Take outs

- Financial advice businesses face an environment of volatility, uncertainty, complexity and ambiguity

- Effective strategic planning for these businesses is now more important than ever

- Smart Brave Consulting’s Brad Fox has developed a 7-step strategic master plan for practice owners.

According to Brad Fox, managing director of Smart Brave Consulting, the financial services sector is in a VUCA world at the moment – with VUCA standing for volatility, uncertainty, complexity and ambiguity.

“There's almost no part of your practice world that isn't under forces of change,” Mr Fox says.

Effective strategic planning is now, therefore, more important than ever for financial advice practices.

To facilitate effective strategic planning, Mr Fox joined the Netwealth webinar Create a strategic roadmap for 2020 and beyond, to guide financial advice practice owners through his 7-step strategic master plan.

It’s a model that provides practice owners with a starting point to drive action into the future.

1. Insight and context – the forces practice owners must consider

What are the forces of change in the financial advice profession that should be considered? Mr Fox offers a few to help practice owners begin the strategic planning process:

- Education standards – costs and the timing to complete.

- Supply of key staff – advisers and paraplanners

- Cost to your practice of a user-pays environment – no more subsidies

- Client services packages – tiered and profitably priced

- Non-traditional advice and revenue streams

- Sources of new prospects

- Brand and reputation management

- Consumer expectations of value

- Remediation projects

- Process improvement

- Need for strategy – it isn’t easy

- Need for leadership and vision.

He suggests that practice owners create their own list of the top five forces of change that will affect their businesses. He has heard from practice owners that the top five across the market are:

- Removal of grandfathered commissions (excluding life insurance)

- Active regulation of advice fees paid from superannuation

- Client/prospect expectations from financial advice changing fast

- Fees for no service risk – need to engage every client annually (and profitably)

- Threat that risk commissions are banned or further reduced.

