EOFY Tax Tools

Maximise efficiencies during the busy year-end period.

Netwealth's useful EOFY (end of financial year) tax tools help maximise efficiencies during the busy year-end period. In this module we cover:

Before using this tool, consider:

View the deadlines for any form or transaction to be processed by the end of financial year (EOFY). Any transaction or form not validly requested before these times will not be processed in the current financial year.

To manage what EOFY communications sent by Netwealth to you and your clients navigate via the main menu to My Business > Business Settings > Communication . Where a communication option is not greyed out, you can turn it off. This will apply to all of your clients linked to the selected adviser.

Our flexible contribution options allow you and your clients to add new money to accounts and claim tax deductions prior to year- end.

There are three steps when contributing to a Netwealth super account:

There are two reports that can help you track contributions against the concessional caps at an individual account level:

|

Report type |

Report name |

Description |

Navigation |

Learn more |

|

Investor report |

Contribution summary report |

This report summarises all non-concessional and concessional contributions made into a client's account for the past 5 financial years. |

Select an account and navigate via the main menu to Reports & Statements > Reports > Contribution Type Summary. |

|

|

Adviser report |

Contribution cap monitoring |

This report can be used to compare client contributions to contribution caps.

|

Navigate via the main menu to Reports > Adviser Reports > Contribution Cap Monitoring |

To contribute into a Netwealth super account on behalf of a client:

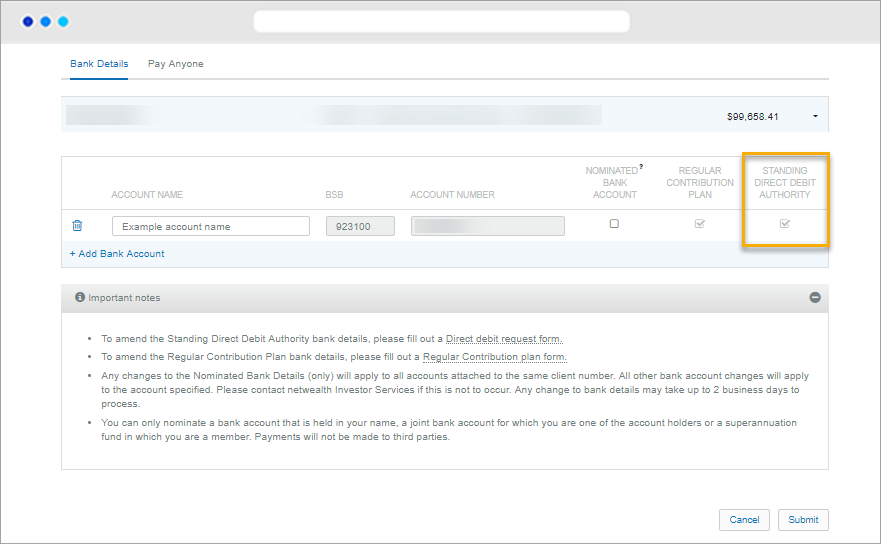

a) Check that the clients direct debit bank account has been set up by selecting an account and navigating via the main menu to Client Details > Bank Settings. Make sure there is a bank account flagged with a 'standing direct debit authority'.

