Security at Netwealth

At Netwealth, we care about keeping your information safe. Here is a guide to how we protect your data and what you can do to stay secure.

Multi-factor authentication (MFA) is designed to prevent people from accessing your Netwealth account, even if they know your password. Strong passwords still matter, but they’re no longer enough on their own. MFA helps protect against threats like phishing and stolen credentials by requiring two forms of verification. They combine something you know (your password) and something only you have (a code from your phone). Even if someone knows your password, they can’t access your account without that code.

You should be using a unique password for your Netwealth account.

Some tips on strong passwordsOur privacy policy explains our policies and practices with respect to the collection and management of personal information we may collect from you.

Read nowThe earlier you can raise a concern, the earlier Netwealth can implement measures to protect you. Even if you are unsure if something is unusual, report it to Netwealth. You can contact Netwealth on 1800 888 223 or email us.

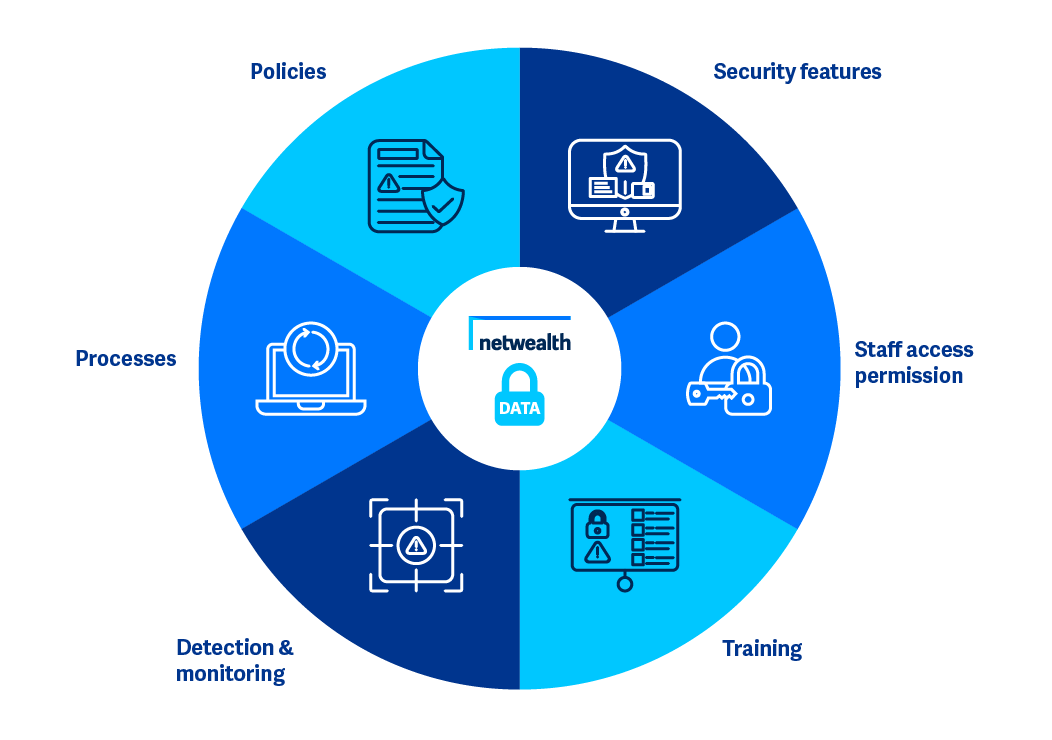

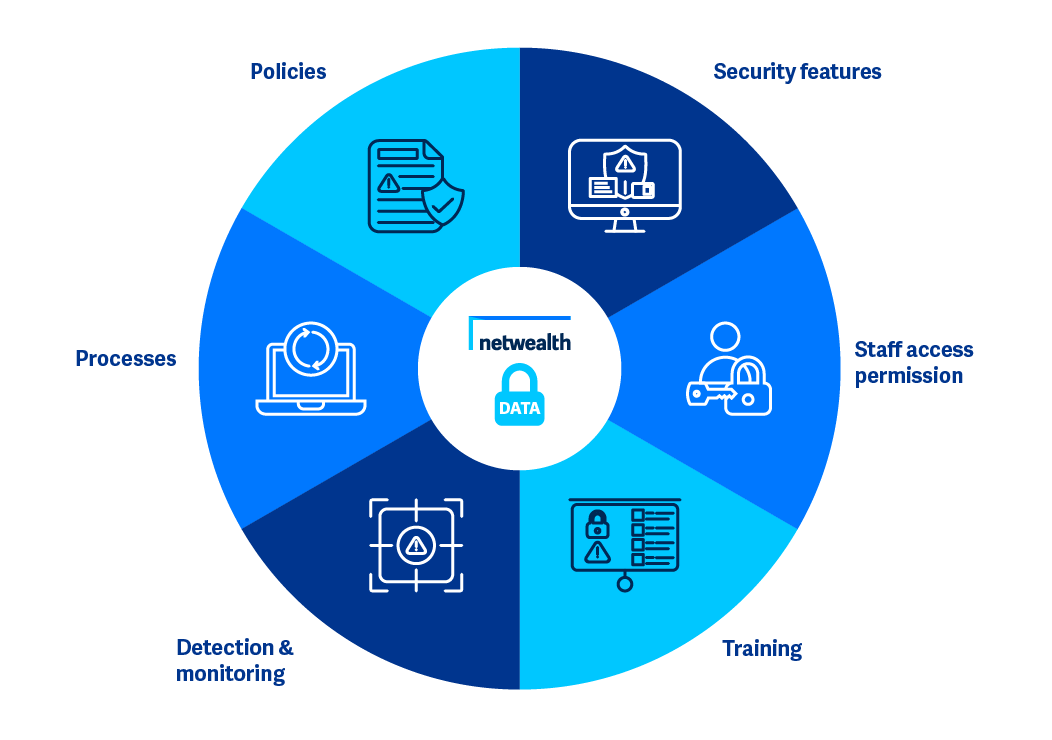

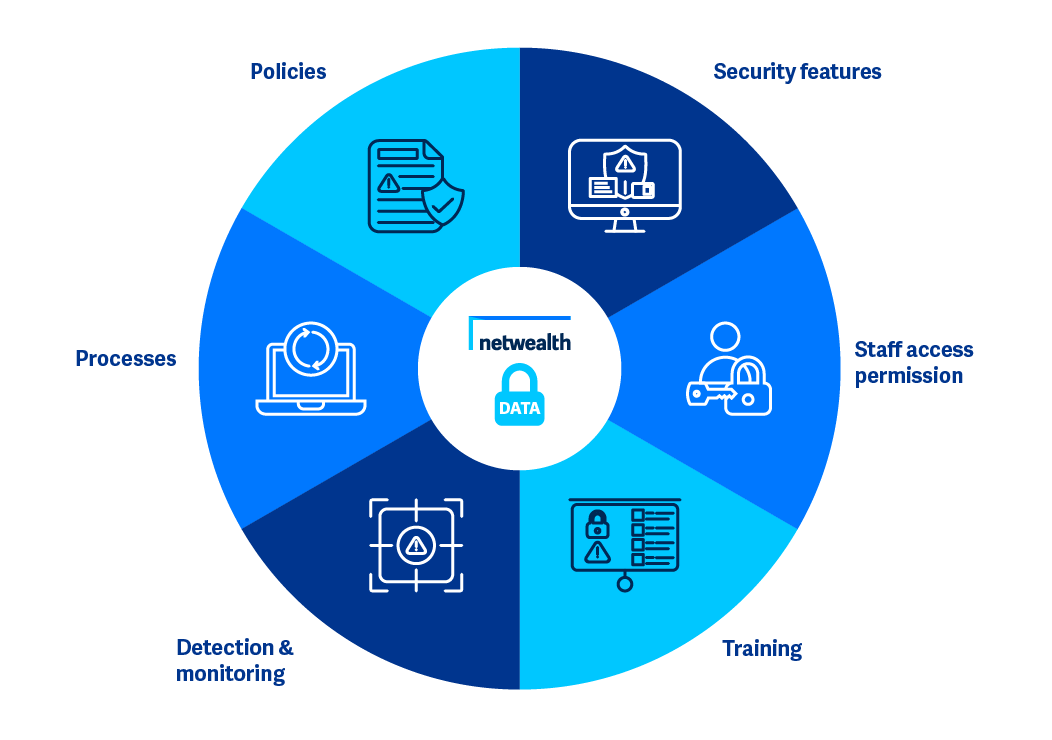

Email NetwealthNo individual mitigation can stop all cyber threats, however, by layering controls together they can provide barriers against a wide variety of threats while incorporating redundancy in the event one mechanism fails. At Netwealth, we use multiple layers of security and controls, so we have several defences in place to reduce the risk of cyber threats like phishing, malware, and ransomware.

Some of the key security features at Netwealth include: multi-factor authentication, SMS alerts for selected transactions undertaken by you or your financial adviser, and monitoring and confirmation of high-risk transactions before they are processed.