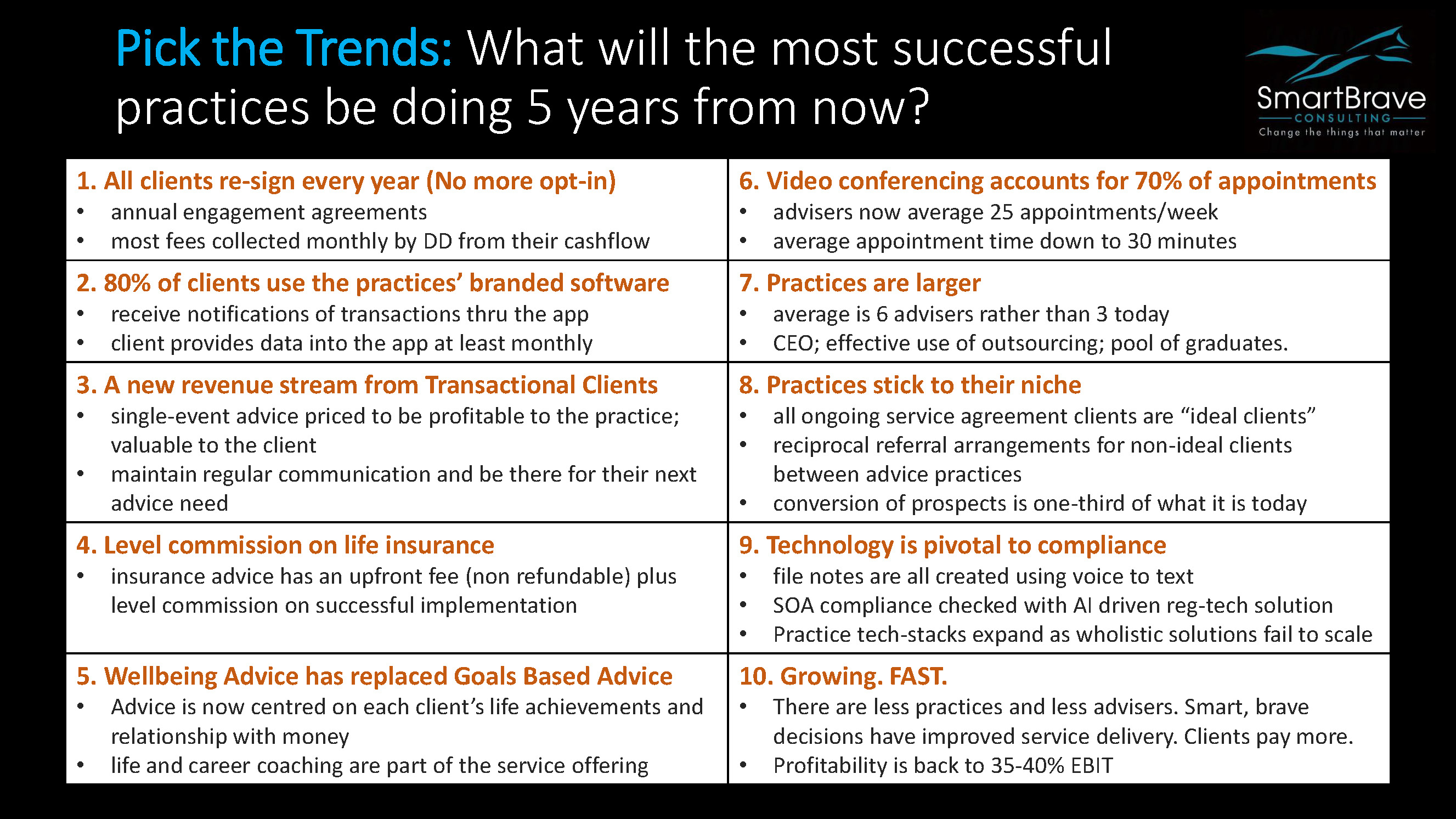

2. Pick the trends

Practice owners then need to pick the trends.

“Picking the trends, for me, is considering what the most successful practices will be doing in five years from now,” Mr Fox says.

Here are a few examples:

“The 10 you pick don’t have to align with these,” Mr Fox says. “You can decide to change the things that matter to you – What type of client do you want to have? What is your niche? What level of profitability do you want to drive for your practice? Who's in your team? What does your team look like? What level of risk tolerance will you have as a practice owner? What's your time commitment going to be?”

