Client engagement reimagined

Welcome to Netwealth's next-gen client portal, a mobile app for your clients.

Download nowImprove client engagement, service levels and build trust with Netwealth's new mobile app for clients.

Today almost half (47.6%) of Advisable Australians* who have an adviser view and manage their superannuation using a website or mobile app. Supporting this trend is that one in 3 advice firms have a client portal today and a further one in 3 plan to get offer in the next 24 months*.

These future-focused businesses are using client portals to evolve the client-adviser relationship beyond in-person interactions to hybrid digitally-led advice.

* 2021 Netwealth Advisable Australian and 2021 Netwealth AdviceTech Reports

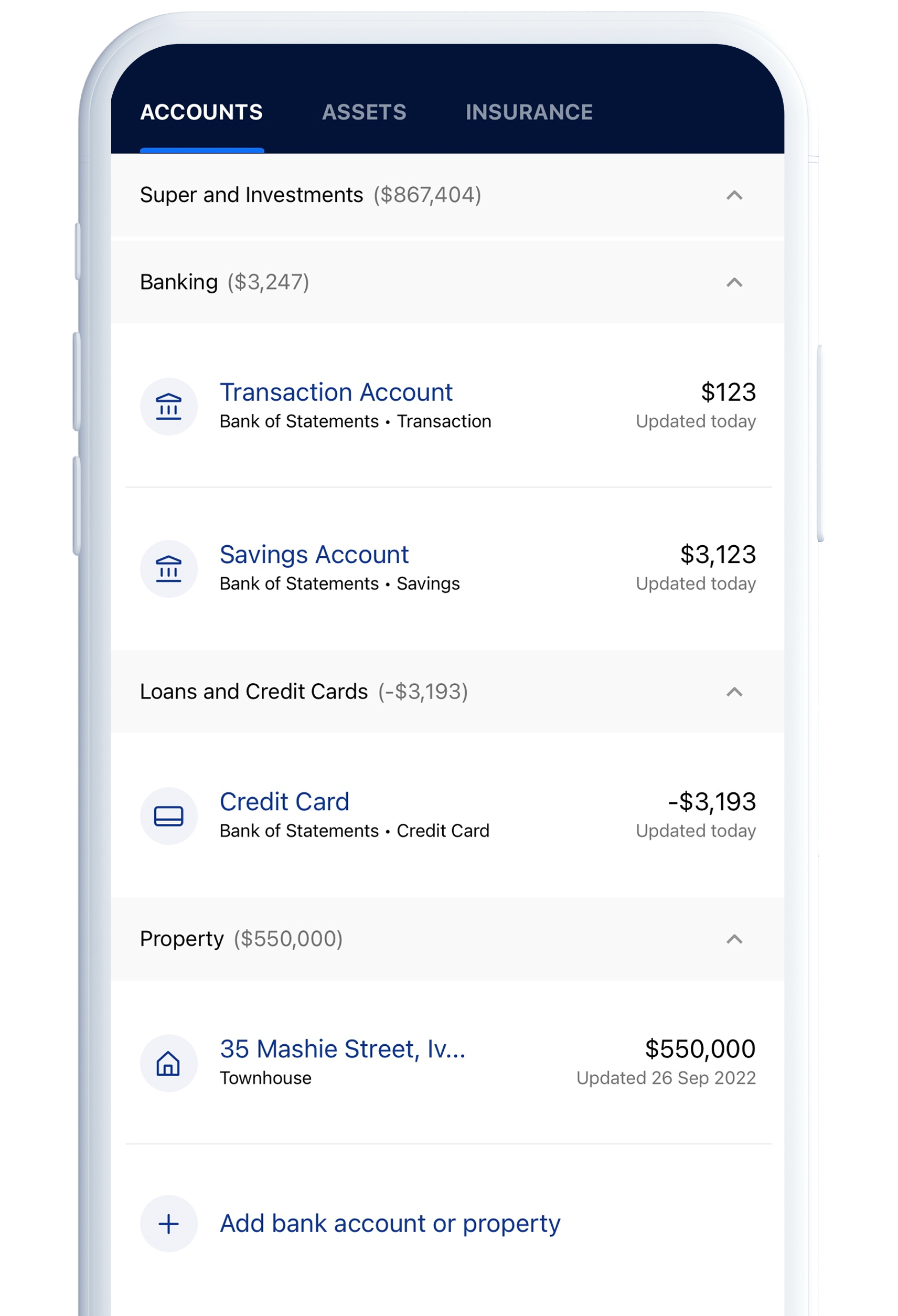

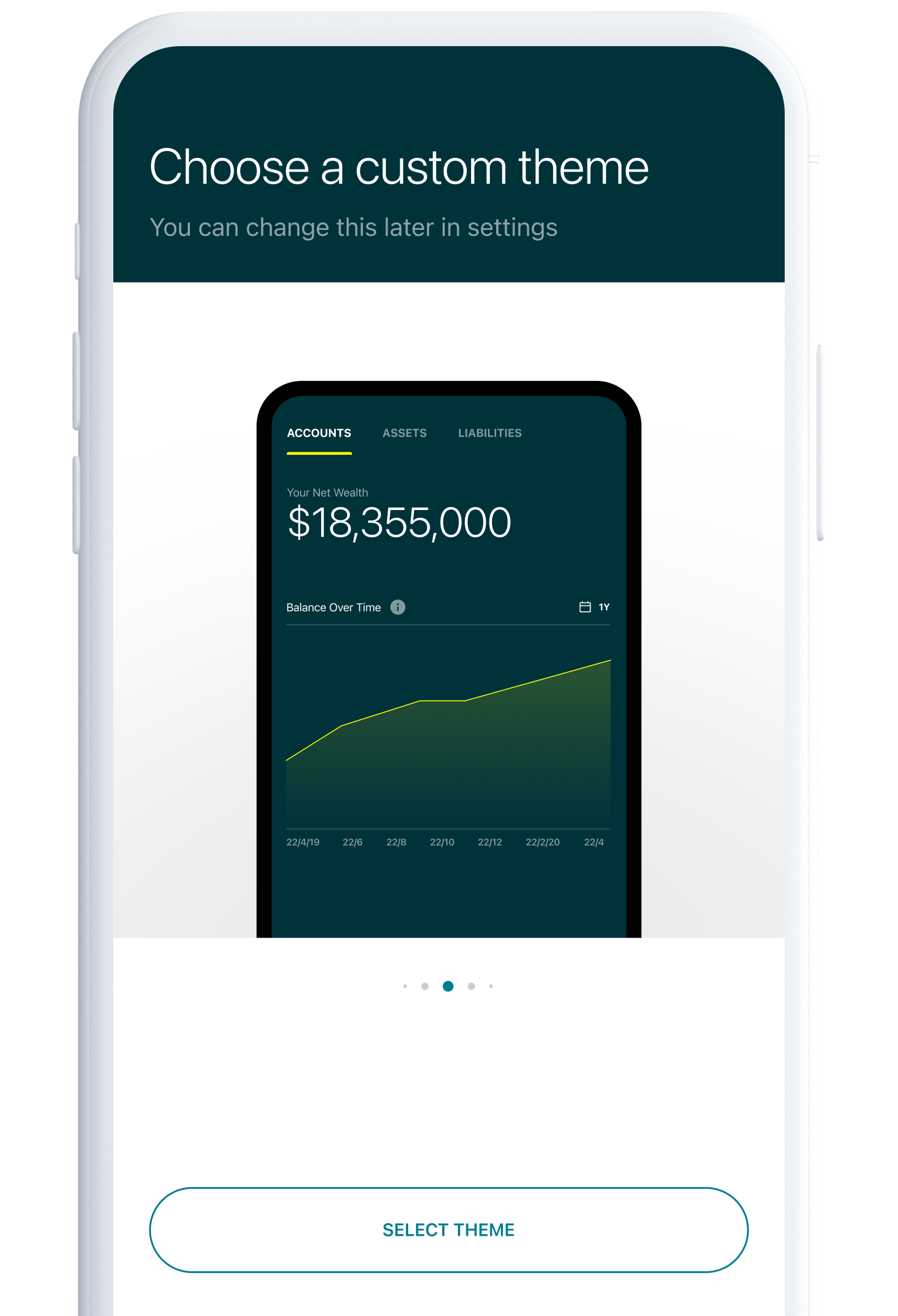

Clients can keep track of their Netwealth Super and Wealth Accelerator accounts and assets on the go

Clients can add external bank, broker and super accounts to their Netwealth account to get a true picture of their wealth

