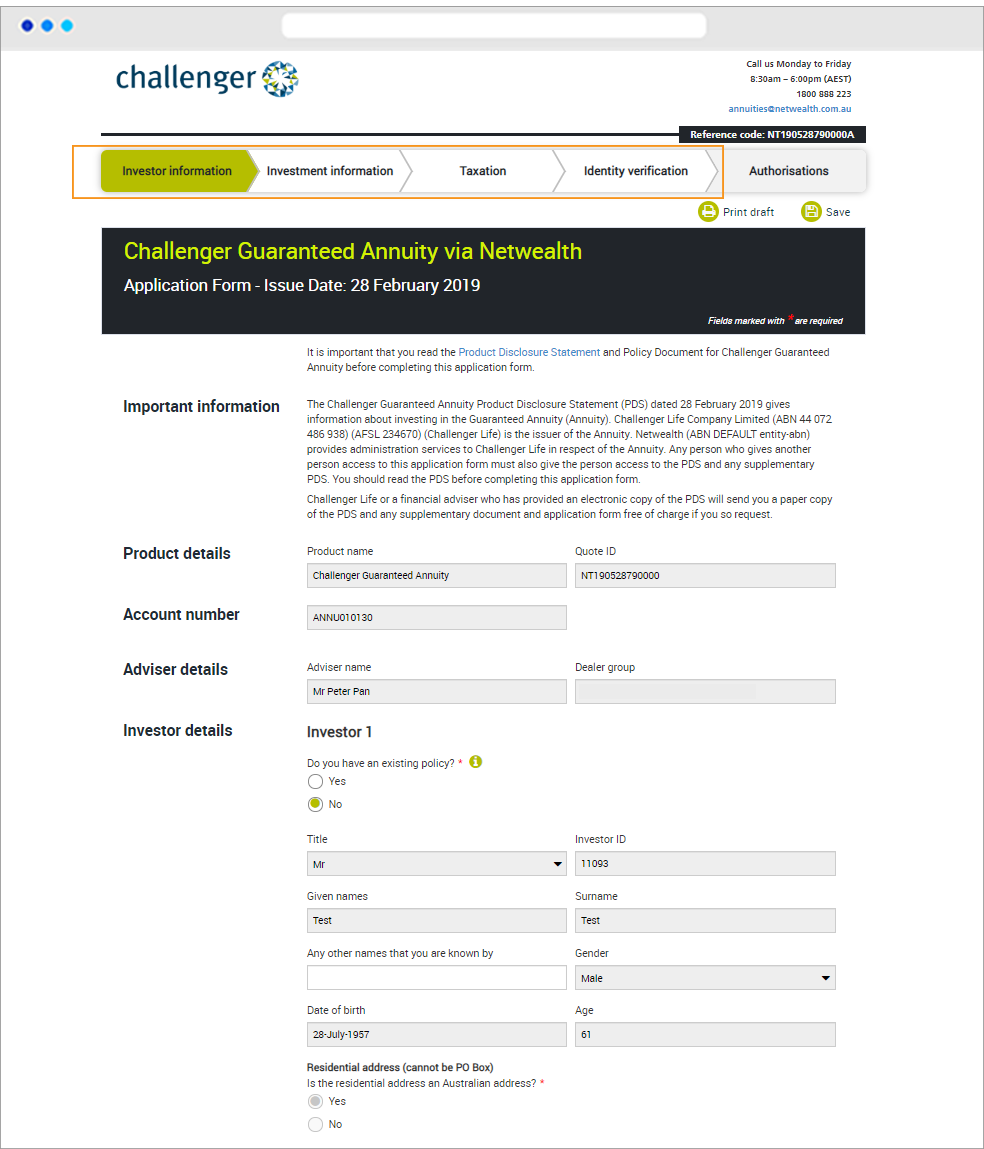

a) There are several steps you will need to complete, requiring you to have access to certain client information (see table below):

