Take outs

- Used by most advisers, the platform may well be the original fintech.

- The platform market has traditionally been dominated by large established and diversified players, but specialist providers are now gaining a bigger slice of net funds flow.

- This shift has been underpinned by regulation, consumer expectations and technology advancements as well as a drop in the number of financial intermediaries aligned with the big, diversified institutions.

We spend so much time talking about fintechs and which innovation will be the next to shake up financial services that we may have forgotten those that originally changed the way we work.

One of these – very possibly the first fintech – is the platform, a cornerstone technology of the modern day advisory offering.

Platforms have been around in Australia since the late 1980s and early 1990s, steadily gaining popularity as a simple way for investors to acquire, hold, administer and monitor their investments both inside super and outside.

Initially, platforms were primarily used to hold managed fund investments, but they gradually expanded to include a range of other assets, including listed securities, international securities, term deposits and most recently, managed accounts.

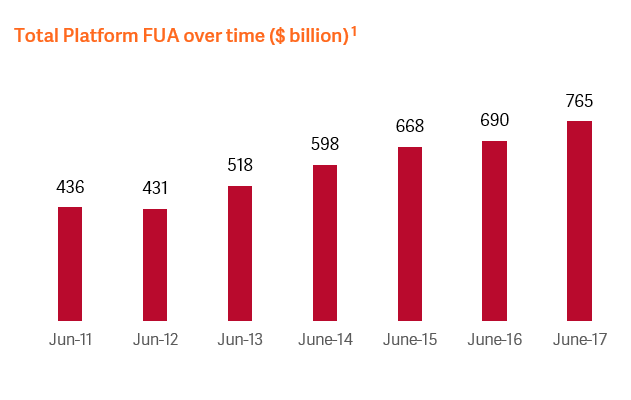

By January 2018, the amount of funds under administration (FUA) held on platforms in Australia topped $821 billion1. That’s an impressive compound annual growth rate of 10 per cent rate since January 20111.

System.NullReferenceException: Object reference not set to an instance of an object. at Umbraco.Cms.Core.Models.PublishedContent.PublishedContentType..ctor(IContentTypeComposition contentType, IPublishedContentTypeFactory factory) at Our.Umbraco.DocTypeGridEditor.Helpers.DocTypeGridEditorHelper.<>c__DisplayClass15_0.<GetContentTypesByAlias>b__0() at Umbraco.Extensions.AppCacheExtensions.<>c__DisplayClass5_0`1.<GetCacheItem>b__0() at Umbraco.Cms.Core.Cache.SafeLazy.<>c__DisplayClass1_0.<GetSafeLazy>b__0() --- End of stack trace from previous location --- at Umbraco.Cms.Core.Cache.ObjectCacheAppCache.Get(String key, Func`1 factory, Nullable`1 timeout, Boolean isSliding, String[] dependentFiles) at Umbraco.Cms.Core.Cache.ObjectCacheAppCache.Get(String key, Func`1 factory) at Umbraco.Cms.Core.Cache.DeepCloneAppCache.Get(String key, Func`1 factory) at Umbraco.Extensions.AppCacheExtensions.GetCacheItem[T](IAppCache provider, String cacheKey, Func`1 getCacheItem) at Our.Umbraco.DocTypeGridEditor.Helpers.DocTypeGridEditorHelper.GetContentTypesByAlias(String contentTypeAlias) at Our.Umbraco.DocTypeGridEditor.Helpers.DocTypeGridEditorHelper.ConvertValue(String id, String contentTypeAlias, String dataJson) at Our.Umbraco.DocTypeGridEditor.Helpers.DocTypeGridEditorHelper.RenderDocTypeGridEditorItem(IViewComponentHelper helper, IHtmlHelper htmlHelper, Object model) at AspNetCoreGeneratedDocument.App_Plugins_DocTypeGridEditor_Render_DocTypeGridEditor.ExecuteAsync() at Microsoft.AspNetCore.Mvc.Razor.RazorView.RenderPageCoreAsync(IRazorPage page, ViewContext context) at Microsoft.AspNetCore.Mvc.Razor.RazorView.RenderPageAsync(IRazorPage page, ViewContext context, Boolean invokeViewStarts) at Microsoft.AspNetCore.Mvc.Razor.RazorView.RenderAsync(ViewContext context) at Microsoft.AspNetCore.Mvc.ViewFeatures.HtmlHelper.RenderPartialCoreAsync(String partialViewName, Object model, ViewDataDictionary viewData, TextWriter writer) at Microsoft.AspNetCore.Mvc.ViewFeatures.HtmlHelper.PartialAsync(String partialViewName, Object model, ViewDataDictionary viewData) at AspNetCoreGeneratedDocument.Views_Partials_grid_editors_base.ExecuteAsync() in C:\a\1\s\NetwealthCms\NetwealthV10\Views\Partials\grid\editors\base.cshtml:line 11