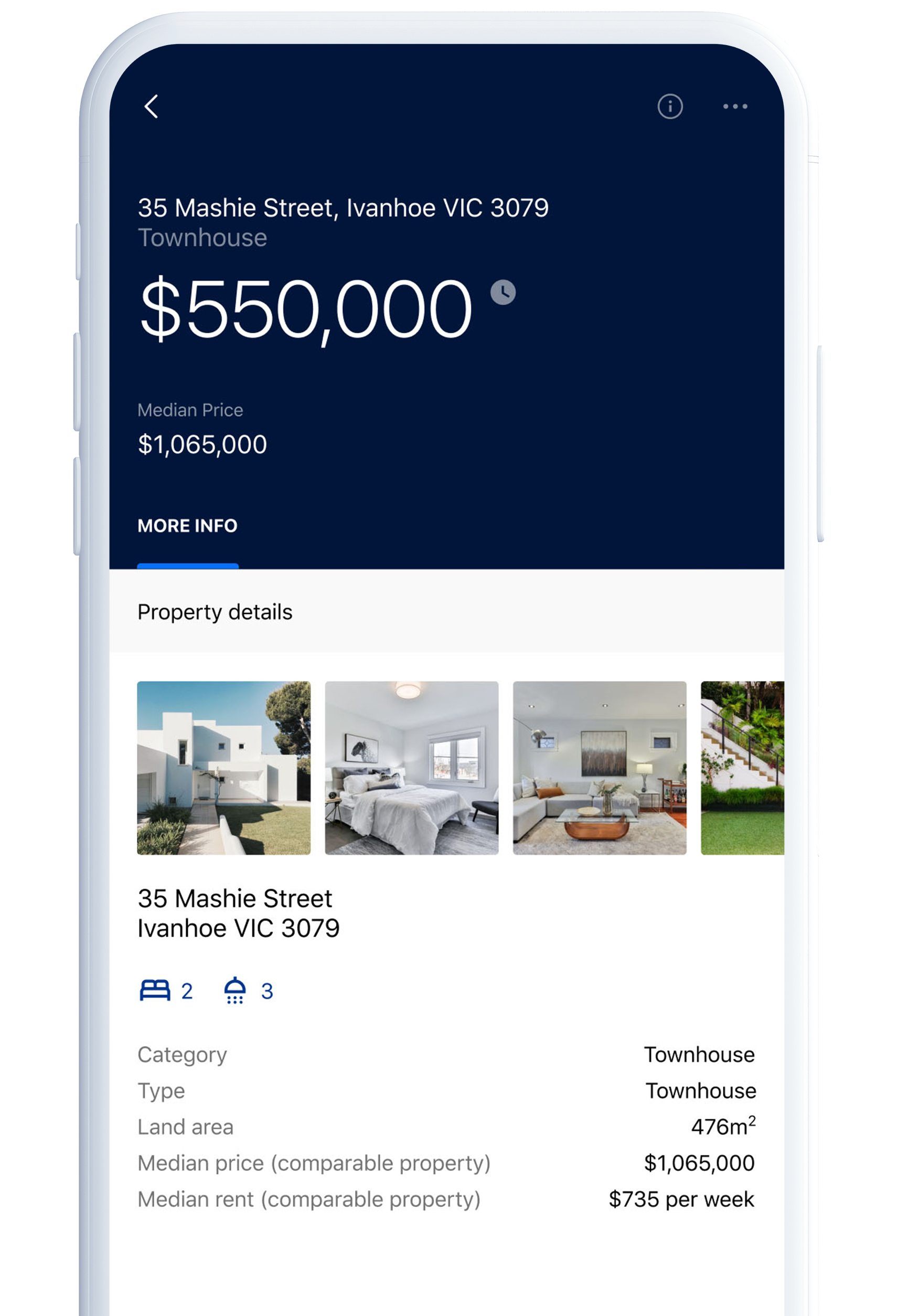

Clients can add property value and information for residential and investment properties