|

Step |

Additional client information required |

|

Investor information |

|

|

Investment Information |

|

|

Taxation |

|

|

Identity |

|

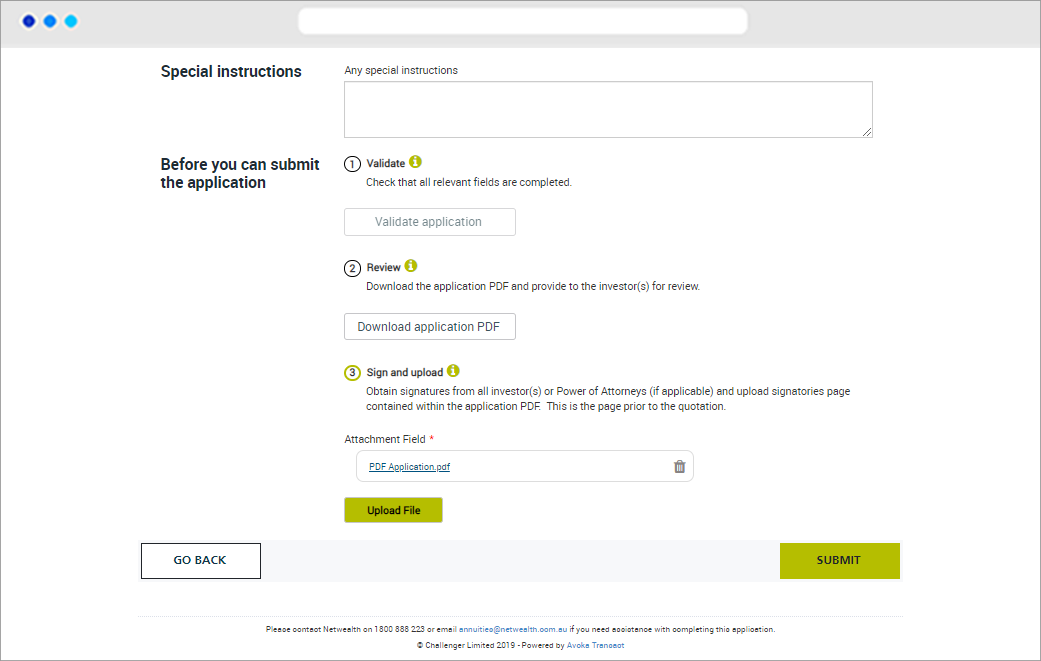

b) The final step in the process, Authorisation, requires you to complete the following steps:

c) Upload the signed Challenger application PDF.

d) Click ‘Submit’

a) The annuity account will be set up via Netwealth once the annuity funds heave cleared from the source. The annuity will commence on the day we receive all outstanding information and monies. This may be the next NSW business day, if received after 3pm or on a non-business day in NSW. You will receive the Challenger rates applicable at the time.

b) Challenger will send an annuity welcome letter to Netwealth, the adviser and then the client via their preferred method of communication:

Netwealth provides a number of ways to manage a client's annuity account. To do so, login to the Netwealth platform and select a client and their annuity account. You will then be able to access the following features:

|

Annuity management |

Detail |

Navigation |

|

View the notional annuity value |

View the notional value of the annuity - via the holdings screen. |

Portfolio > Dashboard and Portfolio > Holdings |

|

View annuity maturity tasks |

In the ‘My Tasks’ section of the dashboard, any annuity maturing within 8 weeks will be displayed. |

Portfolio > Dashboard |

|

View annuity alongside other client assets |

Consolidated view of annuity and other client holdings. |

Portfolio > Holdings |

|

Download portfolio valuation report |

This report provides details of portfolio holdings including number of units, average cost, unit price and value of the annuity as at the selected report date. |

Reports and Statements |

|

Download annuity policy details report |

This report provides annuity policy details including client contact information, product details, payment method, etc. |

Reports and Statements |

|

Download annuity annual statement |

This report is available only if income was paid during the financial year. |

Reports and Statements > Statements |

|

Download annuity client correspondence |

Download all Challenger correspondence. |

Reports and Statements > Document Library |

|

View annuity transaction history |

View transaction data received overnight from Challenger including income payments to the client’s linked annuity bank account. |

Transactions > Search Transactions > Transactions |

|

View annuity policy details |

View annuity policy details including the current withdrawal value.

|

Client Details > Annuity Policy Details |

|

Request a Centrelink schedule |

Request for Centrelink schedules and have them completed overnight. |

Client Details > Annuity Policy Details |

|

Update annuity bank account details |

Update payment source for the annuity. |

Client Details > Bank Settings |

|

Update client personal details |

Update the personal and contact information for the annuity. |

Client Details > Personal details |

For an in depth look at this great feature, or any of our other platform enhancements, request for one of our team to contact you.