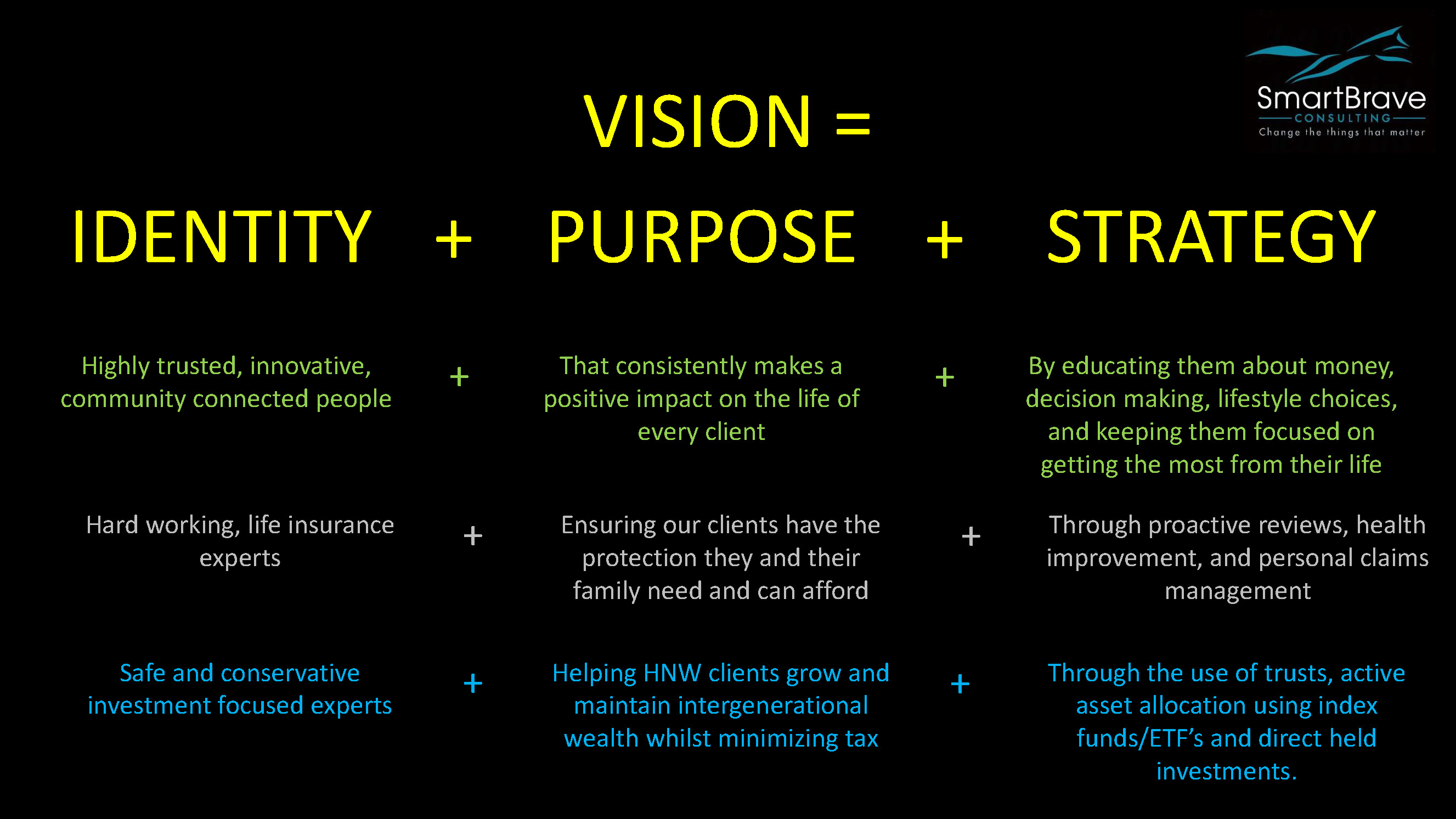

3. Define your vision

Your vision comprises three things:

- Identity – Who are we?

- Purpose – Why are we here?

- Strategy – What are we going to do?

Mr Fox suggests answering these questions to fit your practice.

“I suggest you answer them first in terms of your identity, purpose and strategy now, then your vision of your identity, purpose and strategy in the future.

“There will almost certainly be a difference. It means reading the tea leaves of change and deciding whether how you are now, what your brand is, what you do, who you do it for, and who your team includes is important. How does that fit with how you will be in five, seven, 10 years’ time?”

4. Change analysis

You then need to undertake a change analysis. Here is a list of things to consider, all of which are characteristics of a practice.

- Brand/identity

- Culture/behaviours of our team

- Our advice/practice philosophies

- Client service/value proposition

- Ideal client

- Fee model / revenue mix

- Scale of our practice

- Talent/skills/education of our team

- Location(s)

- Use of technology

- Communications/marketing

- COIs/networks

- Other

For each of these, ask “Is this something I will need to work on changing to achieve my vision over the next five years?” If it is, describe the change and place it in an order of priority.

5. Win supporters

The next step is to get your team and people on board. A useful acronym to use here is MOSTLY:

- Messaging – Clarity, passion, conviction, consistency and persistence.

- Offsite – Remove all distractions. Get them mindful.

- Straight talk – No subtleties, but make sure it’s a two-way conversation. Usually this needs an external facilitator.

- Translate – Make sense of things. Share the changing paradigms. What happens if we don’t change?

- Lead – Engage the protectors. Inspire the innovators.

- Yourself – Role-model what you expect from others.