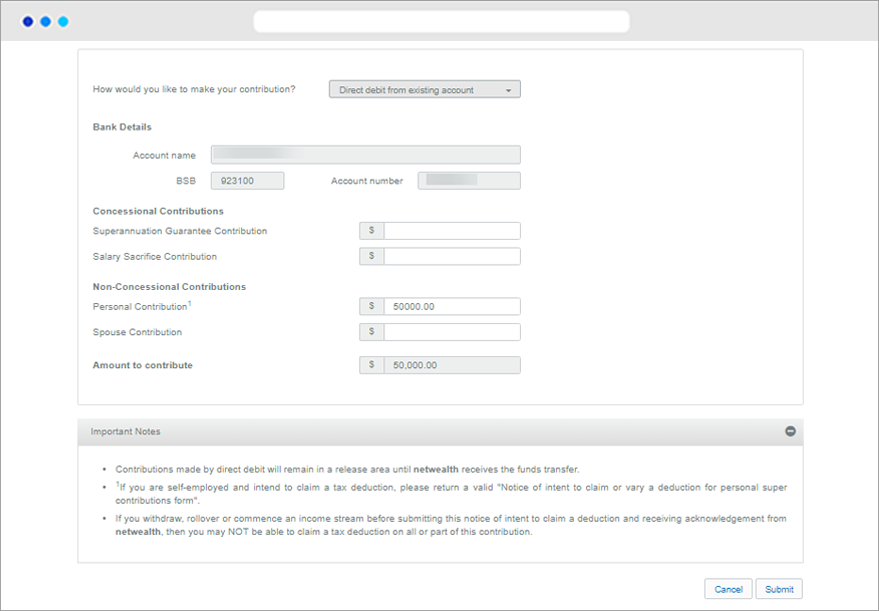

b) Navigate via main menu to Transactions > Deposit and Contribute > One-Off Contribution and enter the information required.

c) Click ‘Submit’. If submitted prior to 12pm AEST, the direct debit will be received into the account overnight.

All personal contributions are processed as non-concessional contributions until you or your client, either:

To save time and process your contribution, you can claim your tax deduction online:

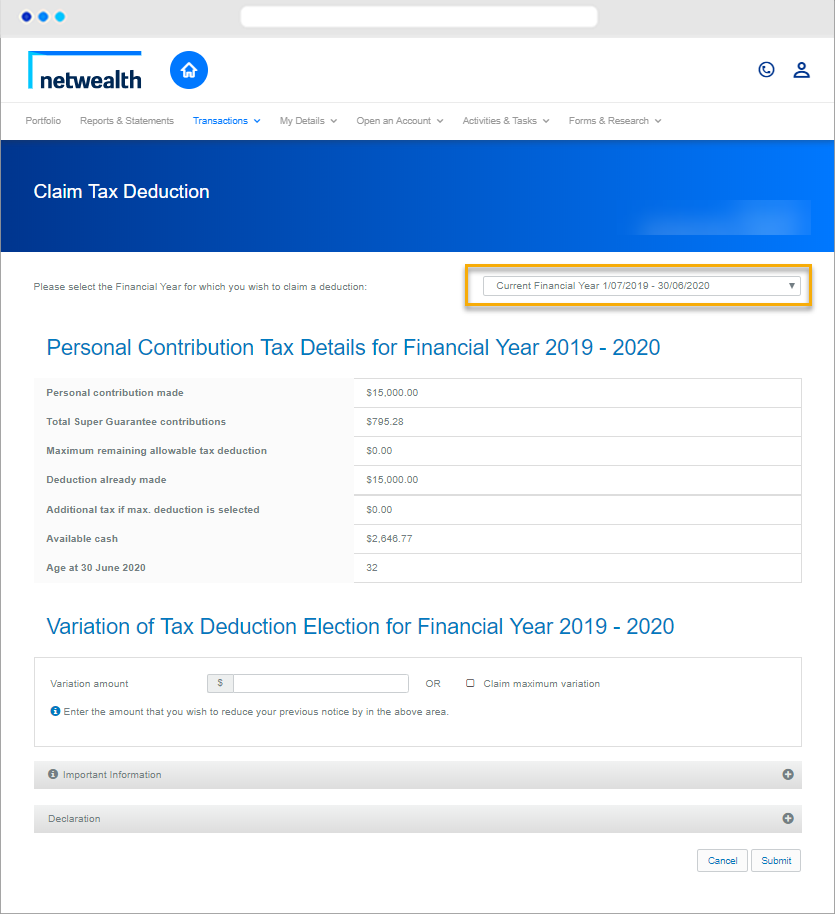

a) Select a client and navigate to their holdings to check the account’s available cash balance. The account must have enough available cash to cover the tax payment if claiming online.