Transactions and logins from suspicious IP addresses or countries are monitored and/or blocked. Session timeouts and secure document upload add another layer of protection. The platform also offers real-time transaction visibility and fraud detection controls. Furthermore, a Data Quality Framework measures the quality and integrity of data on the platform. Data encryption is applied both at rest and in transit, utilising industry standards.

Clearly defined roles and responsibilities are an essential security layer. At Netwealth, role-based access control is implemented, enforcing the Principle of Least Privilege by assigning users, systems, and processes access only to the resources absolutely necessary to perform their assigned functions. Additionally, strong passwords and multifactor authentication are enforced to enhance security.

We run a rigorous and continual programme of security awareness and anti-fraud training for all staff and consistently test their understanding of cyber threats. For instance, our Contact Centre staff are trained to identify, respond, and escalate reports of cyberthreats, scams and fraud. Our highly trained operations support team review payments, account activity and interactions.

Netwealth has a team of in-house expertise with external consultants and applications to detect and monitor activity. As a member of the Australian Government’s Joint Cyber Security Centres (JCSC) program, Netwealth has access to support from law enforcement and the Australian Signals Directorate if needed.

We have defined processes to make updates as required. These processes are tested via simulations on a regular basis.

The Netwealth platform received reasonable assurance from its auditors on Service Organisation Controls, SOC2. SOC2 is a compliance framework developed by the AICPA (American Institute of Certified Public Accountants) to help organisations demonstrate their ability to securely manage customer data, focusing on security and privacy.

If you have any questions or notice unusual activity, please contact our support team at Netwealth on 1800 888 223, or via email at contact@netwealth.com.au.