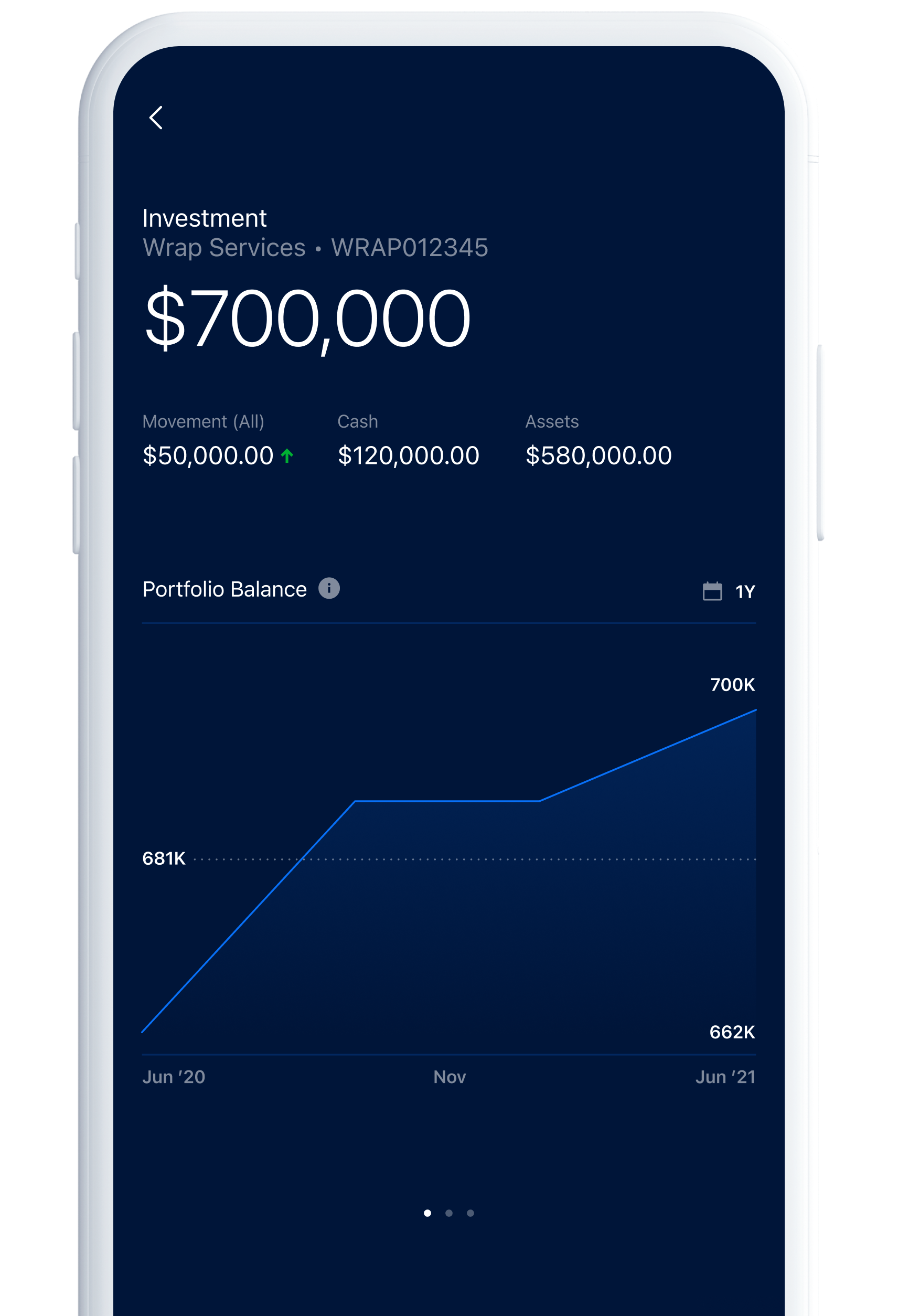

Clients can view overall portfolio performance with a suite of simple to understand charts