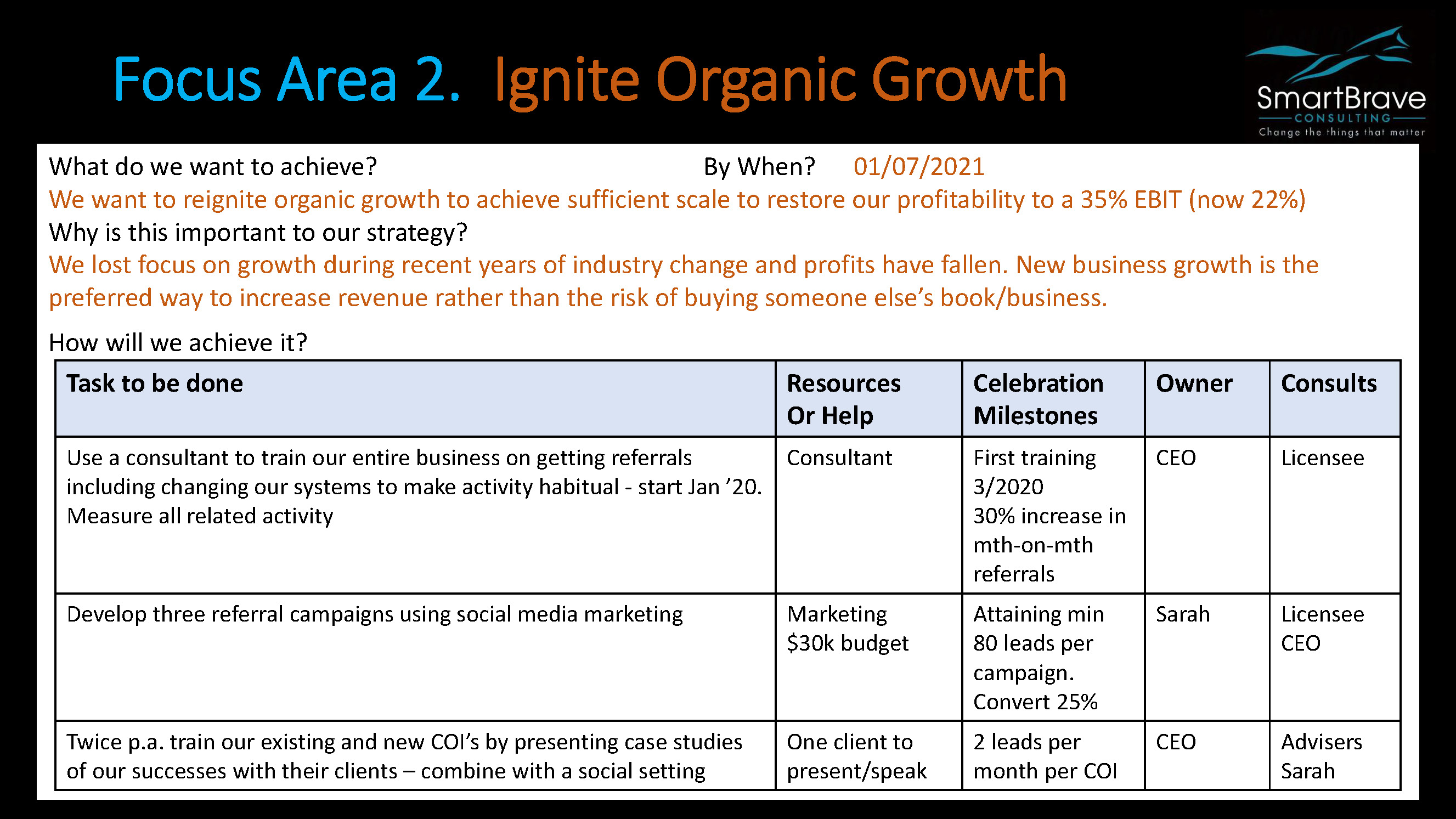

6. Build the plan

This is where most people think strategic planning starts – a sheet of paper with actions on it, such as the following:

“As you can see, however, this is well down in the process,” Mr Fox said.

“You first need to solidify your thinking. Then you get to actions. That way, you choose actions that take you in the direction you want, not actions born out of knee-jerk reactions through not considering biases and through incomplete information, all of which lead to bad decision-making.”

7. Focus

Having built the plan, getting focused requires:

- Courage – “It takes an enormous amount of courage to drive change. It takes self-belief. The definition of courage is taking action despite the presence of fear.”

- Coping – “Everyone goes through a period of coping when they make change. Coping is when you get almost as many things wrong as you get right.”

- Competence – “That's what gets you through to the other side of coping. It's when the things you want to change have become normal or ‘business as usual’.”

- Confidence – “As we get more layers of competence, we get confident. And we can draw this as a circle. When we're confident, we're far more likely to be courageous.”

To learn more

Listen to the Netwealth’s webinar Create a strategic roadmap for 2020 and beyond for more insights on strategic planning for your business, or contact Netwealth to find out more.

Hear more from Brad

Hear why you should create a strategic plan to truly understand the industry environment, your competitive advantages, and stakeholders.

You can also listen to this episode on iTunes, Spotify, Soundcloud or Stitcher.

You may also enjoy

Business management

The business opportunity of estate planning as a core service

Explore why financial advisers are well placed to capitalise on a dedicated estate planning offering.

Business management

Managing culture, client and technology during volatility

Discover ways you can maintain meaningful client relationships and keep your team motivated.

Business management

Key factors in the transition of advice to a profession

Find out three key elements the advice industry needs to achieve for advisers to complete their career makeover.