Source: Strategic Insight: Master Trusts, Platforms & Wraps (June 2017)

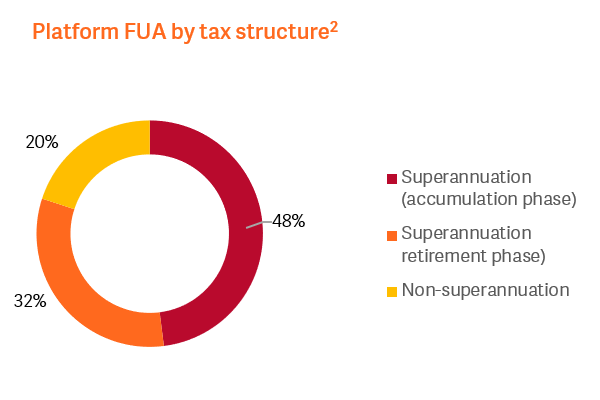

As you might have guessed, most of the FUA on these platforms are in superannuation products – 48 per cent in the accumulation phase and 32 per cent in the retirements phase2.

Source: Financial Services Council/UBS Asset Management State of the Industry Report (2017) based on Rainmaker (September 2016).

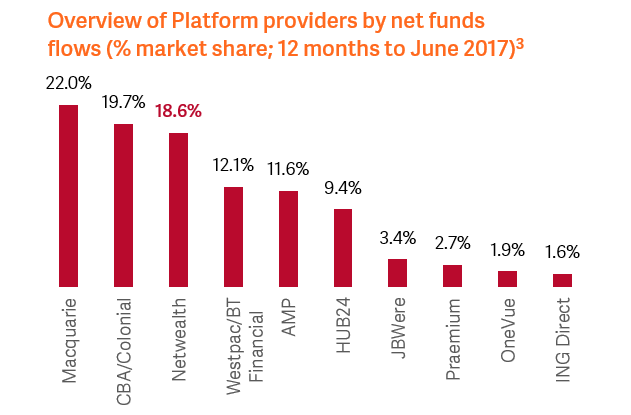

Thanks to their big wallets, the platform market has traditionally been dominated by the large established players. And, major banks and other large diversified financial institutions – with names like Westpac/BT Financial, AMP, Colonial/CBA, NAB and Macquarie – still have the biggest slice of the FUA pie on platforms.

But like everything with technology, the platform market continues to evolve.

Instead of being everything to everyone, a new breed of providers which specialise in platforms have shown their expertise in recent years.

These include companies such as Netwealth, the largest specialist platform provider in Australia and the country’s 10th largest platform provider in terms of total FUA. It has a 1.9 per cent market share.

By their very nature, specialist platform providers only focus on platforms – unlike their larger diversified financial services rivals who view platforms as just a small part of their product and service offerings.

With this razor-sharp focus, it’s not surprising that specialist platforms are starting to have traction in the industry.

Over the past four years, the leading specialist providers have grown annual net fund flows as a per cent of the market from 3.6 per cent per annum to net fund flows of 32.8 per cent per annum in the 12 months to December 20171.

Source: Strategic Insight: Master Trusts, Platforms & Wraps (December 1 2017)

One reason behind this strong growth is a jump in the number of financial advisers (intermediaries) that are not aligned with, or owned by, a major bank or large diversified financial institution.

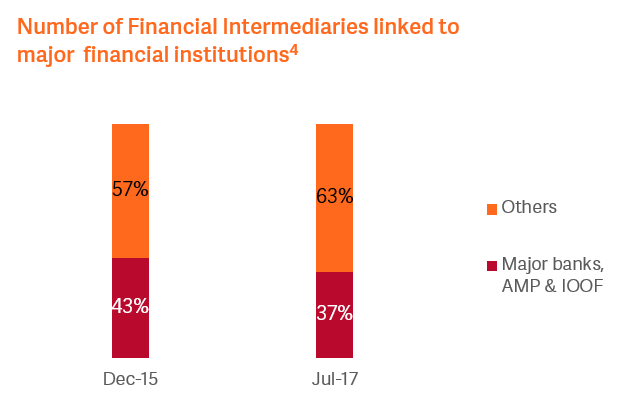

Indeed, the major banks, and the two largest diversified institutions, have seen their aggregate share of financial advisers (intermediaries) decrease by six percentage points between 31 December 2015 and 30 June 2017 as they increasingly choose to obtain their own AFSL or join small to mid-size licensees.