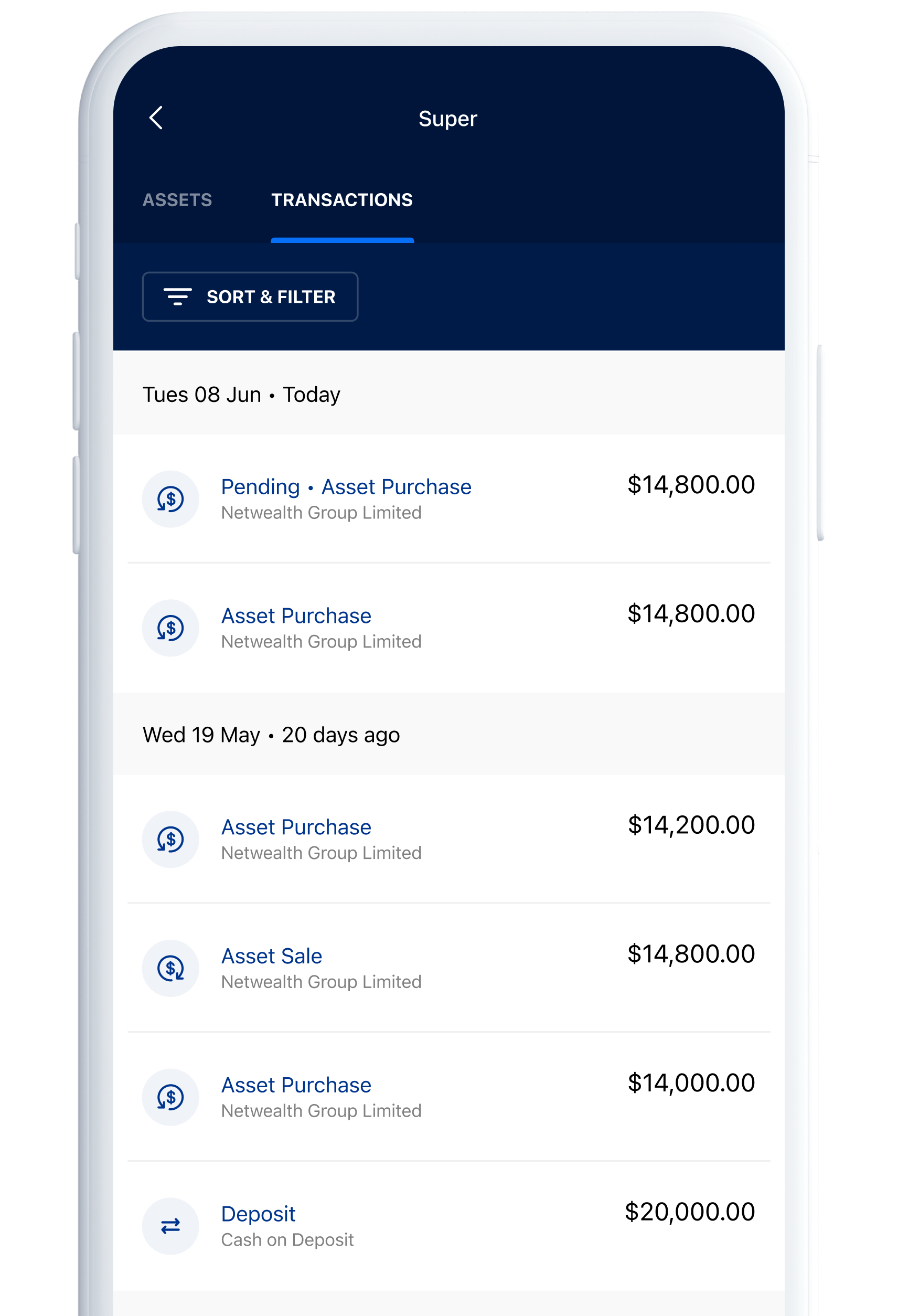

Clients can view the details of pending and historical account transactions

Clients can personalise their experience with impressive colour themes

Other features that enhance transparency and engagement for clients include the ability for them to :

![]()

View asset allocation across their entire portfolio

![]()

Monitor individual asset performance, including daily price information and historical unit prices

![]()

Use advanced sort and filter functionality to analyse portfolio and asset information

8.9% of advice firms say technology is pervasive in all client interactions

51% Advisable Australians say digital is critical for customer experience

50% Emerging Affluents say digital is top 3 factor for choosing advice firm

Over 60% of advisers use a client portal or intend to in next 24 months

2021 Netwealth Advisable Australian and 2021 Netwealth AdviceTech Reports

Client portals represent the next frontier, and a very real path for advice firms to reinvent their client experience to rival many disruptive digital first wealth business. They provide an always available and omni-present reminder of the adviser, evolving and supporting the relationship from a physical one to a hybrid-digital one.

From the 2021 Netwealth AdviceTech Report, advice businesses who use client portals today told us there are real benefits for their clients:

Improved transparency

Improved collaboration

Improved communication

Improved education

As an adviser, you too can download the app to give you access to all of your client accounts and allowing you to quickly respond to client queries on the go.

Easily search and find client accounts from the mobile app

Email clients directly through the app

Review client account balances for each client

View pending and historical account transactions in detail

Get a visual overview of all their portfolio performance and asset allocation with a suite of elegant charts

Monitor asset performance, including daily price information and historical unit prices

Personalise your experience with impressive colour themes

Email or call Netwealth directly through the app

Set up your PIN, Touch ID, Fingerprint or Face ID to access your Netwealth client accounts more conveniently with these secure technology features (mobile operating system dependent).

Almost one in three (30.0%) Advisable Australians solely use their mobile phone for non-work activities and a further

one in three flip between mobile, laptop and table seamlessly (34.7%), which means a mobile 1st approach to client portals is not a nice to have, but a necessity.

Let one of our experienced BDMs pay you a visit to discuss how our platform can be configured to meet your business needs. We may even shout you a coffee.

Contact a BDMIf you want a hands-on experience without the fuss, we can organise a quick online demonstration of some of the key features of the platform and our service.

Schedule a demoTo view the client mobile app and for details on how to download it, visit the investor page.

To download the adviser version of the app, simply follow the steps below.

You will need to be a registered adviser of Netwealth and have an existing Netwealth account or you can contact us to help set up your account.

Visit Apple App Store or Google Play to download the Netwealth mobile app.

Login to the mobile app using your Netwealth username and password (the same one you use when you login in via the desktop).

Find answers to common questions, helpful information and tips. Visit our FAQs page.