b) Navigate via the client menu to Transactions > Deposit and Contribute > Claim Tax Deduction.

c) Select the Financial Year that you wish to claim a deduction. A tax deduction can be claimed/varied for the last financial year and/or the current financial year.

d) Select the amount you wish to claim a tax deduction for. Either type the amount or select ‘Claim maximum deduction’.

e) Click ‘Submit’ to process the tax deduction claim.

f) Client confirmation. The client will receive a confirmation letter via their preferred method of communication confirming the return of their Section 290.170 Tax Notice for the financial year selected.

Important note: For clients transferring to income stream or withdrawing money form the platform, a tax deduction claim must be lodged prior to the transfer.

From 1 July 2018, the unused portion of a client’s concessional cap is carried forward on a rolling basis of five years.

2019/20 is the first financial year in which a client may be eligible to claim a tax deduction on the unused portion of their concessional contribution cap from prior years. This is subject to the combined balance of their superannuation interests being less than $500,000 as at 30 June 2019).

Clients seeking to claim a tax deduction on unused concessional contributions need to submit a ‘notice of intent to claim’ form (via document upload, email or post). No offline transaction fee will be charged.

Going forward, we plan to enhance our online ‘Tax deduction claim’ functionality to support clients seeking to claim a tax deduction on unused concessional contributions.

Our flexible contribution options allow you and your clients to add new money to accounts and claim tax deductions prior to year- end.

There are two steps when contributing to a Netwealth Wealth Accelerator account:

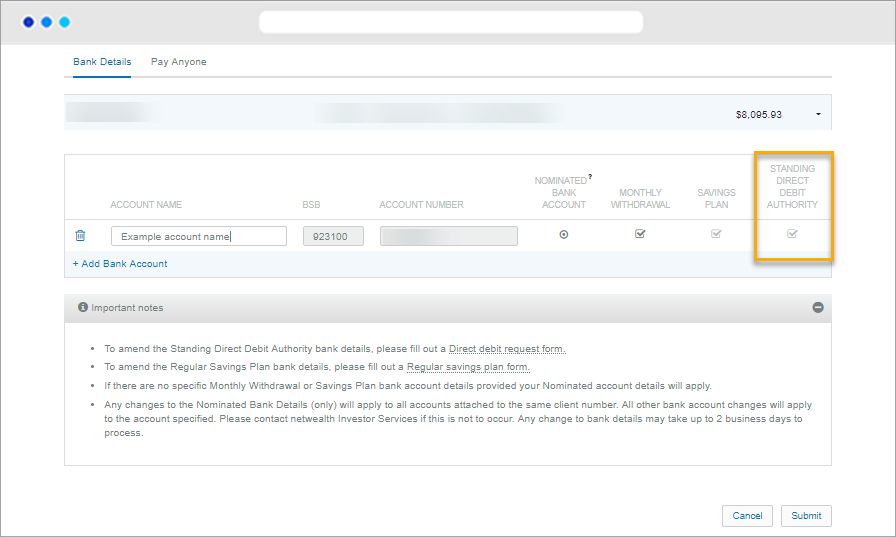

To contribute into a Netwealth investment account on behalf of a client:

a) Check that the clients direct debit bank account has been set up by selecting an account and navigating via the main menu to Client Details > Bank Settings. Make sure there is a bank account flagged with a 'standing direct debit authority'.