Source: ASIC Financial Advisers Dataset (July 2017)

The growth in specialist platforms has also been fuelled by huge shifts in how financial advice is now provided.

Firstly, the industry’s opaque practices and rising concerns about the appropriateness of the vertical integration model have led to a string of regulatory changes. Among these have been increased disclosure and documentation requirements, a ban on conflicted remuneration and the best interest duty. Compulsory education and a Code of Ethics is also set be imposed on advisers.

Secondly, the GFC revealed many shortcomings in the way financial advice is provided. As it kicked in, investors watched as their portfolios began drowning red while their advisers struggled to react quickly enough to market conditions.

There’s also been a general improvement, albeit slow, in financial literacy, driven by a growth in client sophistication, information provided, product choice and household wealth, particularly with larger superannuation balances. As a result, investors are increasingly recognising the value of financial advice, as distinct from financial product advice.

Finally, there is what we at Netwealth refer to as the “Apple” or “Amazon” effect. Put simply, as a result of the advancements made by these types of tech companies, there’s a growing expectation among consumers, especially younger ones, that things will just work with a click or a swipe and that many of the frictions typically experienced through the advice customer journey will fast disappear.

2019 AdviceTech Research Report

The third Netwealth AdviceTech research report highlights the key benefits of adopting technology intelligently within an advice business. This year's report we share the the survey findings from over 330 advisers on 26 technologies.

The future of platforms

Today, most advisers use platforms to assist in investment execution, through technologies like bulk trading, model portfolios, rebalancing technologies and managed accounts. They also are very useful in helping advice practices monitor and review client investment portfolios, through the use of reporting tools.

Arguably super and investment platforms have always existed to reduce friction. But there still is plenty of friction to remove.

The next evolution of the platform, thanks to the rapid pace of innovation and technology change is going to be an exciting one. The iPhone is 10 years old. The NBN is almost here. Businesses have never had more access to low-cost technology, thanks to SAAS (software as a service) companies relying on the cloud and low-cost subscription pricing. And, new technologies like artificial intelligence and blockchain are about to change our world.

It is fair to assume regulatory pressures, widening consumer demands and technology progress will never stop. Arguably, these could become disruptive, helping to further shift customer expectations as we engage with younger generations, especially the digital natives that put more trust in their social media than they do authority figures.

It’s been an exciting journey for possibly the original fintech. But there is more to come. Watch this space!

Discover more AdviceTech tools

Examine the twenty-six technologies used by advisers in their practice in the 2018 Netwealth AdviceTech report or contact one of our local BDM's for more information.

More AdviceTech resources

2020 Netwealth AdviceTech report

Get a comprehensive view of all 25 AdviceTech. Access our research report, articles, videos and team workshop.

Build an effective AdviceTech stack

Discover a framework that all advice firms can use to develop with their AdviceTech strategy and investment roadmap.

Create an AdviceTech roadmap

A team activity to help you prioritise technology solutions and develop an AdviceTech roadmap for your business.

A logo map of technology suppliers

Your guide to AdviceTech suppliers across 25 categories, as featured in the 2020 Netwealth AdviceTech research report.

Insights

Latest: Managed accounts during volatility and beyond

Four advisers share how managed accounts can enhance your client value proposition.

Special reports: Take a deep dive

Our collection of guides take a deep dive on topics including AdviceTech, managed accounts and cultural trends.

Podcasts: Between Meetings with Matt Heine

Netwealth's Matt Heine chats to industry thought leaders on the opportunities they see for financial advisers.

Webinars: Grow your Business IQ

Recordings from our monthly webinar series, covering a range of topics presented by industry professionals.

1 Strategic Insight: Master Trusts, Platforms & Wraps (December 2017)

2 Financial Services Council/UBS Asset Management State of the Industry Report (2017) based on Rainmaker (September 2016)

3 Strategic Insight: Master Trusts, Platforms & Wraps (December 2017)