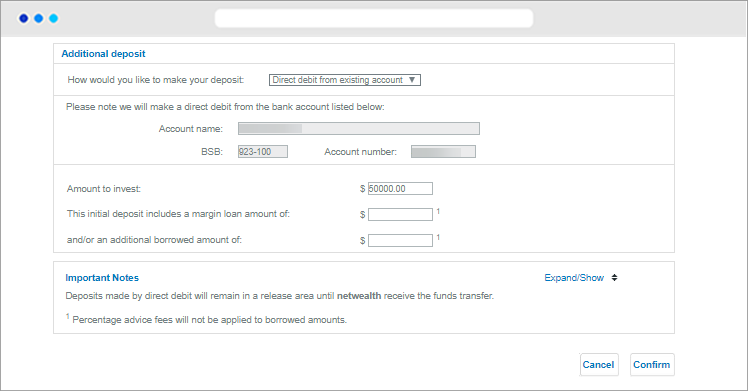

b) Navigate via main menu to Transactions > Deposit and Contribute > One-Off Contribution and enter the information required.

c) Click ‘Submit’. If submitted prior to 12pm AEST, the direct debit will be received into the account overnight.

Advanced tips:

Netwealth Wrap Taxation Statements are produced and sent in weekly batches to clients. They are also available online.

The Taxation Statement is produced once income for all assets held in the portfolio for the period have been reconciled and re-apportioned into the correct tax components (as per the advice received from registries and/or fund managers).

Netwealth ensures the Tax Statements are produced as quickly as possible, but is reliant on receiving information from registries and/or fund managers to do so.

To help track the status of tax statements and to see which assets we are yet to receive year-end tax information for (from fund managers or registries), use the pending Tax Statement tool (’Tax Tracker’).

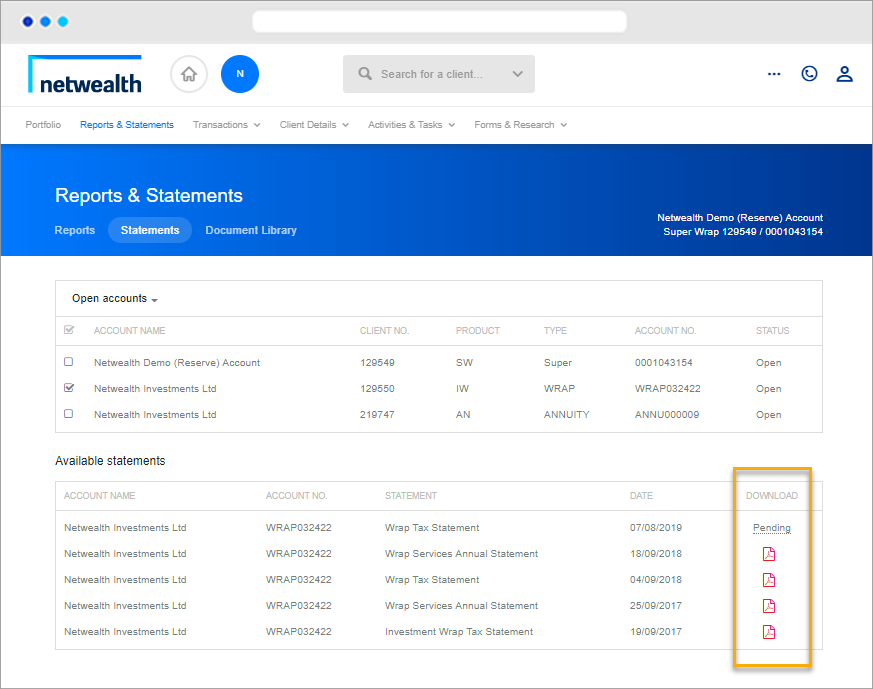

a) Select a client account and then click on Client Details > Reports & Statements > Statements.

b) Select one or more accounts to view.

c) From the information displayed, you can:

Advanced tip: Advisers and clients are also able to view their pending statement details on the client dashboard. By clicking on the task you will be navigated automatically to the statements tab.

To view pending tax statements in bulk:

a) Navigate via the main menu to Reports > Adviser Reports.

b) Download the Tax Statement Tracking report, which will show:

Click here for more information on how to run this report.

For an in depth look at this great feature, or any of our other platform enhancements, request for one of our team to contact you.

® Registered to BPAY Pty Ltd, ABN 69 079 137 518